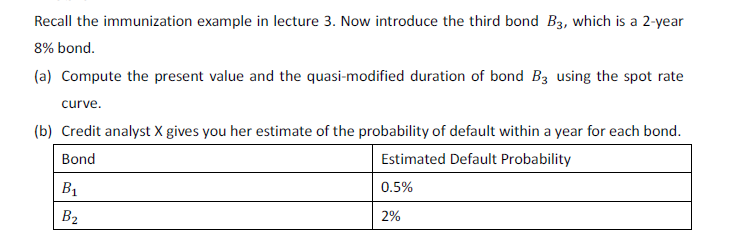

Question: Recall the immunization example in lecture 3. Now introduce the third bond B3, which is a 2-year 8% bond. (a) Compute the present value and

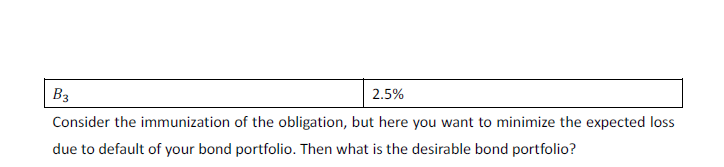

Recall the immunization example in lecture 3. Now introduce the third bond B3, which is a 2-year 8% bond. (a) Compute the present value and the quasi-modified duration of bond B3 using the spot rate curve. (b) Credit analyst X gives you her estimate of the probability of default within a year for each bond. Bond Estimated Default Probability B 0.5% 2% B2 B3 2.5% Consider the immunization of the obligation, but here you want to minimize the expected loss due to default of your bond portfolio. Then what is the desirable bond portfolio? Recall the immunization example in lecture 3. Now introduce the third bond B3, which is a 2-year 8% bond. (a) Compute the present value and the quasi-modified duration of bond B3 using the spot rate curve. (b) Credit analyst X gives you her estimate of the probability of default within a year for each bond. Bond Estimated Default Probability B 0.5% 2% B2 B3 2.5% Consider the immunization of the obligation, but here you want to minimize the expected loss due to default of your bond portfolio. Then what is the desirable bond portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts