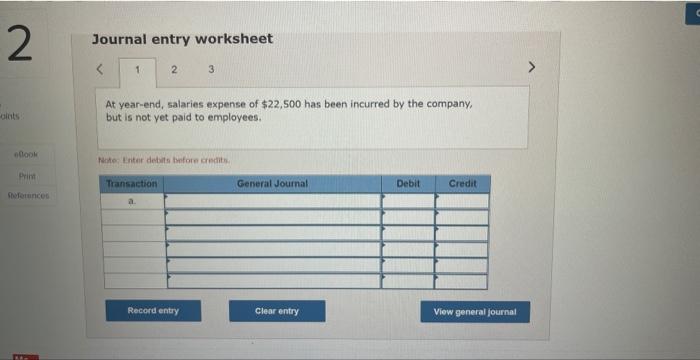

Question: Record adjusting journal entries for each separate case below for year ended December 31. Assume no other adjusting entries are made during the year. a.

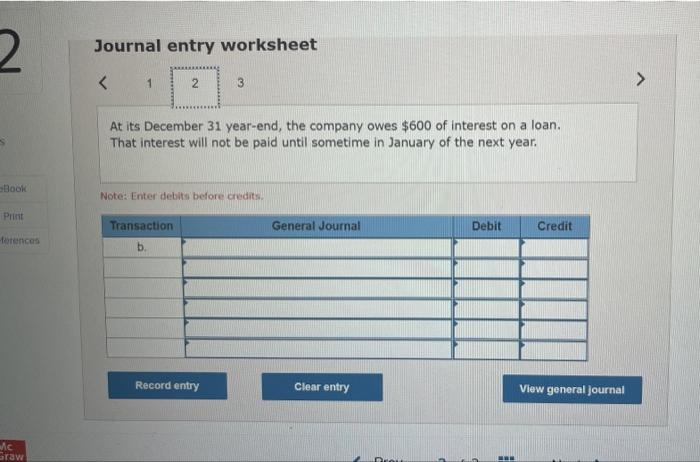

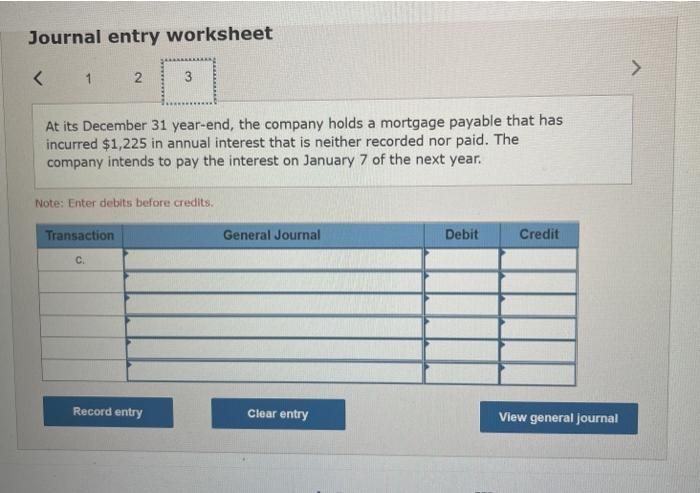

Journal entry worksheet At year-end, salaries expense of $22,500 has been incurred by the company, but is not yet paid to employees. Journal entry worksheet At its December 31 year-end, the company owes $600 of interest on a loan. That interest will not be paid until sometime in January of the next year. Note: Enter debits before credits. Journal entry worksheet At its December 31 year-end, the company holds a mortgage payable that has incurred $1,225 in annual interest that is neither recorded nor paid. The company intends to pay the interest on January 7 of the next year. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts