Question: record entry to close/income statement/balance sheet/cash flow statement (first three pics, ive done my accounts im just running out of time thank you :) Record

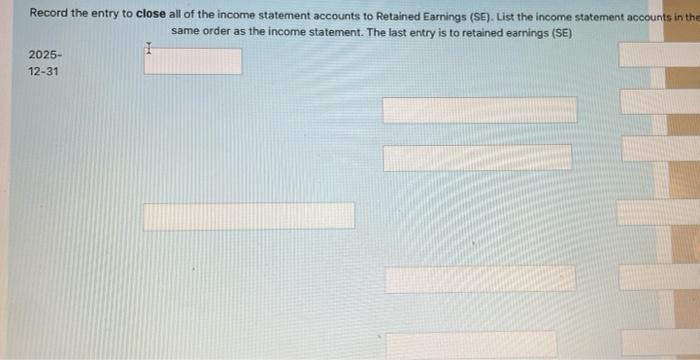

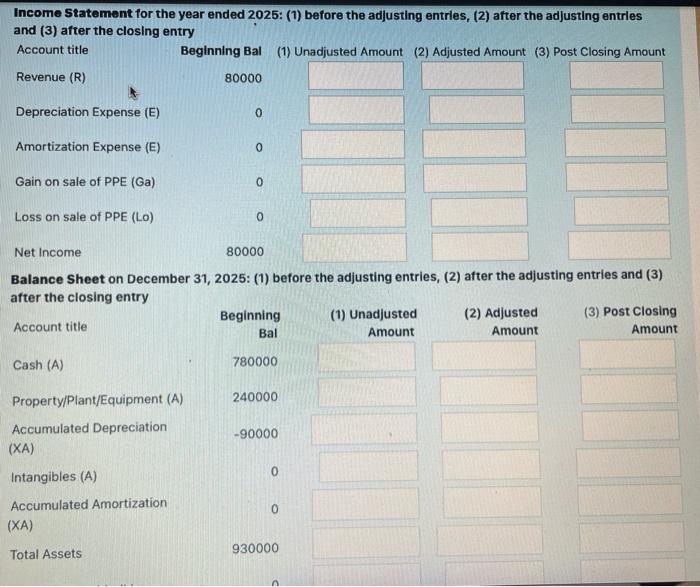

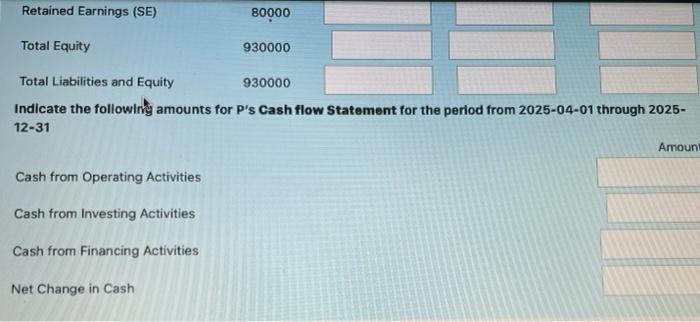

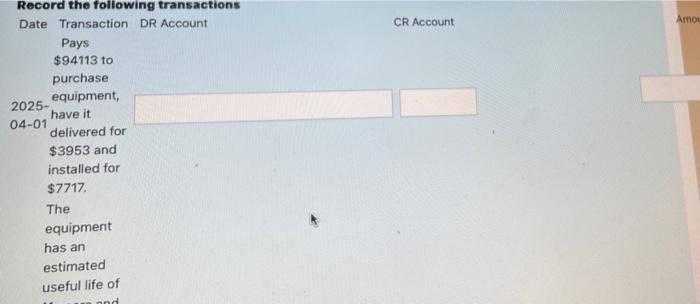

Record the entry to close all of the income statement accounts to Retained Earnings (SE). List the income statement accounts in the same order as the income statement. The last entry is to retained earnings (SE) 2025- 12-31 Income Statement for the year ended 2025: (1) before the adjusting entries, (2) after the adjusting entries and (3) after the closing entry Account title Beginning Bal (1) Unadjusted Amount (2) Adjusted Amount (3) Post Closing Amount Revenue (R) 80000 Depreciation Expense (E) 0 Amortization Expense (E) 0 Gain on sale of PPE (Ga) Loss on sale of PPE (LO) 0 Net Income 80000 Balance Sheet on December 31, 2025: (1) before the adjusting entries, (2) after the adjusting entries and (3) after the closing entry (2) Adjusted (3) Post Closing Account title Beginning Bal (1) Unadjusted Amount Amount Amount Cash (A) 780000 Property/Plant/Equipment (A) 240000 Accumulated Depreciation (XA) -90000 0 Intangibles (A) Accumulated Amortization (XA) 930000 Total Assets n 0 Retained Earnings (SE) 80000 Total Equity 930000 Total Liabilities and Equity 930000 Indicate the following amounts for P's Cash flow Statement for the period from 2025-04-01 through 2025- 12-31 Amount Cash from Operating Activities Cash from Investing Activities Cash from Financing Activities Net Change in Cash Record the following transactions Date Transaction DR Account Pays $94113 to purchase equipment, have it delivered for $3953 and installed for $7717. The equipment has an estimated useful life of ond 2025- 04-01 CR Account Amou property that 2025-includes a 05-01 building valued at $70365 and land valued at $164970. The building has an estimated useful life of 20 years and a residual value of $2779 Pays $27421 for a 2025-customer list 05-01 for future sales prospects The list has an estimated useful life of 5 years and Toidual Sells a plot of land that has a 2025-carrying 05-01 value of $90086 for $114258 cash. H Sells a machine that has carrying value of of $4567 (cost = $16611 and accumulated depreciation = $12044) for $2114 cash 2025- 05-01 Record the entry to close all of the income statement accounts to Retained Earnings (SE). List the income statement accounts in the same order as the income statement. The last entry is to retained earnings (SE) 2025- 12-31 Income Statement for the year ended 2025: (1) before the adjusting entries, (2) after the adjusting entries and (3) after the closing entry Account title Beginning Bal (1) Unadjusted Amount (2) Adjusted Amount (3) Post Closing Amount Revenue (R) 80000 Depreciation Expense (E) 0 Amortization Expense (E) 0 Gain on sale of PPE (Ga) Loss on sale of PPE (LO) 0 Net Income 80000 Balance Sheet on December 31, 2025: (1) before the adjusting entries, (2) after the adjusting entries and (3) after the closing entry (2) Adjusted (3) Post Closing Account title Beginning Bal (1) Unadjusted Amount Amount Amount Cash (A) 780000 Property/Plant/Equipment (A) 240000 Accumulated Depreciation (XA) -90000 0 Intangibles (A) Accumulated Amortization (XA) 930000 Total Assets n 0 Retained Earnings (SE) 80000 Total Equity 930000 Total Liabilities and Equity 930000 Indicate the following amounts for P's Cash flow Statement for the period from 2025-04-01 through 2025- 12-31 Amount Cash from Operating Activities Cash from Investing Activities Cash from Financing Activities Net Change in Cash Record the following transactions Date Transaction DR Account Pays $94113 to purchase equipment, have it delivered for $3953 and installed for $7717. The equipment has an estimated useful life of ond 2025- 04-01 CR Account Amou property that 2025-includes a 05-01 building valued at $70365 and land valued at $164970. The building has an estimated useful life of 20 years and a residual value of $2779 Pays $27421 for a 2025-customer list 05-01 for future sales prospects The list has an estimated useful life of 5 years and Toidual Sells a plot of land that has a 2025-carrying 05-01 value of $90086 for $114258 cash. H Sells a machine that has carrying value of of $4567 (cost = $16611 and accumulated depreciation = $12044) for $2114 cash 2025- 05-01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts