Question: Recapitalization is the process through which firms make desired changes in their capital structure by using debt capital to repurchase outstanding equity. Firms use a

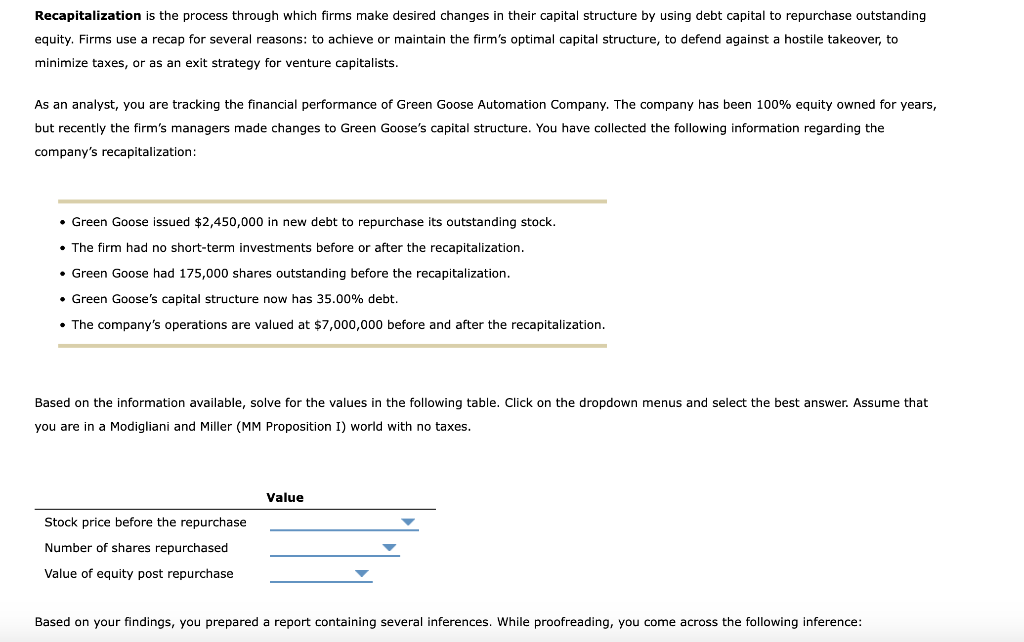

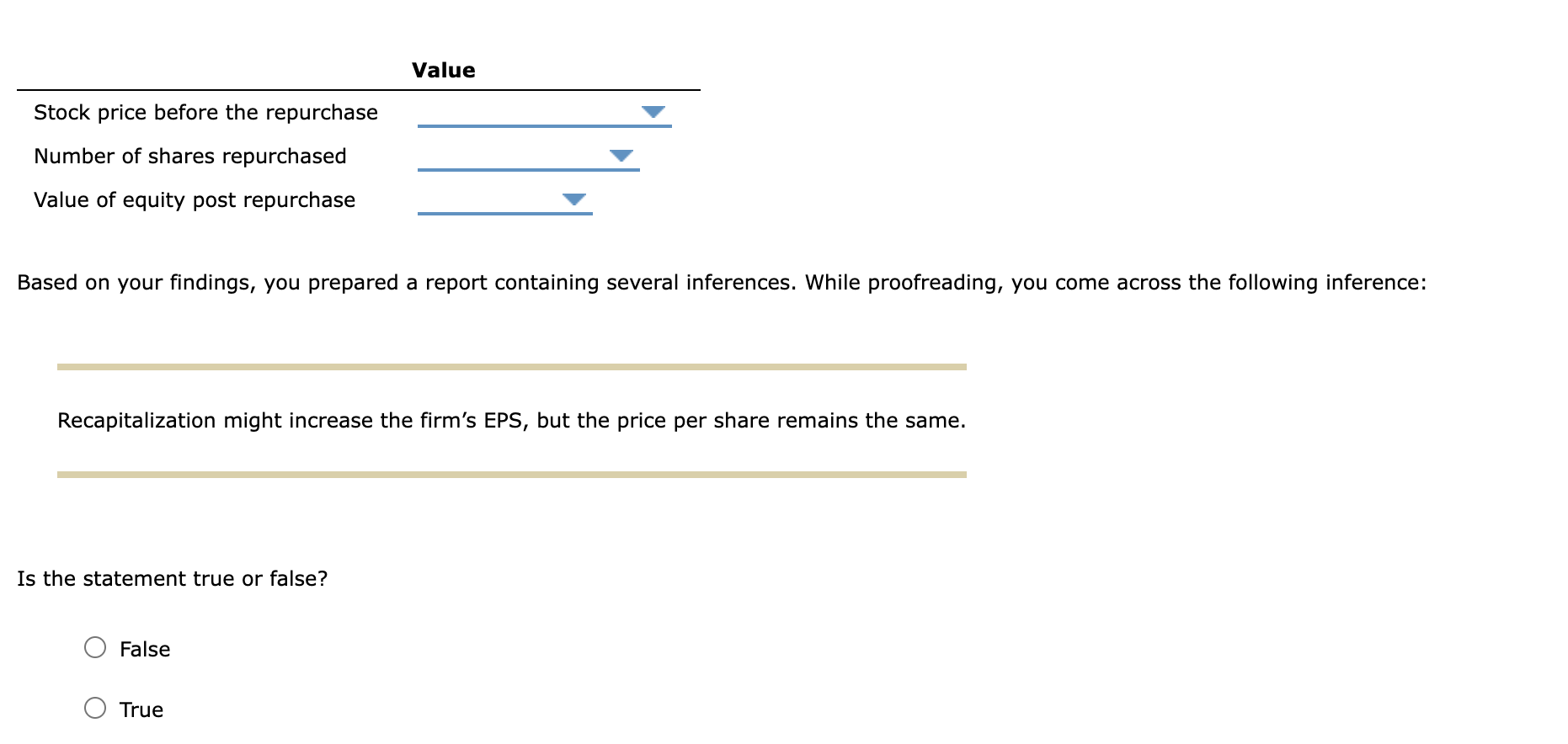

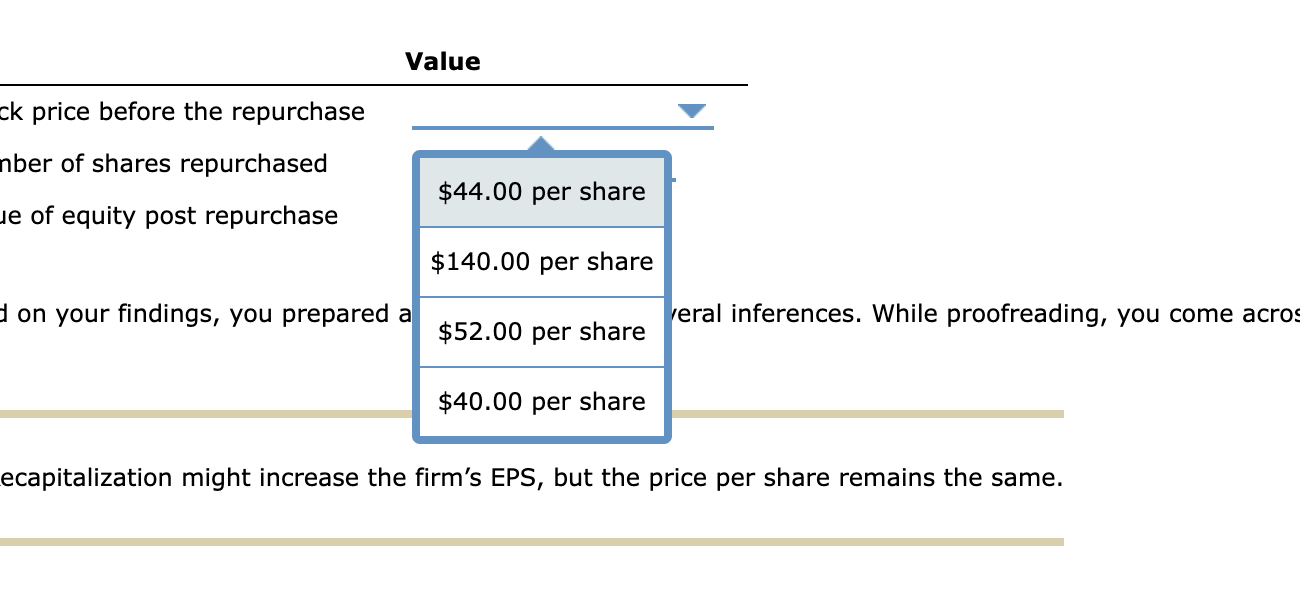

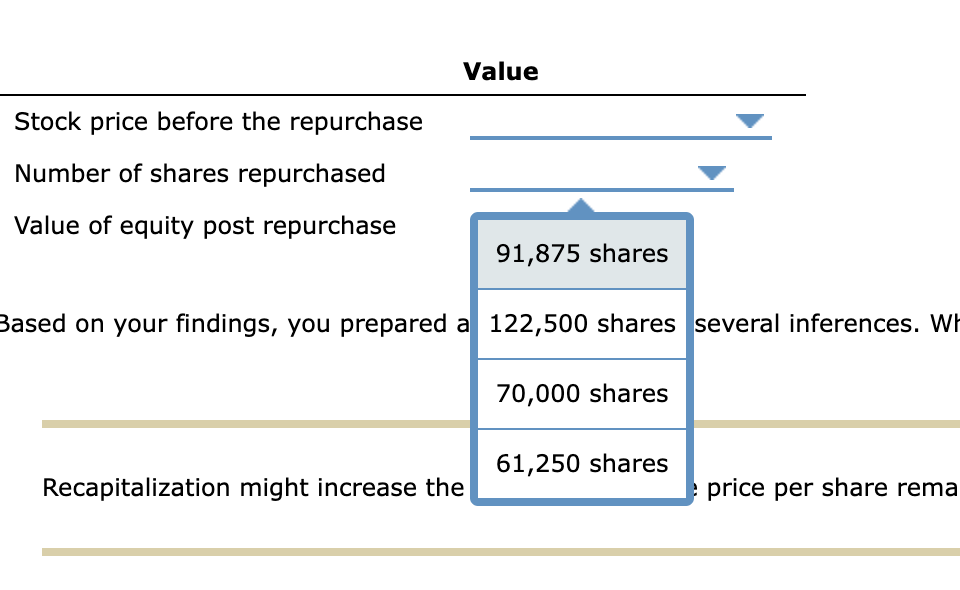

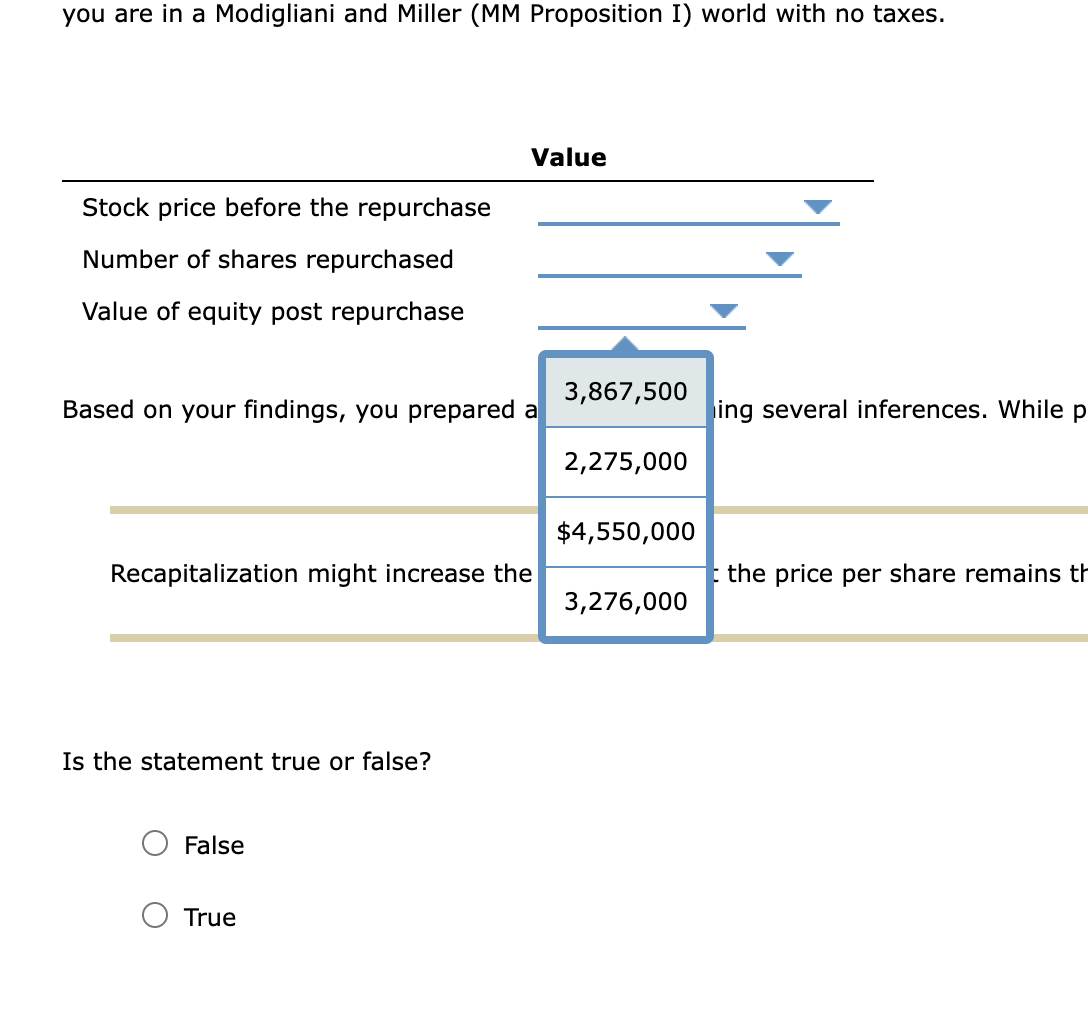

Recapitalization is the process through which firms make desired changes in their capital structure by using debt capital to repurchase outstanding equity. Firms use a recap for several reasons: to achieve or maintain the firm's optimal capital structure, to defend against a hostile takeover, to minimize taxes, or as an exit strategy for venture capitalists. As an analyst, you are tracking the financial performance of Green Goose Automation Company. The company has been 100% equity owned for years, but recently the firm's managers made changes to Green Goose's capital structure. You have collected the following information regarding the company's recapitalization: Green Goose issued $2,450,000 in new debt to repurchase its outstanding stock. The firm had no short-term investments before or after the recapitalization. Green Goose had 175,000 shares outstanding before the recapitalization. Green Goose's capital structure now has 35.00% debt. The company's operations are valued at $7,000,000 before and after the recapitalization. Based on the information available, solve for the values in the following table. Click on the dropdown menus and select the best answer. Assume that you are in a Modigliani and Miller (MM Proposition I) world with no taxes. Value Stock price before the repurchase Number of shares repurchased Value of equity post repurchase Based on your findings, you prepared a report containing several inferences. While proofreading, you come across the following inference: Value Stock price before the repurchase Number of shares repurchased Value of equity post repurchase Based on your findings, you prepared a report containing several inferences. While proofreading, you come across the following inference: Recapitalization might increase the firm's EPS, but the price per share remains the same. Is the statement true or false? False True Value ck price before the repurchase nber of shares repurchased $44.00 per share je of equity post repurchase $140.00 per share d on your findings, you prepared a Veral inferences. While proofreading, you come acros $52.00 per share $40.00 per share ecapitalization might increase the firm's EPS, but the price per share remains the same. Value Stock price before the repurchase Number of shares repurchased Value of equity post repurchase 91,875 shares Based on your findings, you prepared a 122,500 shares several inferences. W 70,000 shares 61,250 shares Recapitalization might increase the price per share rema you are in a Modigliani and Miller (MM Proposition I) world with no taxes. Value Stock price before the repurchase Number of shares repurchased Value of equity post repurchase 3,867,500 Based on your findings, you prepared a ling several inferences. While p 2,275,000 $4,550,000 Recapitalization might increase the the price per share remains th 3,276,000 Is the statement true or false? False True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts