Question: Really need help with these last two questions please and thank you! Caspian Sea Drinks is considering the purchase of a new water filtration system

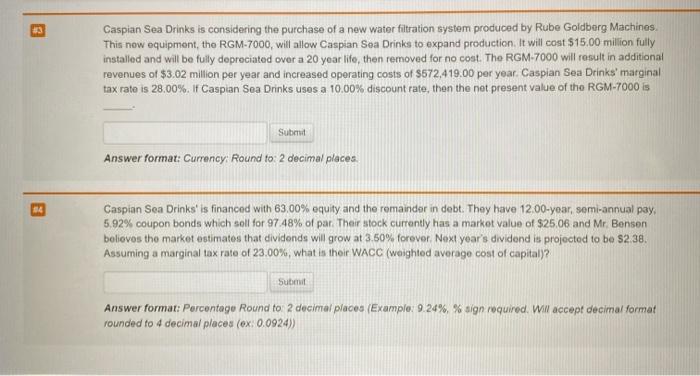

Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines This now equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $15.00 million fully installed and will be fully depreciated over a 20 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.02 million per year and increased operating costs of $572,419.00 per year. Caspian Sea Drinks' marginal tax rate is 28,00%. If Caspian Sea Drinks uses a 10.00% discount rate, then the not present value of the RGM-7000 is Submit Answer formar: Currency: Round to 2 decimal places. 34 Caspian Sea Drinks' is financed with 63,00% equity and the remainder in debt. They have 12.00-year, semi-annual pay, 5.92% coupon bonds which soll for 97.48% of par. Their stock currently has a market value of $25.06 and Mr. Benson believes tho market estimates that dividonds will grow at 3.60% forever. Next year's dividend is projected to be $2.38. Assuming a marginal tax rate of 23.00%, what is their WACC (weighted average cost of capital)? Submit Answer format: Porcentage Round to 2 decimal places (Examplo: 9 24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts