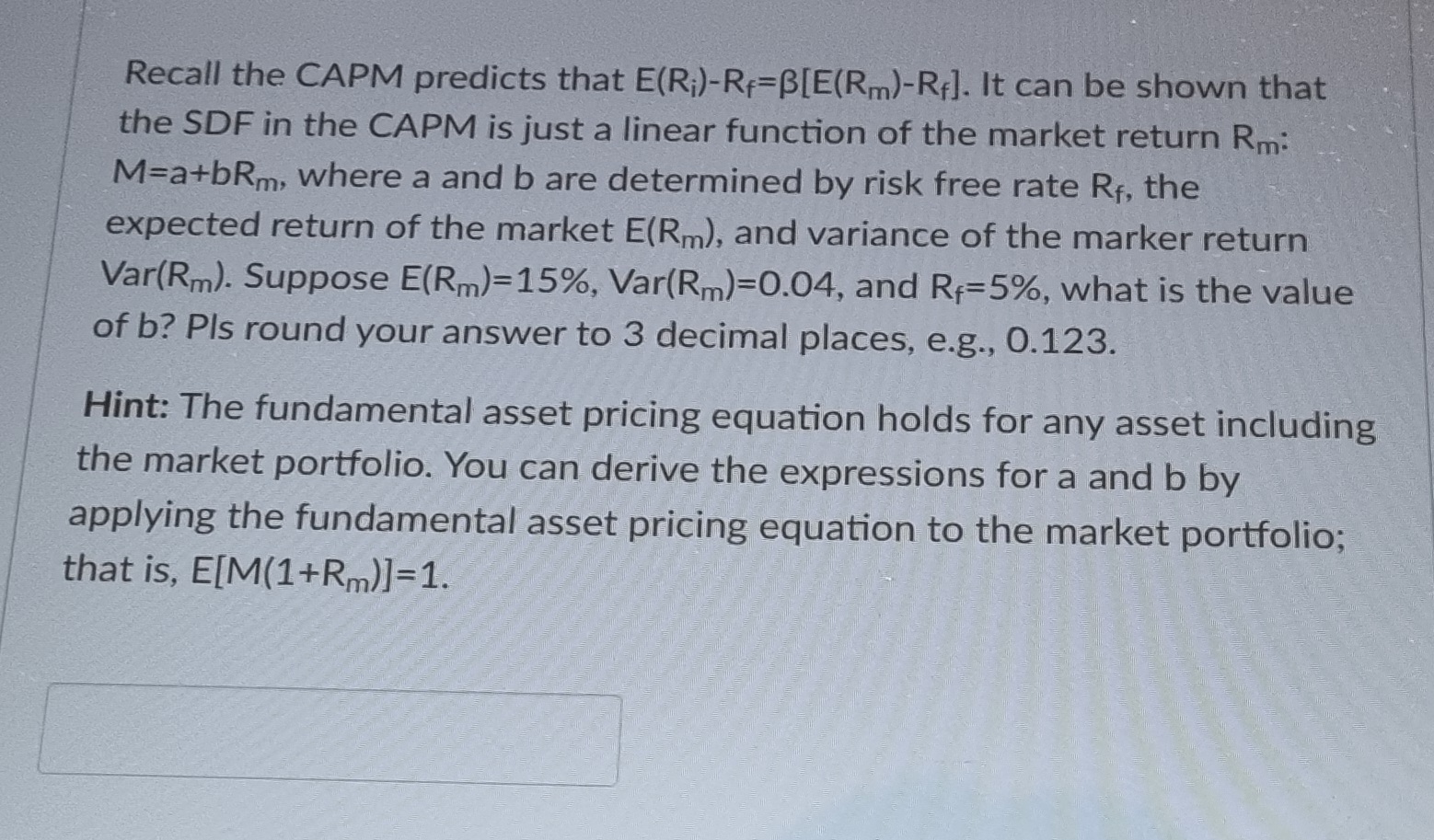

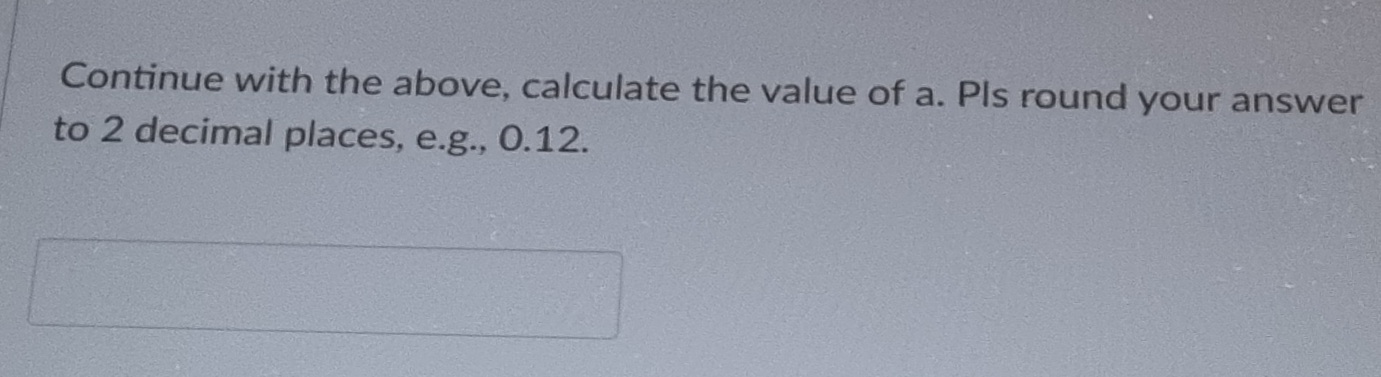

Question: Recall the CAPM predicts that E(R;)-Rf=B[E(Rm)-Rf]. It can be shown that the SDF in the CAPM is just a linear function of the market return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts