Question: Received payment from the customer on the amount due from Jan. 20, less the allowance and discount 29 5-20 Journalizing purchase and sales transactions Learning

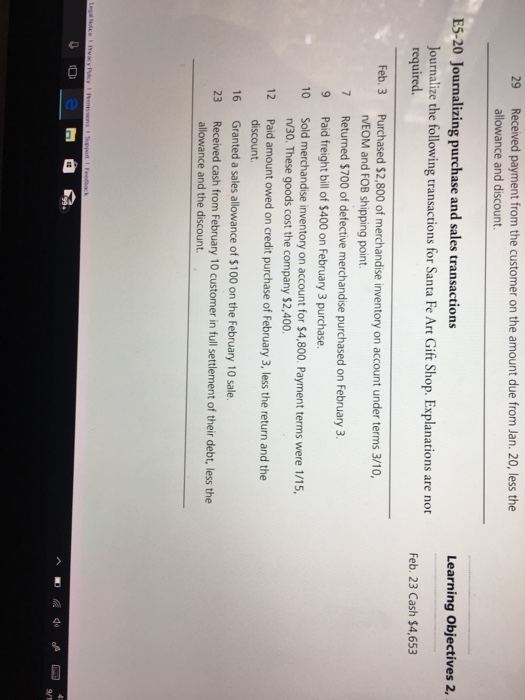

Received payment from the customer on the amount due from Jan. 20, less the allowance and discount 29 5-20 Journalizing purchase and sales transactions Learning Objectives 2, Journalize the following transactions for Santa Fe Art Gift Shop. Explanations are not required. Feb. 23 Cash $4,653 Purchased $2,800 of merchandise inventory on account under terms 3/10, rVEOM and FOB shipping point. Returned $700 of defective merchandise purchased on February 3. Feb. 3 7 9 Paid freight bill of $400 on February 3 purchase 10 12 16 Sold merchandise inventory on account for $4,800. Payment terms were 1/15, n/30. These goods cost the company $2,400. Paid amount owed on credit purchase of February 3, less the return and the discount. Granted a sales allowance of $100 on the February 10 sale. Received cash from February 10 customer in full settlement of their debt, less the 23 allowance and the discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts