Question: Record all transactions, using either journal entries, the balance sheet equation, or any other method of yourchoosing. I recommend using journal entries as we will

Record all transactions, using either journal entries, the balance sheet equation, or any other method of yourchoosing. I recommend using journal entries as we will use those throughout the course. After recording all the transactions, prepare the following financial statements A Balance Sheet for the year ending December An Income Statement for months ending December A Balance Sheet for the year ending December An Income Statement for months ending December

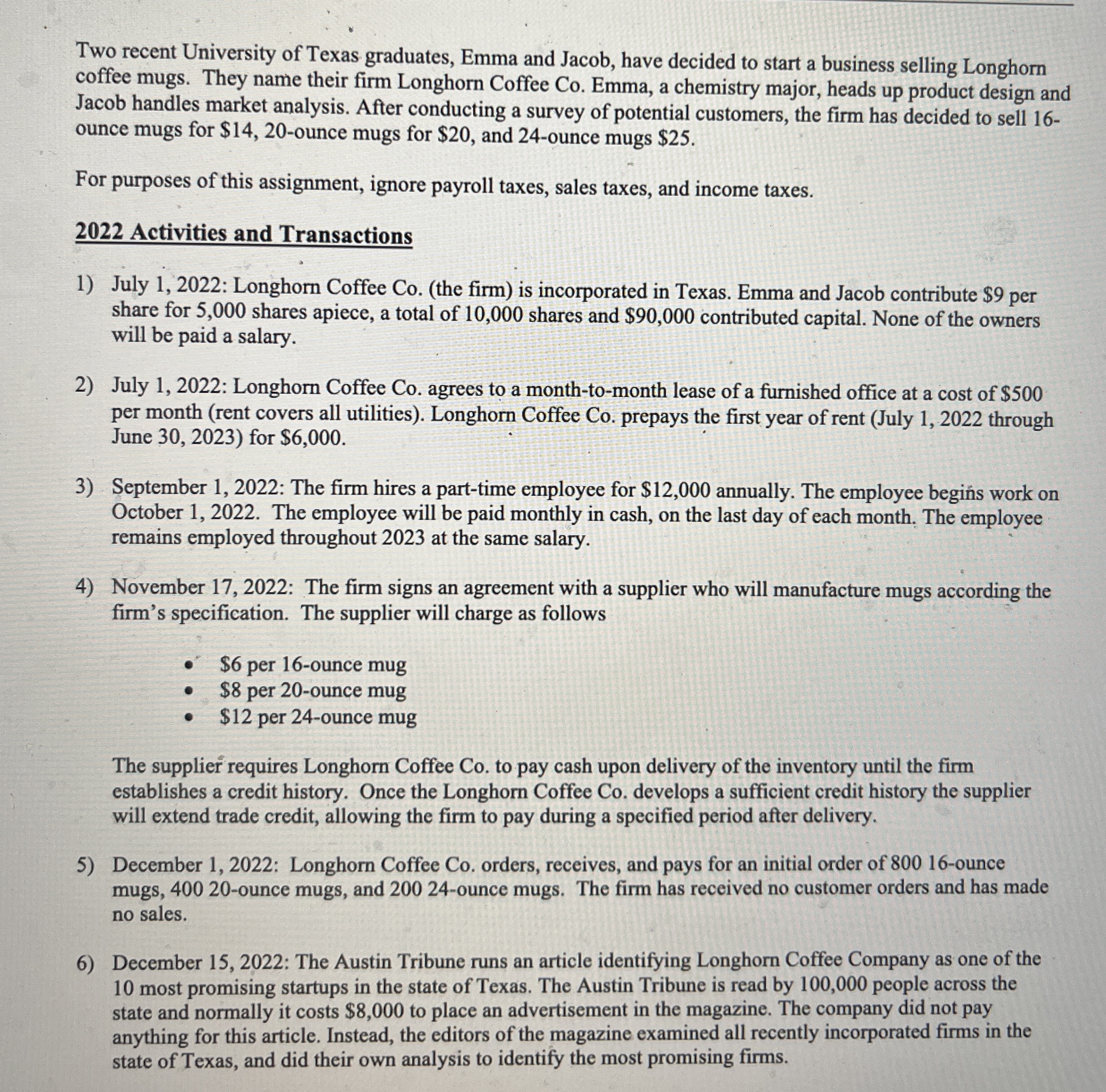

Two recent University of Texas graduates, Emma and Jacob, have decided to start a business selling Longhorncoffee mugs. They name their firm Longhorn Coffee Co Emma, a chemistry major, heads up product design andJacob handles market analysis. After conducting a survey of potential customers, the firm has decided to sell ounce mugs for $ounce mugs for $ and ounce mugs $For purposes of this assignment, ignore payroll taxes, sales taxes, and income taxes Activities and Transactions July : Longhorn Coffee Cothe firm is incorporated in Texas. Emma and Jacob contribute $ pershare for shares apiece, a total of shares and $ contributed capital. None of the ownerswill be paid a salary July : Longhorn Coffee Co agrees to a monthtomonth lease of a furnished office at a cost of $per month rent covers all utilities Longhorn Coffee Co prepays the first year of rent July throughJune for $ September : The firm hires a parttime employee for $ annually. The employee begins work onOctober The employee will be paid monthly in cash, on the last day of each month. The employeeremains employed throughout at the same salary November : The firm signs an agreement with a supplier who will manufacture mugs according thefirms specification. The supplier will charge as follows $ per ounce mug $ per ounce mug $ per ounce mugThe supplier requires Longhorn Coffee Co to pay cash upon delivery of the inventory until the firmestablishes a credit history. Once the Longhorn Coffee Co develops a sufficient credit history the supplierwill extend trade credit, allowing the firm to pay during a specified period after delivery December : Longhorn Coffee Co orders, receives, and pays for an initial order of ouncemugs, ounce mugs, and ounce mugs. The firm has received no customer orders and has madeno sales December : The Austin Tribune runs an article identifying Longhorn Coffee Company as one of the most promising startups in the state of Texas. The Austin Tribune is read by people across thestate and normally it costs $ to place an advertisement in the magazine. The company did not payanything for this article. Instead, the editors of the magazine examined all recently incorporated firms in thestate of Texas, and did their own analysis to identify the most promising firms.Two recent University of Texas graduates, Emma and Jacob, have decided to start a business selling Longhorn coffee mugs. They name their firm Longhorn Coffee Co Emma, a chemistry major, heads up product design and Jacob handles market analysis. After conducting a survey of potential customers, the firm has decided to sell ounce mugs for $ounce mugs for $ and ounce mugs $

For purposes of this assignment, ignore payroll taxes, sales taxes, and income taxes.

Activities and Transactions

July : Longhorn Coffee Cothe firm is incorporated in Texas. Emma and Jacob contribute $ per share for shares apiece, a total of shares and $ contributed capital. None of the owners will be paid a salary.

July : Longhorn Coffee Co agrees to a monthtomonth lease of a furnished office at a cost of $ per month rent covers all utilities Longhorn Coffee Co prepays the first year of rent July through June for $

September : The firm hires a parttime employee for $ annually. The employee begins work on October The employee will be paid monthly in cash, on the last day of each month. The employee remains employed throughout at the same salary.

November : The firm signs an agreement with a supplier who will manufacture mugs according the firm's specification. The supplier will charge as follows

$ per ounce mug

$ per ounce mug

$ per ounce mug

The supplier requires Longhorn Coffee Co to pay cash upon delivery of the inventory until t

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock