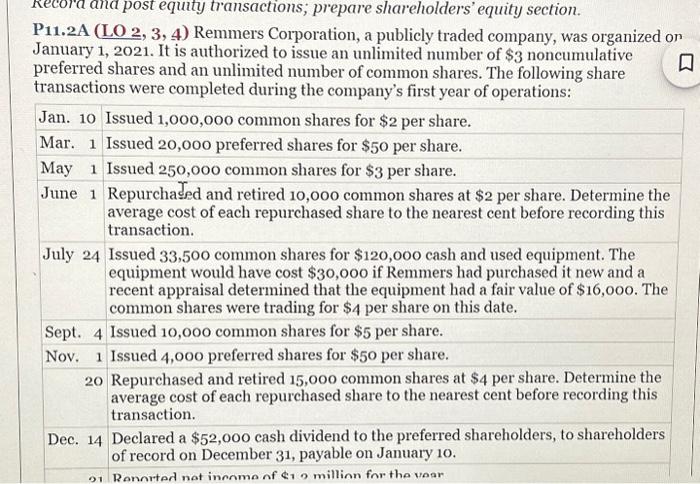

Question: Record and post equity transactions; prepare shareholders' equity section. P11.2A (LO 2, 3, 4) Remmers Corporation, a publicly traded company, was organized on January 1,

P11.2A (LO 2, 3, 4) Remmers Corporation, a publicly traded company, was organized on January 1,2021. It is authorized to issue an unlimited number of $3 noncumulative preferred shares and an unlimited number of common shares. The following share transactions were completed during the company's first year of operations: Jan. 10 Issued 1,000,0oo common shares for $2 per share. Mar. 1 Issued 20,000 preferred shares for $50 per share. May 1 Issued 250,000 common shares for $3 per share. June 1 Repurchaded and retired 10,000 common shares at \$2 per share. Determine the average cost of each repurchased share to the nearest cent before recording this transaction. July 24 Issued 33,500 common shares for $120,000 cash and used equipment. The equipment would have cost $30,000 if Remmers had purchased it new and a recent appraisal determined that the equipment had a fair value of $16,000. The common shares were trading for $4 per share on this date. Sept. 4 Issued 10,000 common shares for $5 per share. Nov. 1 Issued 4,0oo preferred shares for $50 per share. 20 Repurchased and retired 15,000 common shares at \$4 per share. Determine the average cost of each repurchased share to the nearest cent before recording this transaction. Dec. 14 Declared a $52,000 cash dividend to the preferred shareholders, to shareholders of record on December 31, payable on January 10. P11.2A (LO 2, 3, 4) Remmers Corporation, a publicly traded company, was organized on January 1,2021. It is authorized to issue an unlimited number of $3 noncumulative preferred shares and an unlimited number of common shares. The following share transactions were completed during the company's first year of operations: Jan. 10 Issued 1,000,0oo common shares for $2 per share. Mar. 1 Issued 20,000 preferred shares for $50 per share. May 1 Issued 250,000 common shares for $3 per share. June 1 Repurchaded and retired 10,000 common shares at \$2 per share. Determine the average cost of each repurchased share to the nearest cent before recording this transaction. July 24 Issued 33,500 common shares for $120,000 cash and used equipment. The equipment would have cost $30,000 if Remmers had purchased it new and a recent appraisal determined that the equipment had a fair value of $16,000. The common shares were trading for $4 per share on this date. Sept. 4 Issued 10,000 common shares for $5 per share. Nov. 1 Issued 4,0oo preferred shares for $50 per share. 20 Repurchased and retired 15,000 common shares at \$4 per share. Determine the average cost of each repurchased share to the nearest cent before recording this transaction. Dec. 14 Declared a $52,000 cash dividend to the preferred shareholders, to shareholders of record on December 31, payable on January 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts