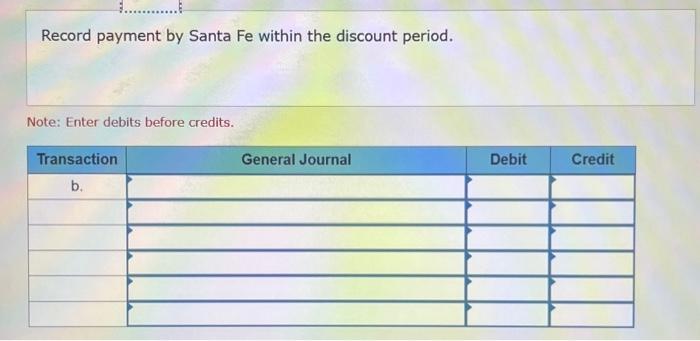

Question: Record payment by Santa Fe after the discount period. Note: Enter debits before credits. Record Mesa Wholesaler's sale of merchandise as is (with no returns)

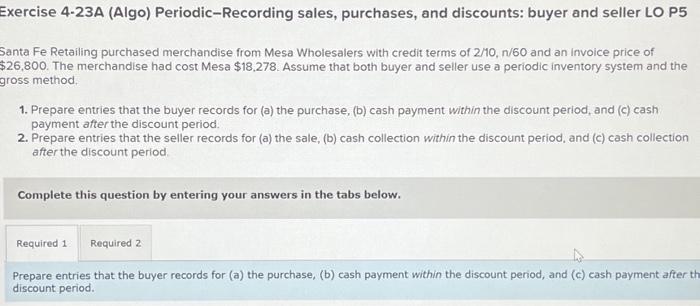

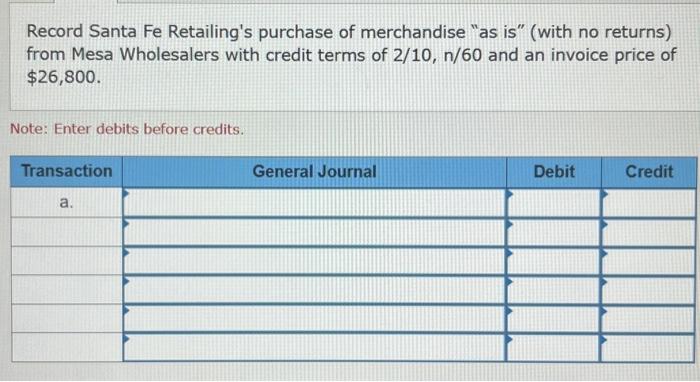

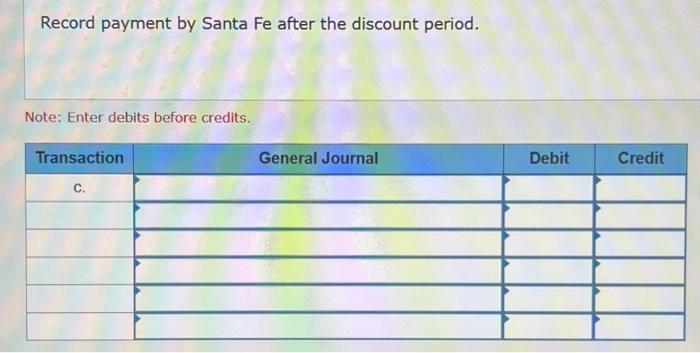

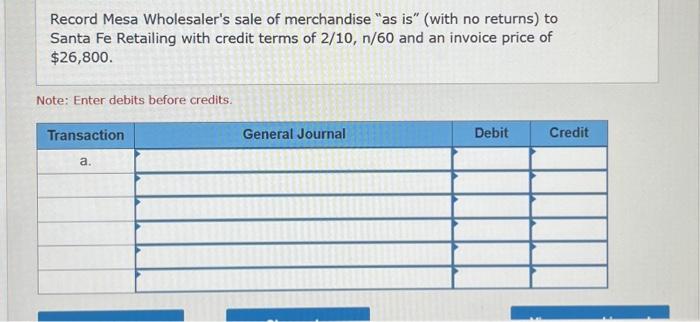

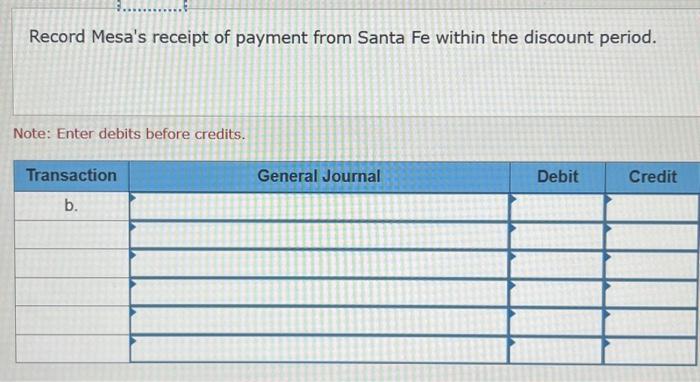

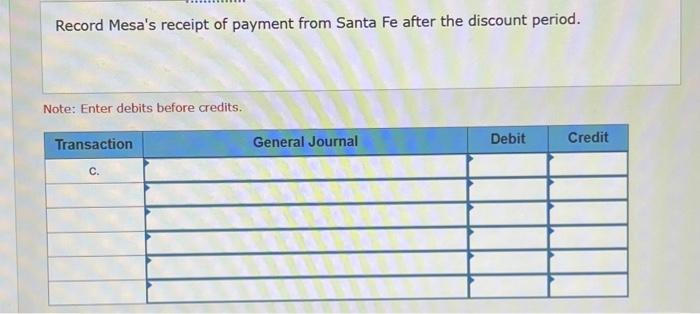

Record payment by Santa Fe after the discount period. Note: Enter debits before credits. Record Mesa Wholesaler's sale of merchandise "as is" (with no returns) to Santa Fe Retailing with credit terms of 2/10,n/60 and an invoice price of $26,800. Note: Enter debits before credits. Record Mesa's receipt of payment from Santa Fe after the discount period. Note: Enter debits before credits. xercise 4-23A (Algo) Periodic-Recording sales, purchases, and discounts: buyer and seller LO P5 anta Fe Retailing purchased merchandise from Mesa Wholesalers with credit terms of 2/10,n/60 and an invoice price of 26,800. The merchandise had cost Mesa $18,278. Assume that both buyer and seller use a periodic inventory system and the ross method. 1. Prepare entries that the buyer records for (a) the purchase, (b) cash payment within the discount period, and (c) cash payment after the discount period. 2. Prepare entries that the seller records for (a) the sale, (b) cash collection within the discount period, and (c) cash collection after the discount period. Complete this question by entering your answers in the tabs below. Prepare entries that the buyer records for (a) the purchase, (b) cash payment within the discount period, and (c) cash payment after th discount period. Record Mesa's receipt of payment from Santa Fe within the discount period. Note: Enter debits before credits. Record Santa Fe Retailing's purchase of merchandise "as is" (with no returns) from Mesa Wholesalers with credit terms of 2/10,n/60 and an invoice price of $26,800. Note: Enter debits before credits. Record payment by Santa Fe within the discount period. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts