Question: Record the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700 Record the adjusting entry for

Record the adjusting entry for supplies remaining on hand at the end of the of the year equal to $4,700

Record the adjusting entry for revenue earned. provide services of $13,600 related to cash paid in advanced by customers.

Record the closing entry for revenue

Record the closing entry for expenses

Record the closing entry for cash dividends

Could you prepare the income statement and balance sheet also

thank you

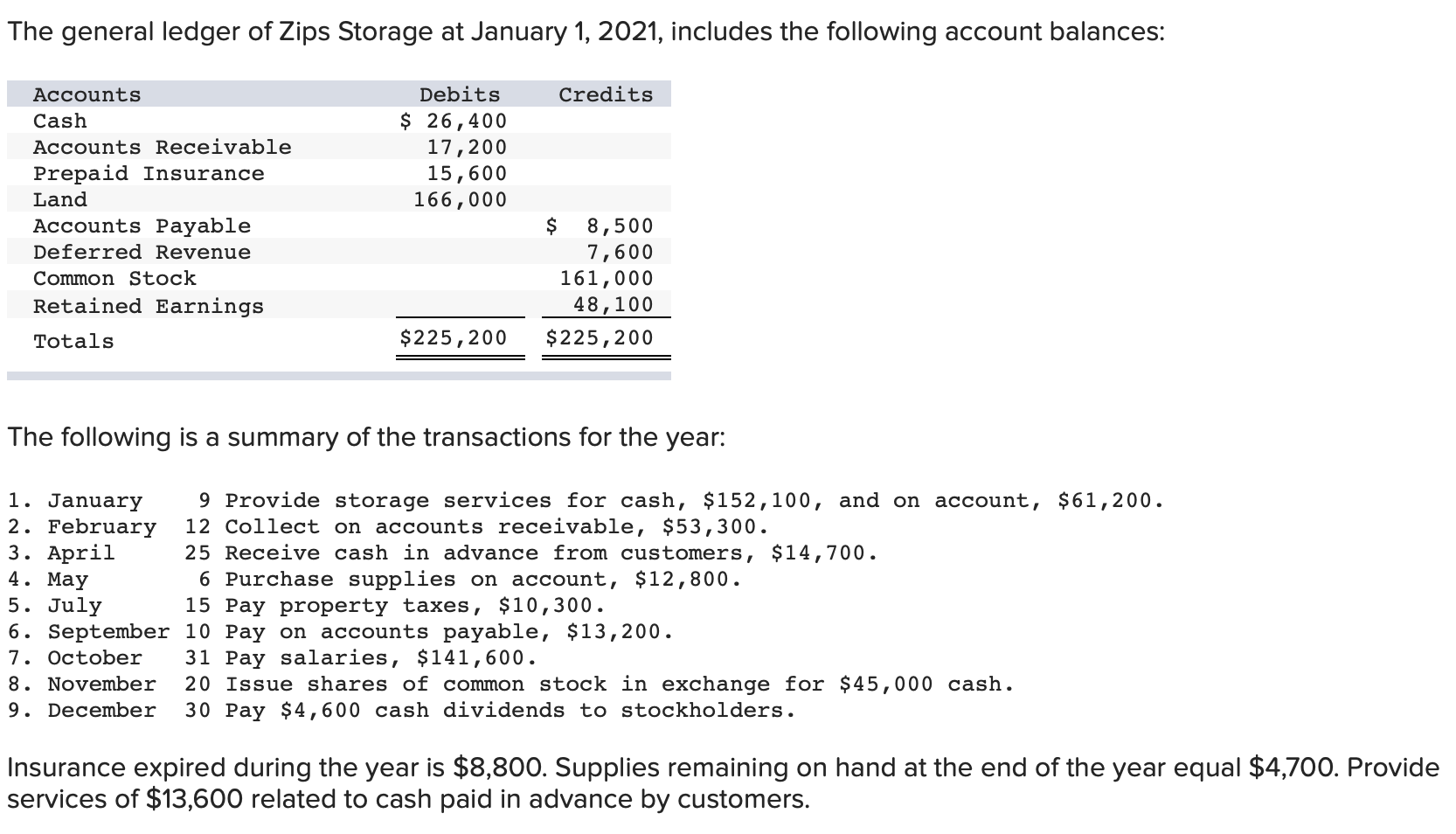

The general ledger of Zips Storage at January 1, 2021, includes the following account balances: Credits Debits $ 26,400 17,200 15,600 166,000 Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Deferred Revenue Common Stock Retained Earnings Totals $ 8,500 7,600 161,000 48,100 $225, 200 $225,200 The following is a summary of the transactions for the year: 1. January 9 Provide storage services for cash, $152,100, and on account, $61,200. 2. February 12 Collect on accounts receivable, $53,300. 3. April 25 Receive cash in advance from customers, $14,700. 4. May 6 Purchase supplies on account, $12,800. 5. July 15 Pay property taxes, $10,300. 6. September 10 Pay on accounts payable, $13,200. 7. October 31 Pay salaries, $141,600. 8. November 20 Issue shares of common stock in exchange for $45,000 cash. 9. December 30 Pay $4,600 cash dividends to stockholders. Insurance expired during the year is $8,800. Supplies remaining on hand at the end of the year equal $4,700. Provide services of $13,600 related to cash paid in advance by customers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts