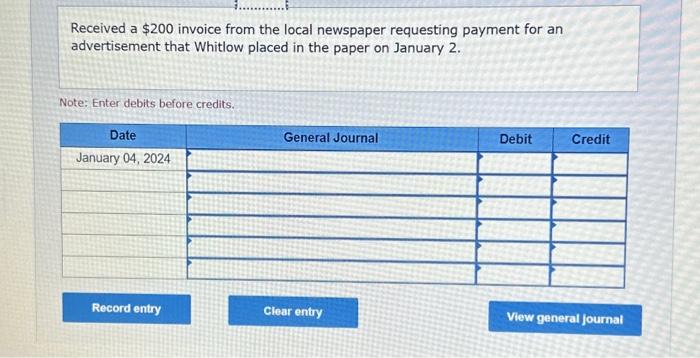

Question: Received a $200 invoice from the local newspaper requesting payment for an advertisement that Whitlow placed in the paper on January 2. Note: Enter debits

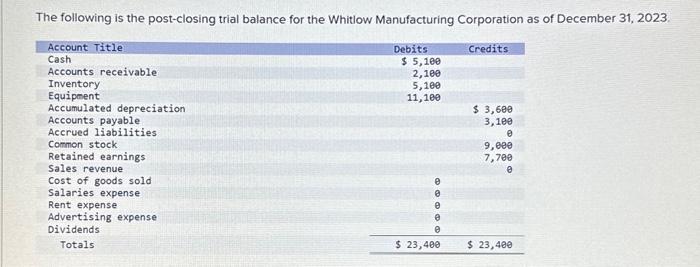

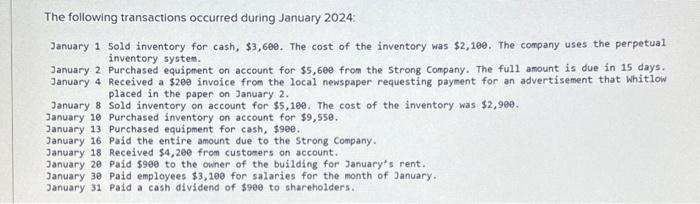

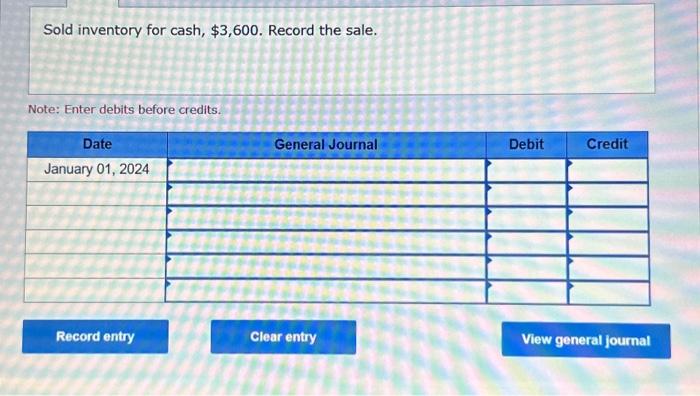

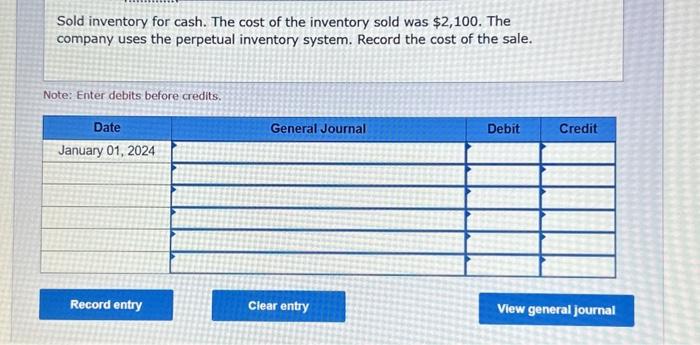

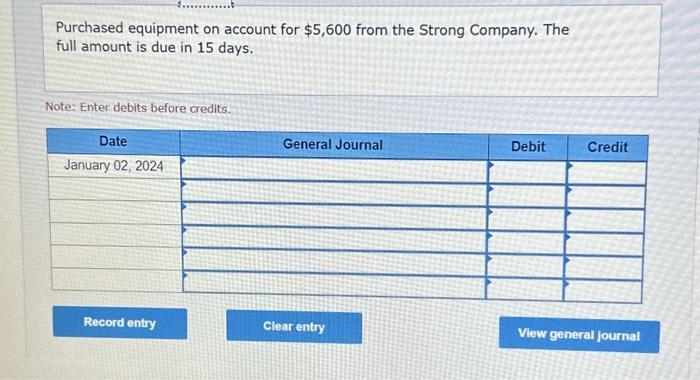

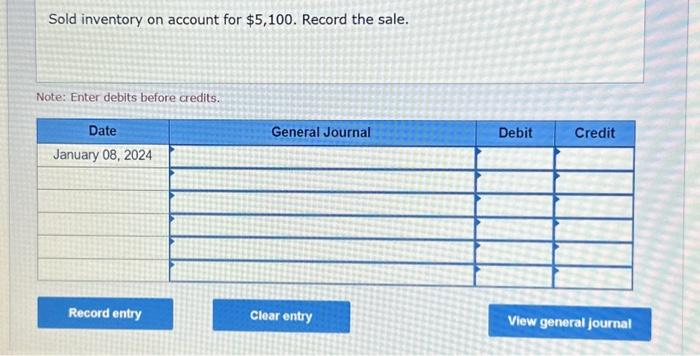

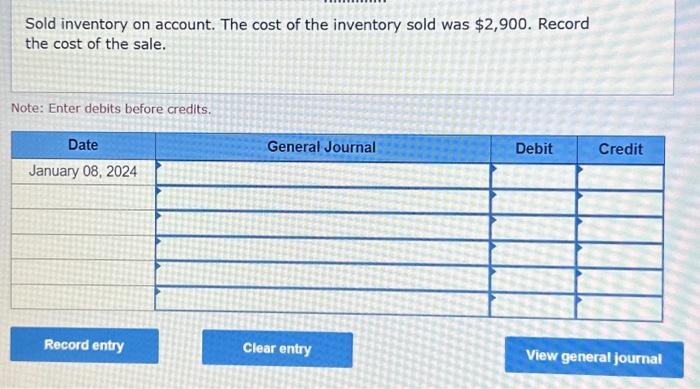

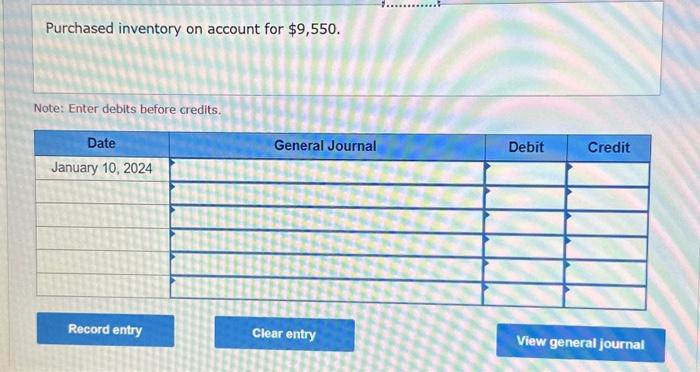

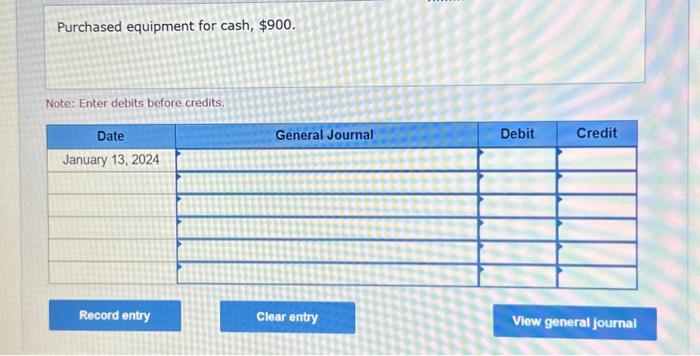

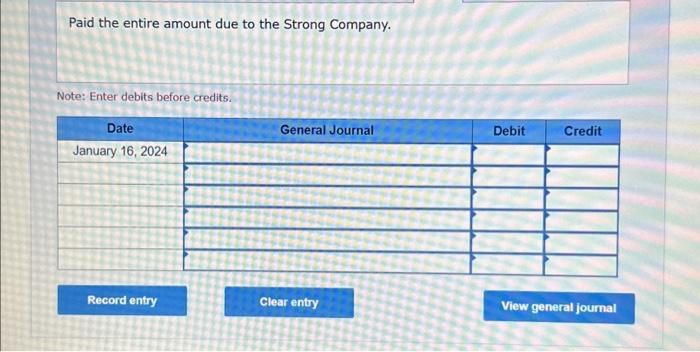

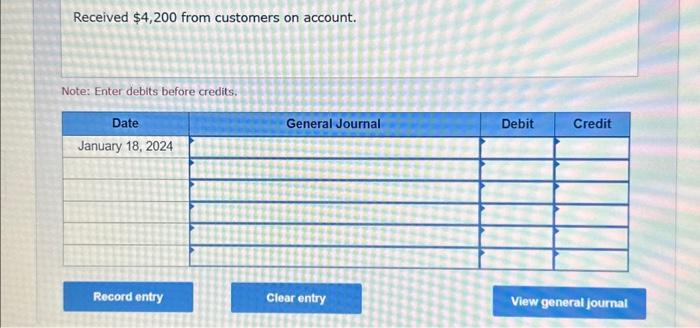

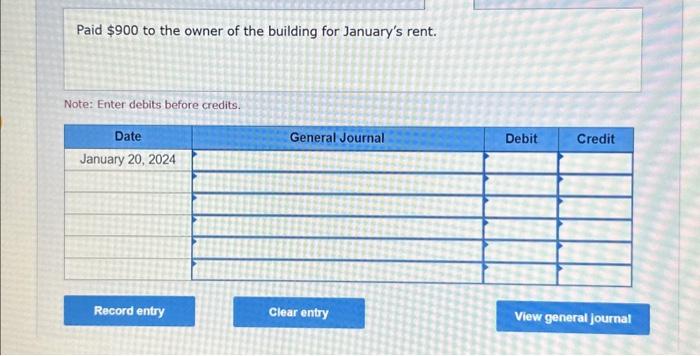

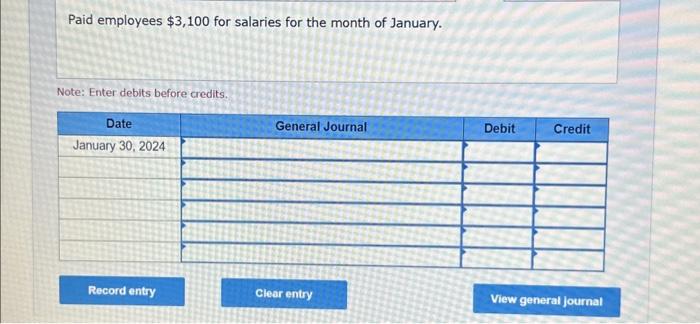

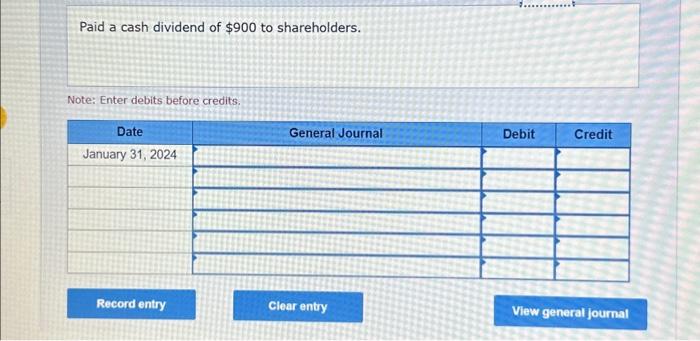

Received a $200 invoice from the local newspaper requesting payment for an advertisement that Whitlow placed in the paper on January 2. Note: Enter debits before credits. Sold inventory on account. The cost of the inventory sold was $2,900. Record the cost of the sale. Note: Enter debits before credits. Paid the entire amount due to the Strong Company. Note: Enter debits before credits. Sold inventory for cash. The cost of the inventory sold was $2,100. The company uses the perpetual inventory system. Record the cost of the sale. Note: Enter debits before credits. Sold inventory for cash, $3,600. Record the sale. Note: Enter debits before credits. Paid a cash dividend of $900 to shareholders. Note: Enter debits before credits. Paid $900 to the owner of the building for January's rent. Note: Enter debits before credits. The following is the post-closing trial balance for the Whitlow Manufacturing Corporation as of December 31,2023 Purchased equipment for cash, $900. Note: Enter debits before credits. Sold inventory on account for $5,100. Record the sale. Note: Enter debits before credits. Purchased equipment on account for $5,600 from the Strong Company. The full amount is due in 15 days. Note: Enter debits before credits. Purchased inventory on account for $9,550. Note: Enter debits before credits. Received $4,200 from customers on account. Note: Enter debits before credits. Paid employees $3,100 for salaries for the month of January. Note: Enter debits before credits. The following transactions occurred during January 2024 : January 1 sold inventory for cash, $3,600. The cost of the inventory was $2,100. The company uses the perpetual inventory systes. January 2 Purchased equipment on account for \$5,60e from the Strong company. The full amount is due in 15 days. January 4 Received a $200 invoice froe the local newspaper requesting payment for an advertisement that Whitlow. placed in the paper on January 2. January 8 Sold inventory on account for $5,100. The cost of the inventory was $2,900. January 10 Purchased inventory on account for $9,550. January 13 Purchased equipment for cash, $900. January 16 paid the entire amount due to the strong Company. January 18 Received $4,200 from customers on account. January 20 paid $9e0 to the owner of the building for January's rent. January 30 Paid employees $3,100 for salaries for the month of January. January 31 paid a cash dividend of $90e to shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts