Question: receivable. b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for

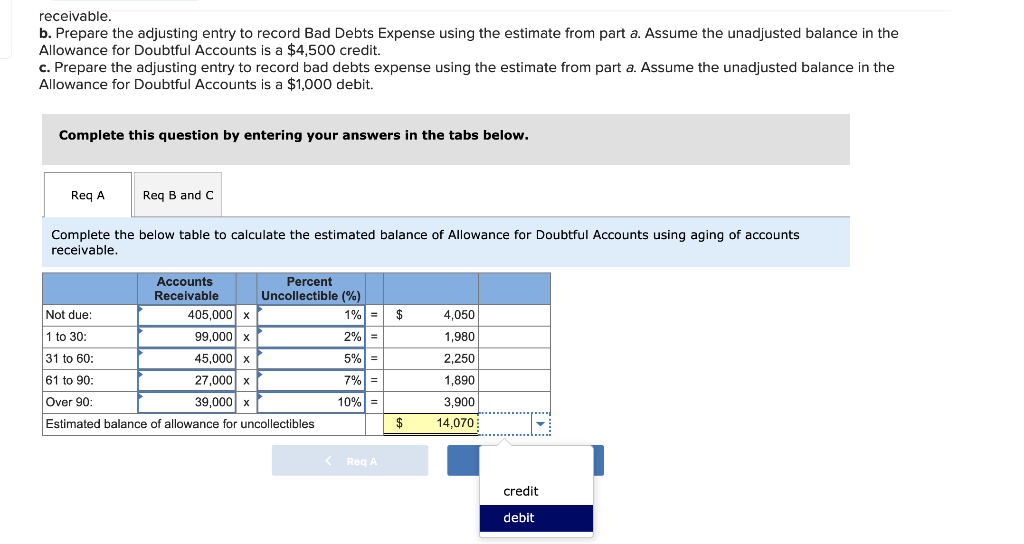

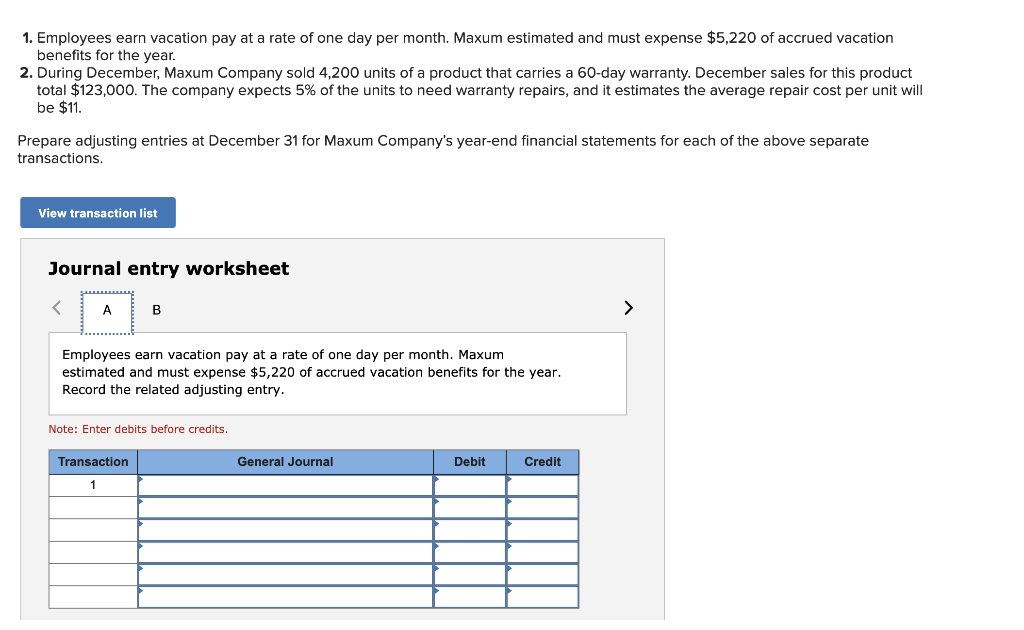

receivable. b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $4,500 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $1,000 debit. Complete this question by entering your answers in the tabs below. Req A Req B and C Complete the below table to calculate the estimated balance of Allowance for Doubtful Accounts using aging of accounts receivable. $ 2%) = Accounts Percent Receivable Uncollectible (%) Not due: 405,000 x 1% = 1 to 30: 99,000 X 31 to 60: 45,000 x 5% = 61 to 90: 27,000 x 7% = Over 90 39,000 x 10% = Estimated balance of allowance for uncollectibles 4,050 1,980 2,250 1,890 3,900 14,070 $ Red A credit debit 1. Employees earn vacation pay at a rate of one day per month. Maxum estimated and must expense $5,220 of accrued vacation benefits for the year. 2. During December, Maxum Company sold 4,200 units of a product that carries a 60-day warranty. December sales for this product total $123,000. The company expects 5% of the units to need warranty repairs, and it estimates the average repair cost per unit will be $11. Prepare adjusting entries at December 31 for Maxum Company's year-end financial statements for each of the above separate transactions. View transaction list Journal entry worksheet Employees earn vacation pay at a rate of one day per month. Maxum estimated and must expense $5,220 of accrued vacation benefits for the year. Record the related adjusting entry. Note: Enter debits before credits. Transaction General Journal Debit Credit 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts