Question: Record adjusting journal entries for each separate case below for year ended December 31. Assume no other adjusting entries are made during the year. a.

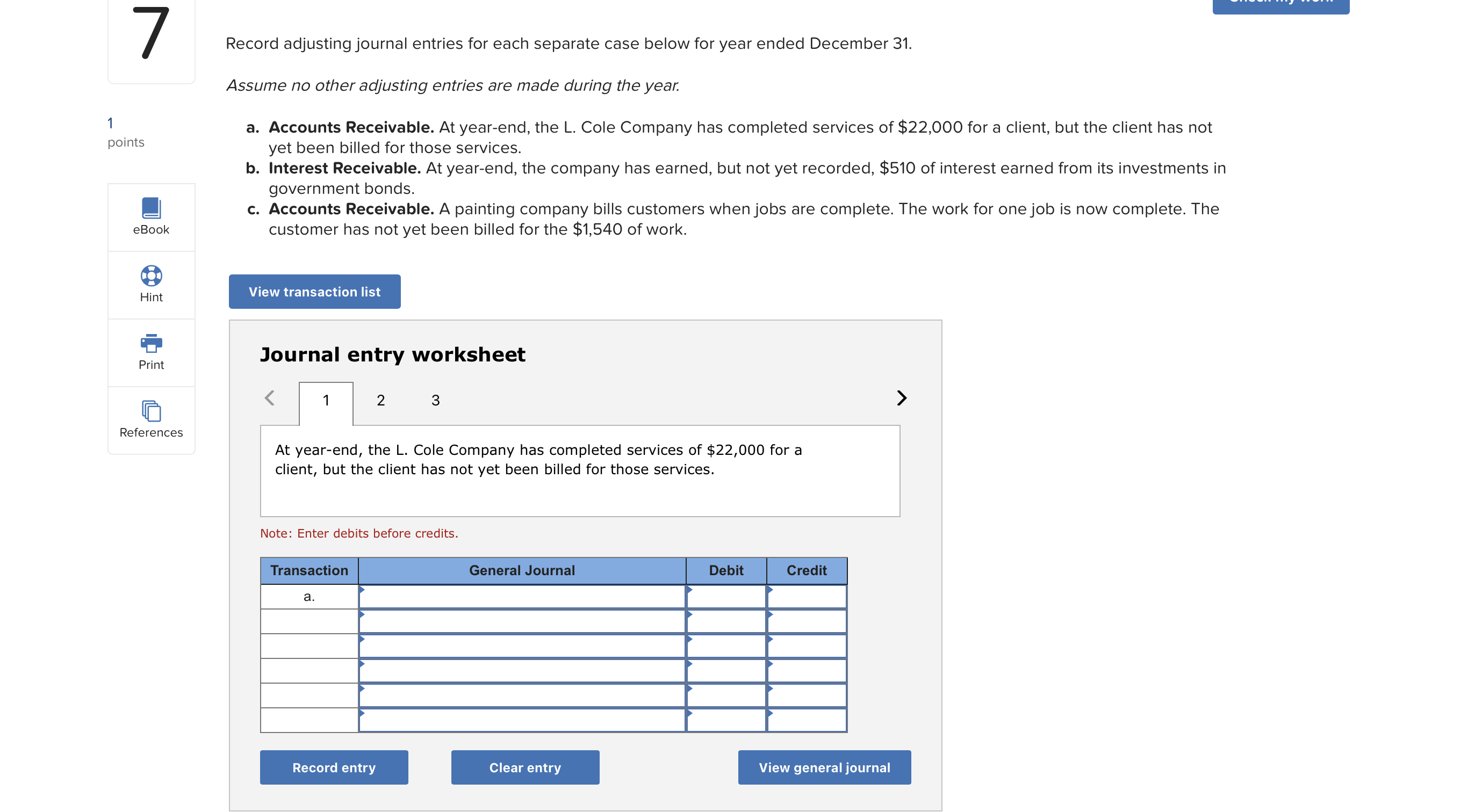

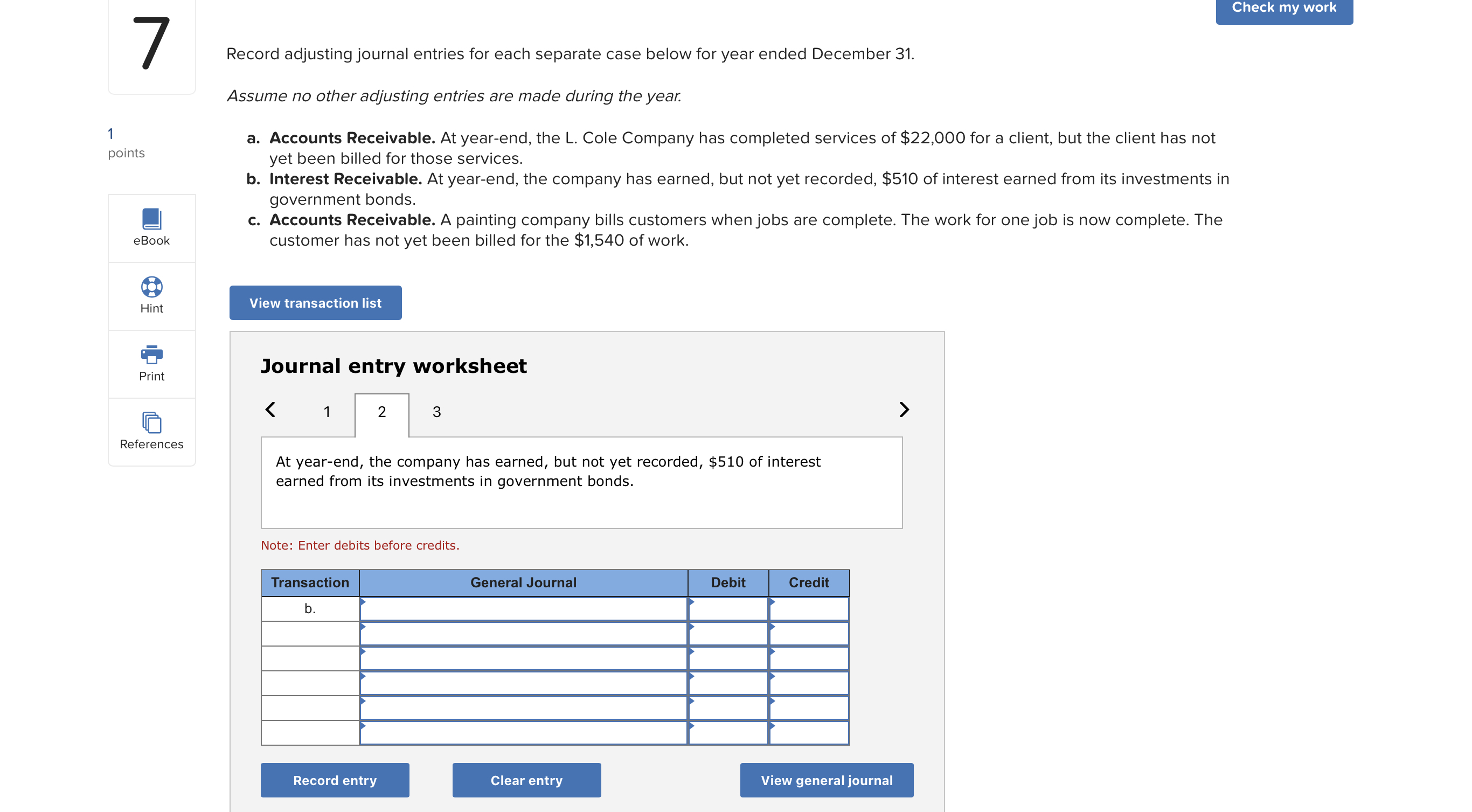

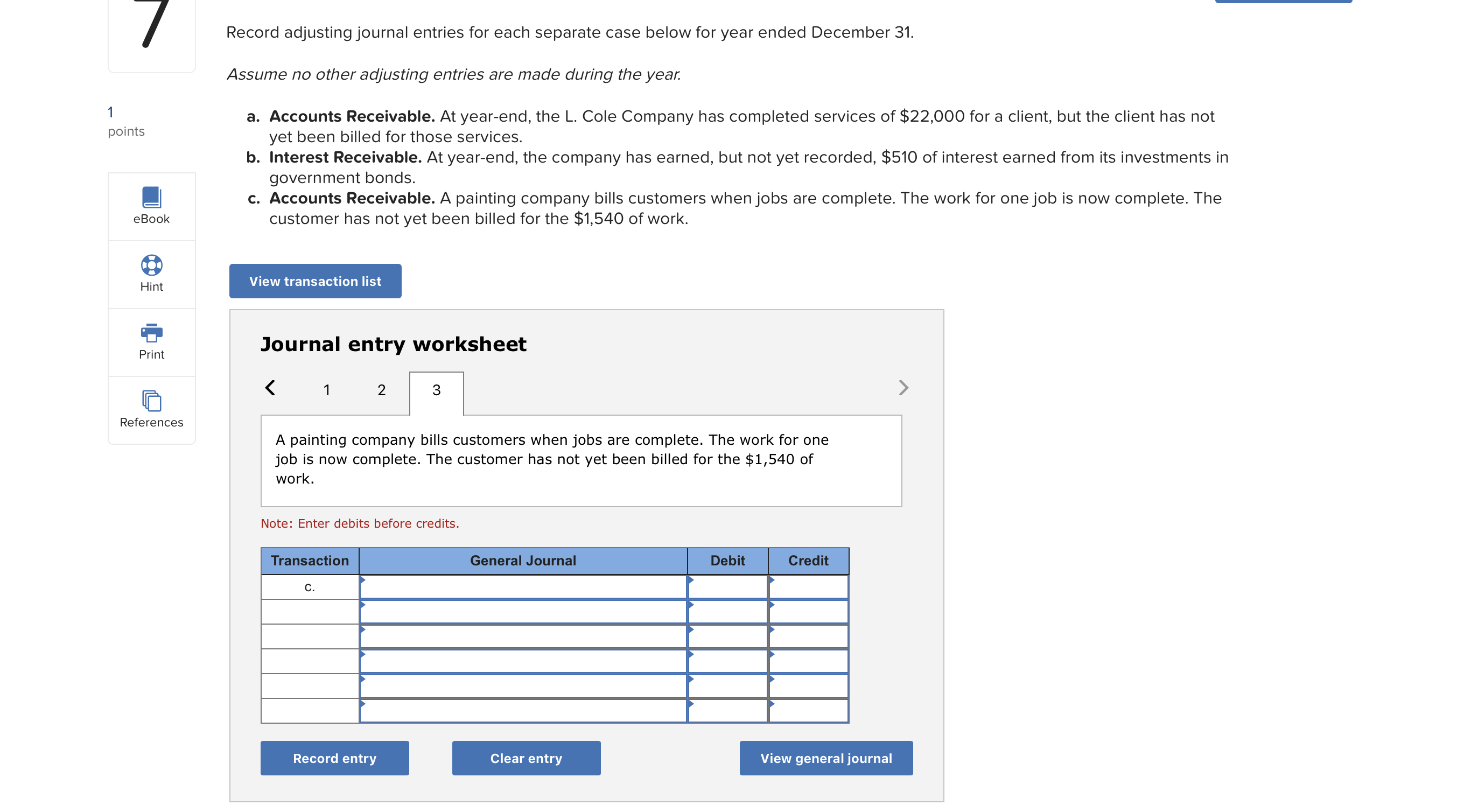

Record adjusting journal entries for each separate case below for year ended December 31. Assume no other adjusting entries are made during the year. a. Accounts Receivable. At year-end, the L. Cole Company has completed services of $22,000 for a client, but the client has not yet been billed for those services. b. Interest Receivable. At year-end, the company has earned, but not yet recorded, $510 of interest earned from its investments in government bonds. c. Accounts Receivable. A painting company bills customers when jobs are complete. The work for one job is now complete. The customer has not yet been billed for the $1,540 of work. Journal entry worksheet At year-end, the company has earned, but not yet recorded, $510 of interest earned from its investments in government bonds. Note: Enter debits before credits. Record adjusting journal entries for each separate case below for year ended December 31. Assume no other adjusting entries are made during the year. a. Accounts Receivable. At year-end, the L. Cole Company has completed services of $22,000 for a client, but the client has not yet been billed for those services. b. Interest Receivable. At year-end, the company has earned, but not yet recorded, $510 of interest earned from its investments in government bonds. c. Accounts Receivable. A painting company bills customers when jobs are complete. The work for one job is now complete. The customer has not yet been billed for the $1,540 of work. Journal entry worksheet A painting company bills customers when jobs are complete. The work for one job is now complete. The customer has not yet been billed for the $1,540 of work. Note: Enter debits before credits. Record adjusting journal entries for each separate case below for year ended December 31. Assume no other adjusting entries are made during the year. a. Accounts Receivable. At year-end, the L. Cole Company has completed services of $22,000 for a client, but the client has not yet been billed for those services. b. Interest Receivable. At year-end, the company has earned, but not yet recorded, $510 of interest earned from its investments in government bonds. c. Accounts Receivable. A painting company bills customers when jobs are complete. The work for one job is now complete. The customer has not yet been billed for the $1,540 of work. Journal entry worksheet At year-end, the L. Cole Company has completed services of $22,000 for a client, but the client has not yet been billed for those services. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts