Question: Rebecca just started learning about options for saving for her retirement. Her friend is a big fan of tax-sheltered accounts. Why do you suppose that

Rebecca just started learning about options for saving for her retirement.

Her friend is a big fan of tax-sheltered accounts.

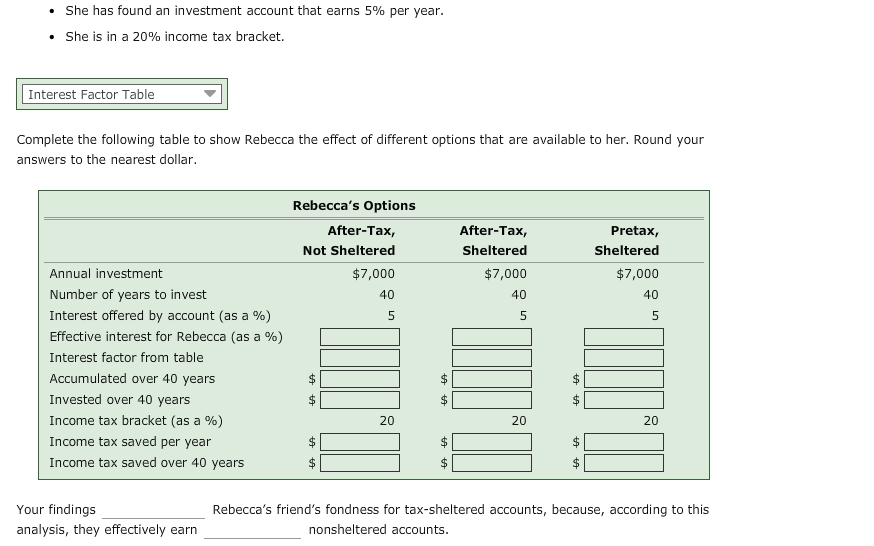

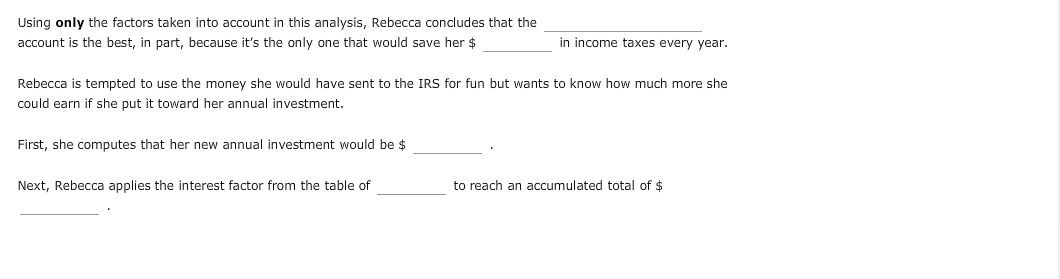

Why do you suppose that is? Check all that apply. tax-sheltered accounts? under the mattress? O Funds can be withdrawn at any time for any reason without penalty or tax payments. Contributions may be tax deductible in the year the contributions are made. Earnings are tax-deferred as long as they are reinvested within the account. Some withdrawals may be tax-free. Before she commits any money to an account, Rebecca wants to see how much her savings would earn using different investment tactics. She asked you to help and provided the following information: She plans to invest $7,000 every year for 40 years. She has found an investment account that earns 5% per year. She is in a 20% income tax bracket. Interest Factor Table Complete the following table to show Rebecca the effect of different options that are available to her. Round your answers to the nearest dollar. Rebecca's Options After-Tax, Not Sheltered $7,000 40 After-Tax, Sheltered $7,000 Pretax, Sheltered $7,000 40 Annual investment Number of years to invest Interest offered by account (as a %) Effective interest for Rebecca (as a %) Interest factor from table Accumulated over 40 years Invested over 40 years Income tax bracket (as a %) Income tax saved per year Income tax saved over 40 years + # to + # to + to to + # Your findings analysis, they effectively earn Rebecca's friend's fondness for tax-sheltered accounts, because, according to this nonsheltered accounts. Using only the factors taken into account in this analysis, Rebecca concludes that the account is the best, in part, because it's the only one that would save her $ in income taxes every year. Rebecca is tempted to use the money she would have sent to the IRS for fun but wants to know how much more she could earn if she put it toward her annual investment. First, she computes that her new annual investment would be $ Next, Rebecca applies the interest factor from the table of to reach an accumulated total of $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts