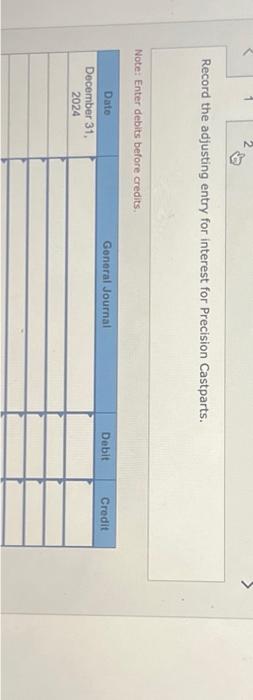

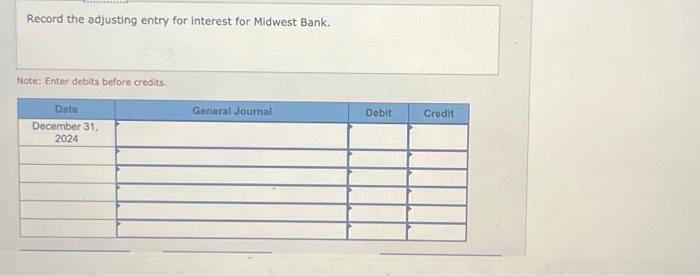

Question: Record the adjusting entry for interest for Precision Castparts. Note: Enter debits before credits. Record the repayment of the note and payment of interest at

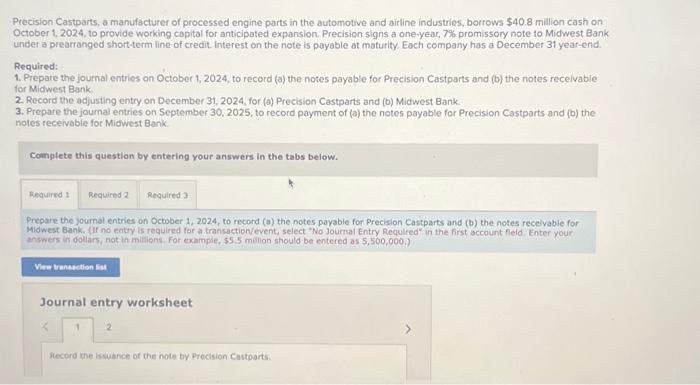

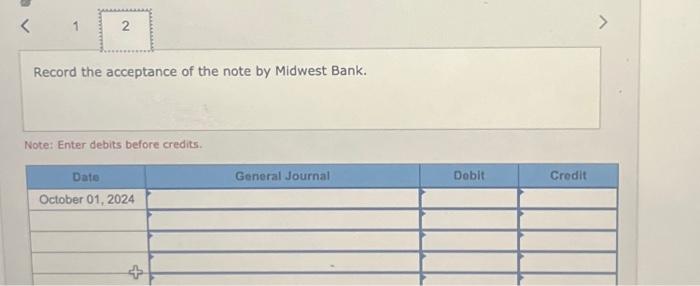

Record the adjusting entry for interest for Precision Castparts. Note: Enter debits before credits. Record the repayment of the note and payment of interest at maturity for Precision Castparts. Note: Enter debits before credits. Precision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.8 million cash on October 1,2024, to provide working copital for anticipated expansion. Precision signs a one-year, 7% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturify. Each company has a December 31 year-end. Required: 1. Prepare the journal entries on October 1,2024 , to record (a) the notes payable for Precision Castparts and (b) the notes recelvable for Midwest Bank. 2. Record the adjusting entry on December 31, 2024, for (0) Precision Castparts and (0) Midwest Bank. 3. Prepare the journal entries on September 30, 2025, to record payment of (o) the notes payable for Precision Castparts and (b) the notes recelvable for Midwest Bank. Complete this question by entering your answers in the tabs below. Prepare the joumal entries on October 1,2024 , to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. (if no entry is required for a transaction/event, select "No Journal Entry Required" in the first occount fleld. Enter your answers in dollars, not ta militions. For exampie, 55.5 million should be entered as 5,500,000 ) Record the adjusting entry for interest for Midwest Bank. Note: Enter debits before credits. Record the acceptance of the note by Midwest Bank. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts