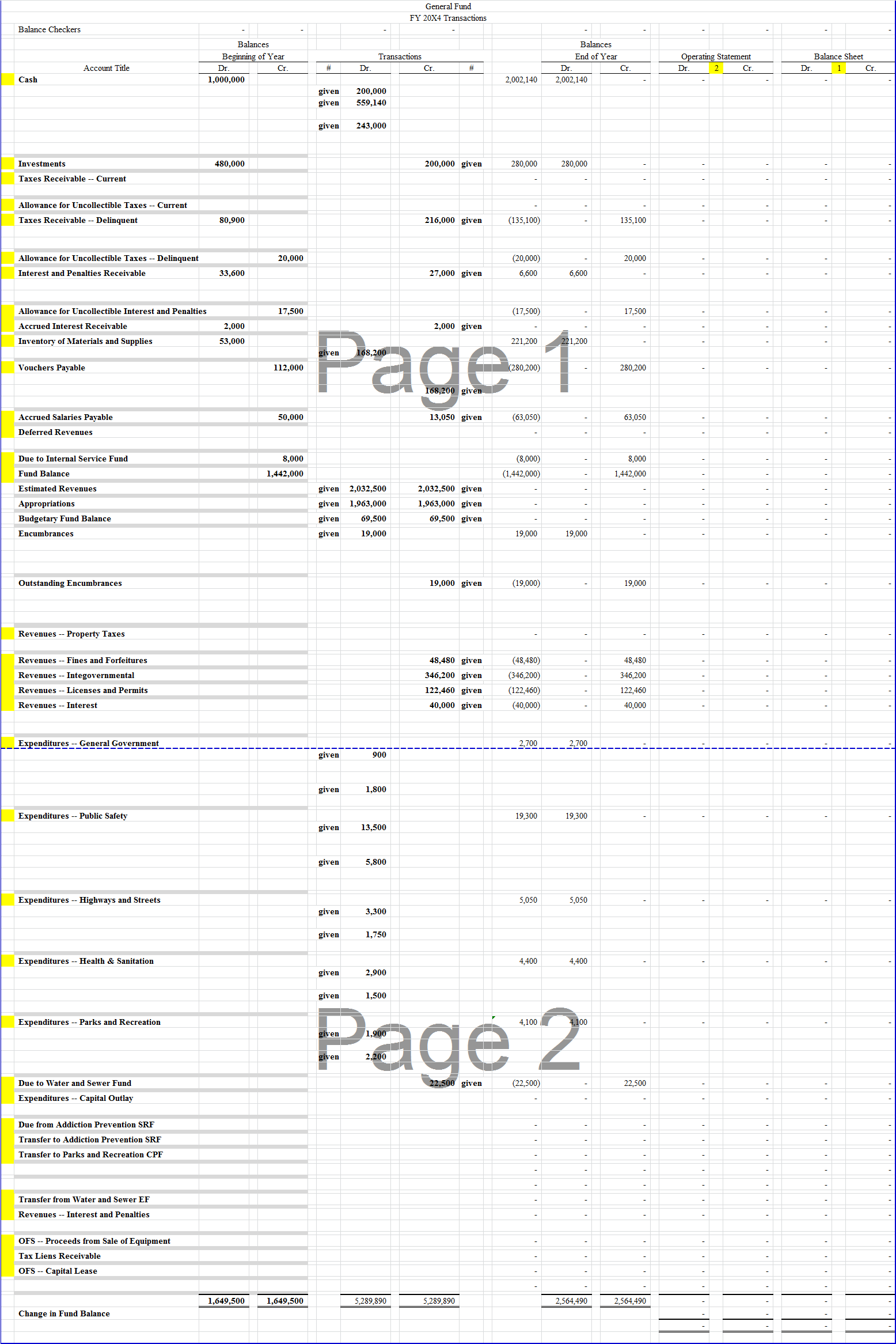

Question: Record the following transactions in the table below: also identify which transactions should go in the operating statement or the balance sheet. 1. The city

Record the following transactions in the table below: also identify which transactions should go in the operating statement or the balance sheet.

1. The city approved a major capital improvement project to construct a recreational facility. The project will be financed by a bond issue of $1,500,000, transfers from the General Fund of $500,000, and a contribution from the county of $300,000. Record the budget assuming these amounts, along with an equal appropriation for the project, were adopted for 20X4.

2. The city received the countys contribution of $300,000. These resources are required to be used for the construction project. The grant is expenditure-driven. The citys policies indicate that resources restricted for a given purpose are considered expended prior to any unrestricted resources available for that purpose.

3. The city transferred $200,000 from the General Fund to the Parks and Recreation Capital Projects Fund.

4. The city issued bonds with a face (par) value of $1,500,000 at a premium of $50,000 on January 1. Bond issue costs of $15,000 were incurred. Interest of 8% per year and $100,000 of principal are due each December 31.

5. The city signed a $2,190,000 contract for construction of the new recreational facility. The process to establish the contract qualifies as a commitment under the citys commitments policy.

6. The city purchased land as the site for the facility at a cost of $110,000. Payment was made for the land.

7. The contractor billed the city $1,200,000. The city paid all but a 5% retainage.

8. The outstanding encumbrances were closed (use the transactions columns for this entry).

9. The budgetary accounts were closed at year end. Appropriations do not lapse at year end. Close the budgetary accounts in the transactions columns.

General Fund FY 20X4 Transactions Balance Checkers Balance Balances ating Statement Balance Sheet Account Title Dr.CrDr.2CrDr 000,000 2,002,1402,002,140 200,00 480,000 200,000 280,000 280,000 Rece Allowance for Uncollectible Taxe Taxes Rece Delinque 6,000 give 100 100 Allowance for Uncollectible Taxes- Delinqu (20,000) 20,000 terest and Rece Allowance for Uncollectible AccruedI Inventory of Materials and Supplies res Pena t Receivable 2,000 give ayable 280,200 68,20 Accrued Salaries Pavabl 50,000 3,050 give 63,050) Deferred Re Due to Internal Service Fund Fund Balance 442,000 1,442,000 1,442,000 2,032,500 2.500 give Appropriation etary Fund Balance 69,500 ncumbrance Outstanding Encumbranc 9,000 give Fines and Forfeitures 48,480 346,200 122,460 40,000 48,480 346,200 give 460 give 40,000 give (346.200 122,460) 40,000 s and Permits Re Interes l Governm 700 800 Expenditures Public Safety 13,500 Highways and Street Health & Sanitati arks and Recreation Due to Water and Sew (22,500 22,500 l Outl Due om Addiction Pre ntion SRF ddiction Preven o Parks and Recreat ransfer from Va r and Sewer EF Re t and Penaltie OFS - Proceeds from Sale of Equipme Tax Liens Re OFS 649.500 564,490 2,564,490 4:099.500 1,649,500 Change in Fund Balanc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts