Question: >>>>>Record each transaction in the journal. (Narrations are not required) - (Journalising, posting, adjusting, closing, and the financial statements)- Q1. Ben Consulting Inc. completed the

>>>>>Record each transaction in the journal. (Narrations are not required)

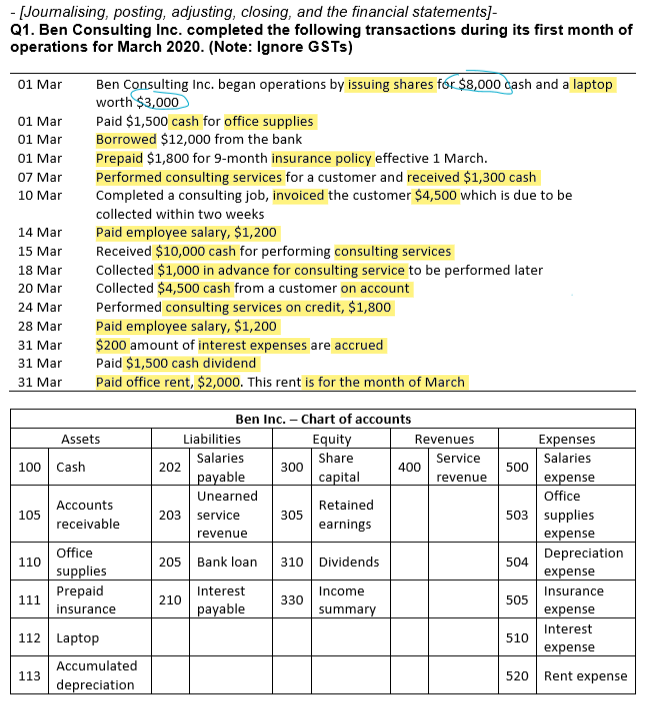

- (Journalising, posting, adjusting, closing, and the financial statements)- Q1. Ben Consulting Inc. completed the following transactions during its first month of operations for March 2020. (Note: Ignore GSTs) 01 Mar 01 Mar 01 Mar 01 Mar 07 Mar 10 Mar 14 Mar 15 Mar 18 Mar 20 Mar 24 Mar 28 Mar 31 Mar 31 Mar 31 Mar Ben Consulting Inc. began operations by issuing shares for $8,000 cash and a laptop worth $3,000 Paid $1,500 cash for office supplies Borrowed $12,000 from the bank Prepaid $1,800 for 9-month insurance policy effective 1 March Performed consulting services for a customer and received $1,300 cash Completed a consulting job, invoiced the customer $4,500 which is due to be collected within two weeks Paid employee salary, $1,200 Received $10,000 cash for performing consulting services Collected $1,000 in advance for consulting service to be performed later Collected $4,500 cash from a customer on account Performed consulting services on credit, $1,800 Paid employee salary, $1,200 $200 amount of interest expenses are accrued Paid $1,500 cash dividend Paid office rent, $2,000. This rent is for the month of March Assets 100 Cash 202 300 Shar 400 500 Ben Inc. - Chart of accounts Liabilities Equity l Revenues Salaries Service payable capital revenue Unearned Retained 203 service earnings revenue 105 Accounts receivable 305 503 Expenses Salaries expense Office supplies expense Depreciation expense Insurance expense Interest expense 110 205 Bank loan 310 Dividends Office supplies Prepaid insurance 111 Interest payable 330 Income summary 112 Laptop 113 Accumulated depreciation 520 Rent expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts