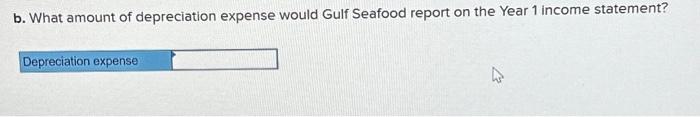

Question: Really need help with this question. Thanks in advance. b. What amount of depreciation expense would Gulf Seafood report on the Year 1 income statement?

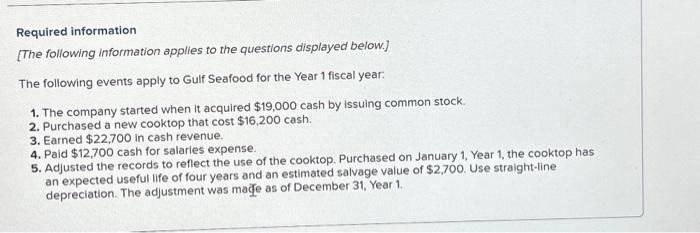

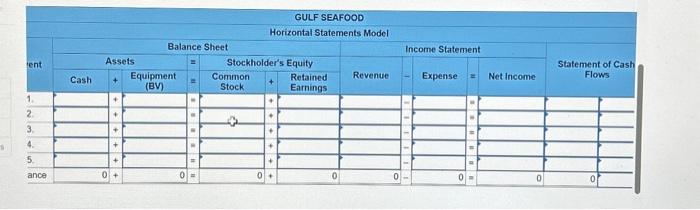

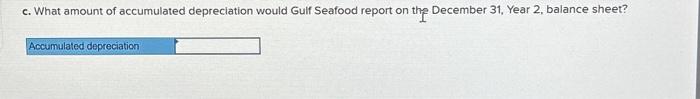

b. What amount of depreciation expense would Gulf Seafood report on the Year 1 income statement? d. Would the cash flow from operating activities be affected by depreciation in Year 1 ? Yes No c. What amount of accumulated depreciation would Gulf Seafood report on the December 31 , Year 2 , balance sheet? Required information [The following information applies to the questions displayed below.] The following events apply to Gulf Seafood for the Year 1 fiscal year: 1. The company started when it acquired $19,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $16,200 cash. 3. Earned $22,700 in cash revenue. 4. Paid $12,700 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1, the cooktop has an expected useful life of four years and an estimated salvage value of $2,700. Use straight-line depreciation. The adjustment was mae as of December 31, Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts