Question: Record adjusting journal entries for each separate case below for year ended December 31. Assume no other adjusting entries are made during the year. a.

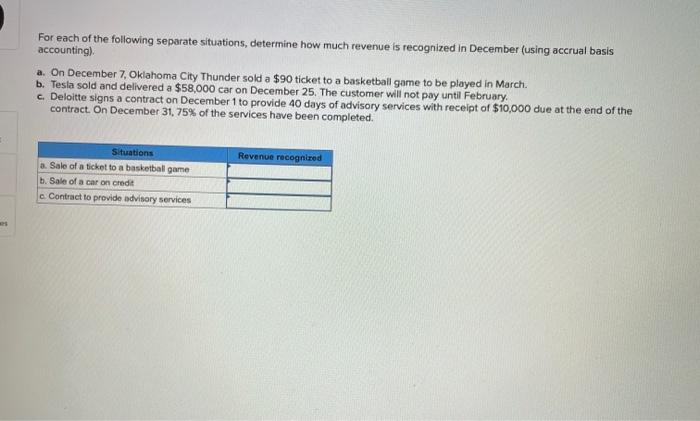

For each of the following separate situations, determine how much revenue is recognized in December (using accrual basis accounting) a. On December 7, Oklahoma City Thunder sold a $90 ticket to a basketball game to be played in March. b. Tesla sold and delivered a $58,000 car on December 25. The customer will not pay until February c. Deloitte signs a contract on December 1 to provide 40 days of advisory services with receipt of $10,000 due at the end of the contract. On December 31, 75% of the services have been completed. Revenue recognized Situations a. Sale of a ticket to a basketball game b. Sale of a car on credit c. Contract to provide advisory services

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts