Question: Really only inquiring about Part B, if only one part can be answered. The DCF method and Bond Yield RP 3. Big Boy, Inc. has

Really only inquiring about Part B, if only one part can be answered. The DCF method and Bond Yield RP

Really only inquiring about Part B, if only one part can be answered. The DCF method and Bond Yield RP

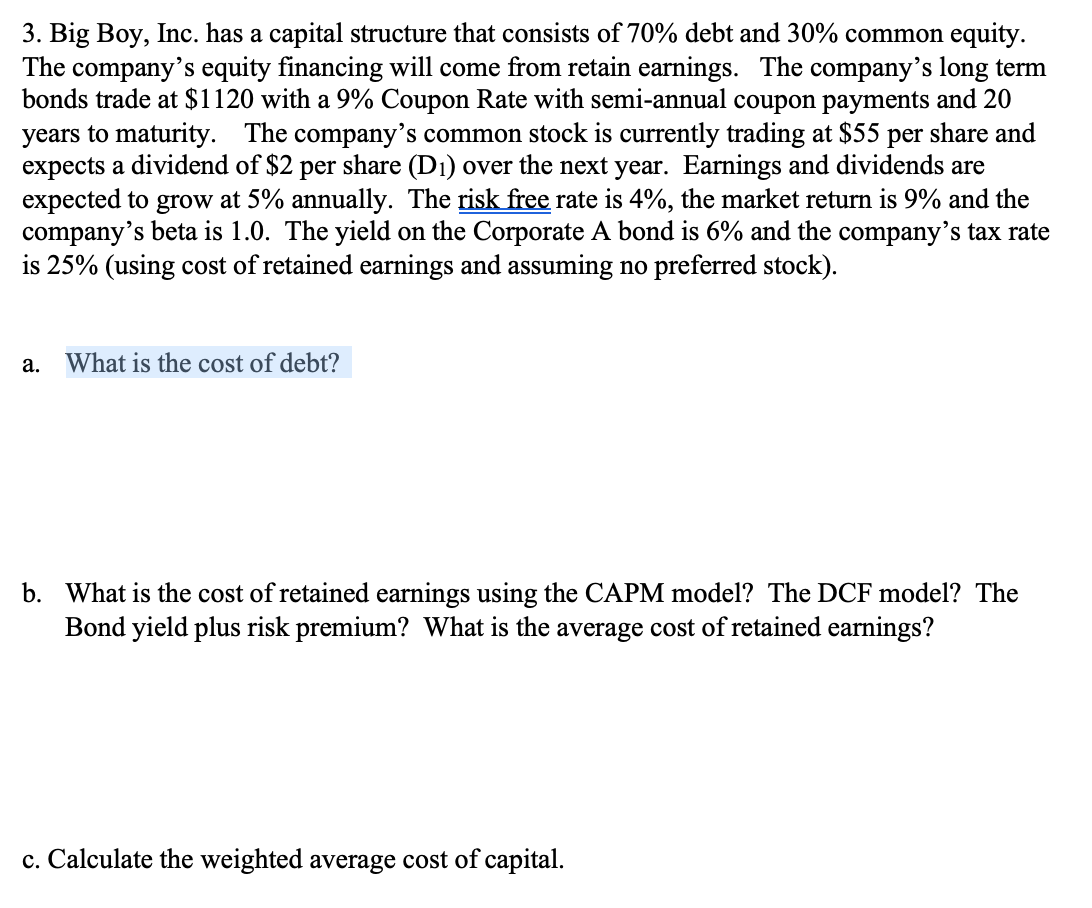

3. Big Boy, Inc. has a capital structure that consists of 70% debt and 30% common equity. The company's equity financing will come from retain earnings. The company's long term bonds trade at $1120 with a 9% Coupon Rate with semi-annual coupon payments and 20 years to maturity. The company's common stock is currently trading at $55 per share and expects a dividend of $2 per share (D1) over the next year. Earnings and dividends are expected to grow at 5% annually. The risk free rate is 4%, the market return is 9% and the company's beta is 1.0. The yield on the Corporate A bond is 6% and the company's tax rate is 25% (using cost of retained earnings and assuming no preferred stock). a. What is the cost of debt? b. What is the cost of retained earnings using the CAPM model? The DCF model? The Bond yield plus risk premium? What is the average cost of retained earnings? c. Calculate the weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts