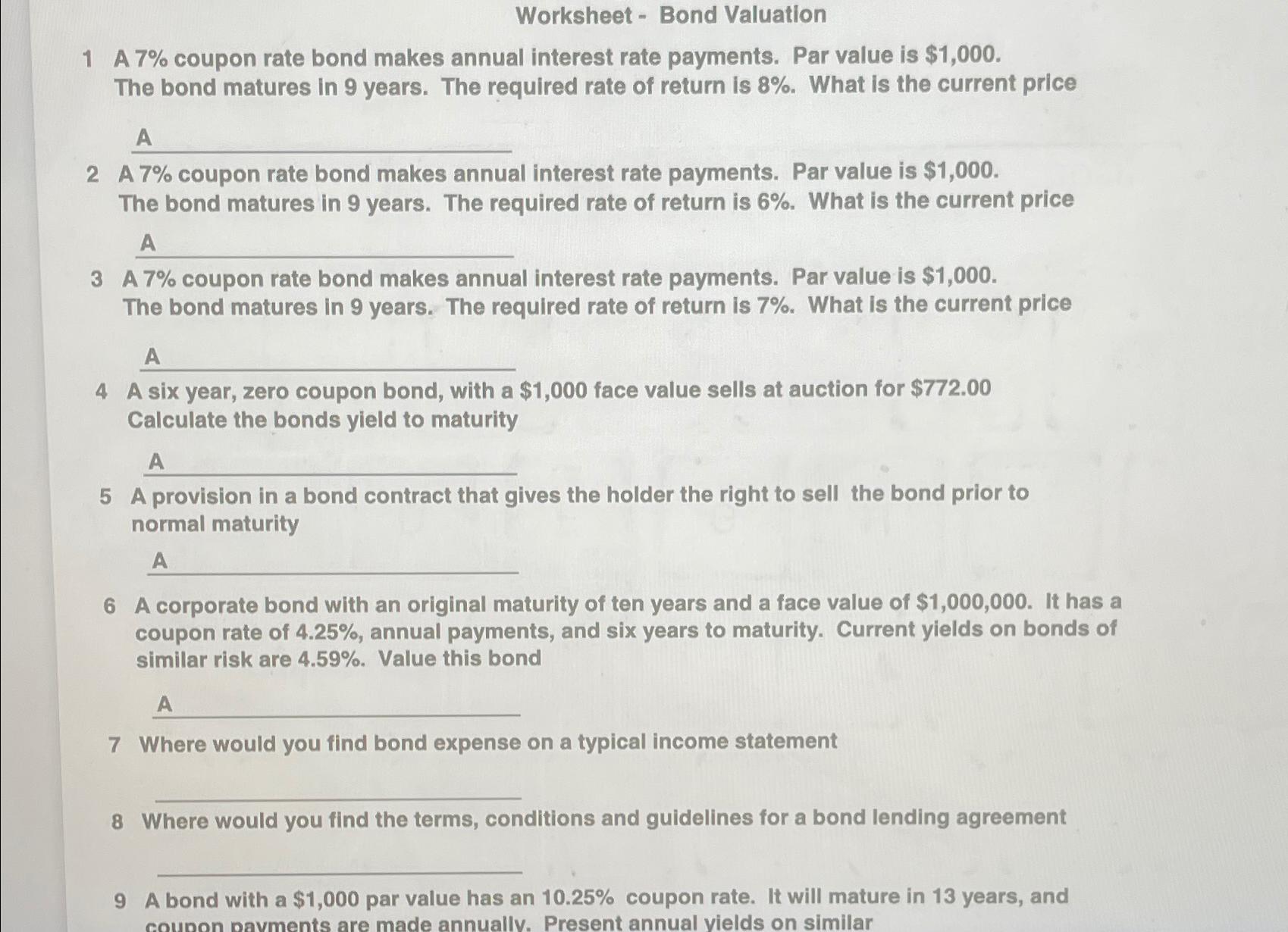

Question: REALLY NEED HELP WITH FORMULAS Worksheet - Bond Valuation 1 A 7 % coupon rate bond makes annual interest rate payments. Par value is $

REALLY NEED HELP WITH FORMULAS Worksheet Bond Valuation

A coupon rate bond makes annual interest rate payments. Par value is $ The bond matures in years. The required rate of return is What is the current price

A coupon rate bond makes annual interest rate payments. Par value is $ The bond matures in years. The required rate of return is What is the current price

A coupon rate bond makes annual interest rate payments. Par value is $ The bond matures in years. The required rate of return is What is the current price

A six year, zero coupon bond, with a $ face value sells at auction for $ Calculate the bonds yield to maturity

A provision in a bond contract that gives the holder the right to sell the bond prior to normal maturity

A corporate bond with an original maturity of ten years and a face value of $ It has a coupon rate of annual payments, and six years to maturity. Current yields on bonds of similar risk are Value this bond

Where would you find bond expense on a typical income statement

Where would you find the terms, conditions and guidelines for a bond lending agreement

A bond with a $ par value has an coupon rate. It will mature in years, and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock