Question: Record the adjusting entry for supplies. Chrome File Edit View History Bookmarks Profiles Tab Window Help Q @ Mon Feb 17 6:53 PM ... Sign

Record the adjusting entry for supplies.

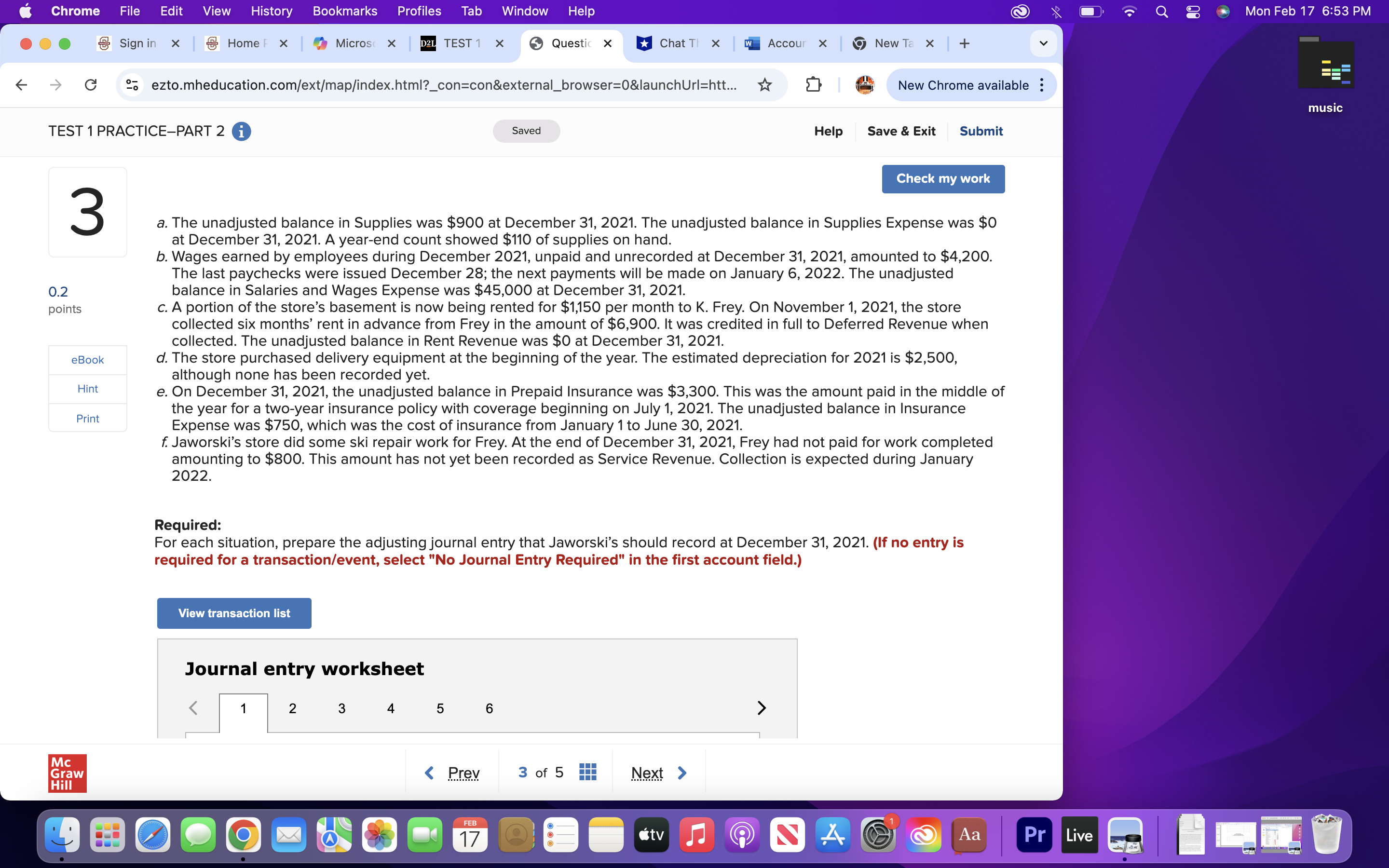

Chrome File Edit View History Bookmarks Profiles Tab Window Help Q @ Mon Feb 17 6:53 PM ... Sign in X Home F X Micros( X D2L TEST 1 X Questic X Chat TI X w Accour X 9New Ta x + C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=htt New Chrome available : music TEST 1 PRACTICE-PART 2 i Saved Help Save & Exit Submit Check my work 3 a. The unadjusted balance in Supplies was $900 at December 31, 2021. The unadjusted balance in Supplies Expense was $0 at December 31, 2021. A year-end count showed $110 of supplies on hand. b. Wages earned by employees during December 2021, unpaid and unrecorded at December 31, 2021, amounted to $4,200. The last paychecks were issued December 28; the next payments will be made on January 6, 2022. The unadjusted 0.2 balance in Salaries and Wages Expense was $45,000 at December 31, 2021. points c. A portion of the store's basement is now being rented for $1,150 per month to K. Frey. On November 1, 2021, the store collected six months' rent in advance from Frey in the amount of $6,900. It was credited in full to Deferred Revenue when collected. The unadjusted balance in Rent Revenue was $0 at December 31, 2021. eBook d. The store purchased delivery equipment at the beginning of the year. The estimated depreciation for 2021 is $2,500, although none has been recorded yet. Hint e. On December 31, 2021, the unadjusted balance in Prepaid Insurance was $3,300. This was the amount paid in the middle of Print the year for a two-year insurance policy with coverage beginning on July 1, 2021. The unadjusted balance in Insurance Expense was $750, which was the cost of insurance from January 1 to June 30, 2021. f. Jaworski's store did some ski repair work for Frey. At the end of December 31, 2021, Frey had not paid for work completed amounting to $800. This amount has not yet been recorded as Service Revenue. Collection is expected during January 2022. Required: For each situation, prepare the adjusting journal entry that Jaworski's should record at December 31, 2021. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 5 6 Mc Graw Hill FEB 17 O Aa Pr Live