Question: Reconsider Lanni Products from the previous problem. a. Prepare its balance sheet just after it gets the bank loan. What is the ratio of real

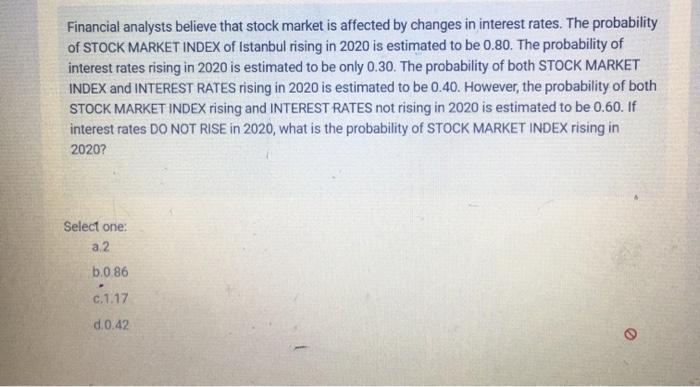

Reconsider Lanni Products from the previous problem. a. Prepare its balance sheet just after it gets the bank loan. What is the ratio of real assets to total assets? b. Prepare the balance sheet after Lanni spends the $70,000 to develop its software product. What is the ratio of real assets to total assets? c. Prepare the balance sheet after Lanni accepts the payment of shares from Microsoft. What is the ratio of real assets to total assets? 9. Examine the balance sheet of commercial banks in Table 1.3. a. What is the ratio of real assets to total assets? b. What is the ratio of real assets to total assets for nonfinancial firms (Table 1.4)? c. Why should this difference be expected? 10. Consider Figure 1A, which describes an issue of American gold certificates. a. Is this issue a primary or secondary market transaction? b. Are the certificates primitive or derivative assets? c. What market niche is filled by this offering? 11. Discuss the advantages and disadvantages of the following forms of managerial compensation in terms of mitigating agency problems, that is, potential conflicts of interest between managers and shareholders. a. A fixed salary. b. Stock in the firm that must be held for five years. c. A salary linked to the firm's profits. 12. Oversight by large institutional investors or creditors is one mechanism to reduce agency problems. Why don't individual investors in the firm have the same incentive to keep an eye on management? 13. Give an example of three financial intermediaries and explain how they act as a bridge between small investors and large capital markets or corporations. 14. The average rate of return on investments in large stocks has outpaced that on investments in Treasury bills by about 8% since 1926. Why, then, does anyone invest in Treasury bills? 15. What are some advantages and disadvantages of top-down versus bottom-up investing styles? 16. You see an advertisement for a book that claims to show how you can make $1 million with no risk and with no money down. Will you buy the book? 17. Why do financial assets show up as a component of household wealth, but not of national wealth? Why do financial assets still matter for the material well-being of an economy? 18. Wall Street firms have traditionally compensated their traders with a share of the trading profits that they generated. How might this practice have affected traders' willingness to assume risk? What is the agency problem this practice engendered? 19. WAll financial institutions finance long-time period needs with short-time period assets of price range to some volume. But a monetary group that is predicated too heavily on quick-time period finances is possibly to reveal itself to unacceptable liquidity risks. During the length main up to the credit score disaster of 2007, there was a tendency for subprime mortgages and different lengthy-term property to be financed by way of business paper whilst they have been in a portfolio waiting to be packaged into established products. Conduits and special motive motors had an ongoing requirement for this form of financing. The commercial paper might commonly be rolled over each month. For example, the purchasers of business paper issued on April 1 might be redeemed with the proceeds of a brand new commercial paper trouble on May 1; this new business paper problem could in flip be redeemed with some other new industrial paper problem on June 1; and so forth.When investors lost confidence in subprime mortgages in August 2007, it became not possible to roll over business paper. In many times, banks had supplied ensures and had to provide financing. This led to a scarcity of liquidity. As a end result, the credit score crisis was more severe than it would have been if longer-term financing had been arranged. Many of the screw ups of financial establishments for the duration of the crisis (e.G., Lehman Brothers and Northern Rock) have been as a result of immoderate reliance on short-term funding. Once the market (rightly or wrongly) will become concerned approximately the health of a monetary insti- tution, it may be not possible to roll over the financial group's short-term funding. The Basel Committee has identified the significance of liquidity dangers with the aid of introducing liquidity requirements in Basel III. 29.Three.Three Market Transparency Is Important One of the classes from the credit score disaster of 2007 is that marketplace transparency is vital. During the length leading as much as 2007, traders have been trading notably dependent merchandise without any actual knowledge of the underlying property. All they knew turned into the credit rating of the security being traded.With hindsight,we will say that investors must have demanded extra records approximately the underlying property and should have extra cautiously assessed the dangers they have been taking. The subprime meltdown of August 2007 caused traders to lose self assurance in all dependent products and withdraw from that market. This brought about a market breakdown where tranches of based merchandise ought to only be sold at prices properly underneath their theoretical values. There became a flight to fine and credit spreads multiplied. If there had been marketplace transparency, so that traders understood the asset-subsidized securities they have been buying, there could nonetheless were subprime losses, however the flight to first-class and disruptions to the market might were much less stated.hat reforms to the financial system might reduce its exposure to systemic risk?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts