Question: * - - - Recently BIDV has sold VND 1 billion T-bonds to the State Bank of Vietnam (SBV). Assume: The required reserves ratio is

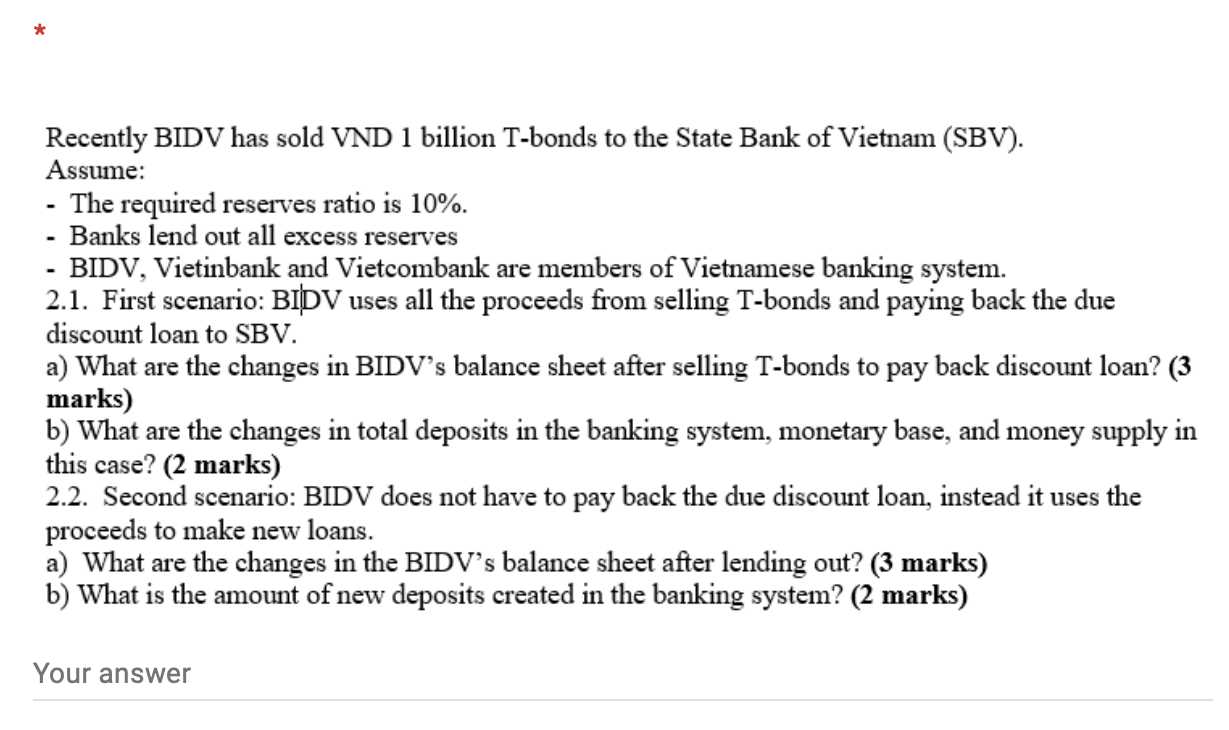

* - - - Recently BIDV has sold VND 1 billion T-bonds to the State Bank of Vietnam (SBV). Assume: The required reserves ratio is 10%. Banks lend out all excess reserves BIDV, Vietinbank and Vietcombank are members of Vietnamese banking system. 2.1. First scenario: BIDV uses all the proceeds from selling T-bonds and paying back the due discount loan to SBV. a) What are the changes in BIDV's balance sheet after selling T-bonds to pay back discount loan? (3 marks) b) What are the changes in total deposits in the banking system, monetary base, and money supply in this case? (2 marks) 2.2. Second scenario: BIDV does not have to pay back the due discount loan, instead it uses the proceeds to make new loans. a) What are the changes in the BIDV's balance sheet after lending out? (3 marks) b) What is the amount of new deposits created in the banking system? (2 marks) Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts