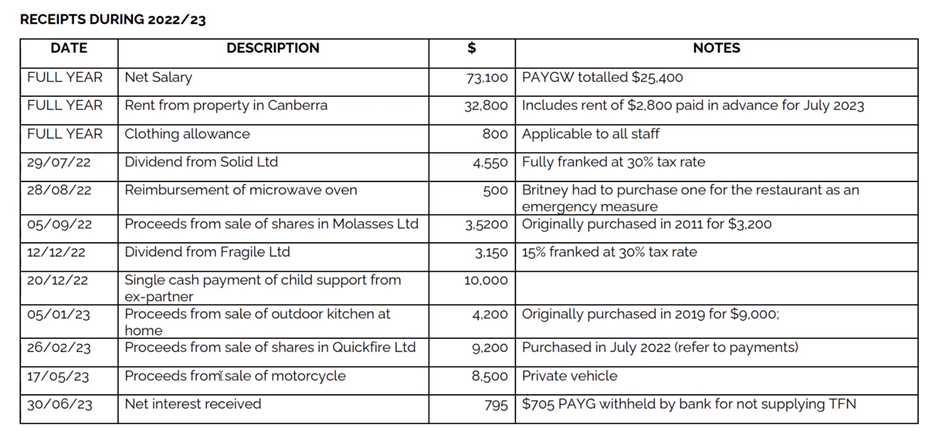

Question: RECEIPTS DU RING 2022/23 29/07f22 Dividend from Solid Ltd Fully franked at 30% tax rate 28/03X22 Reimbursement of microwave oven ' Britney had to purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts