Question: Recall the SMP (Surface Mount Placement) machine example above. Assume given values are before-tax cash flows. Determine the after-tax A)PW, B)FW, C)AW and D)IRR. The

Recall the SMP (Surface Mount Placement) machine example above. Assume given values are before-tax cash flows. Determine the after-tax A)PW, B)FW, C)AW and D)IRR. The SMP machine is a 5-year property for MACRS depreciation. Use a 40% income-tax rate and and 10% after-tax MARR.

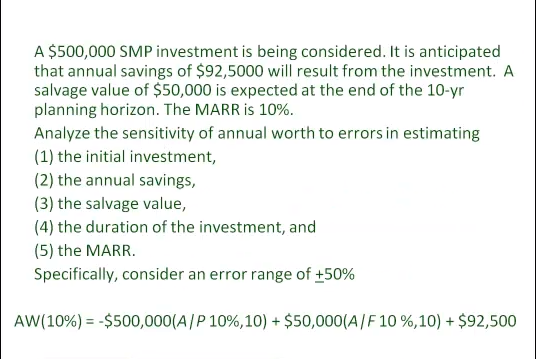

A $500,000 SMP investment is being considered. It is anticipated that annual savings of $92,5000 will result from the investment. A salvage value of $50,000 is expected at the end of the 10-yr planning horizon. The MARR is 10%. Analyze the sensitivity of annual worth to errors in estimating (1) the initial investment, (2) the annual savings, (3) the salvage value, (4) the duration of the investment, and (5) the MARR. Specifically, consider an error range of +50% AW(10%) -$500,000(A/P 10%, 10) $50,000(AIF 10 10) $92,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts