Question: Record the journal entry that would be made by a nongovernmental, not-for-profit organization involved in medical research. (If no entry is required for a transaction/event,

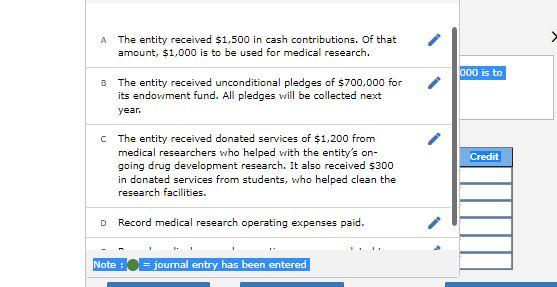

Record the journal entry that would be made by a nongovernmental, not-for-profit organization involved in medical research. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

The entity received $1,500 in cash contributions. Of that amount, $1,000 is to be used for medical research.

The entity received unconditional pledges of $700,000 for its endowment fund. All pledges will be collected next year.

The entity received donated services of $1,200 from medical researchers who helped with the entitys on-going drug development research. It also received $300 in donated services from students, who helped clean the research facilities.

The entity paid medical research operating expenses of $5,000 that were related to restricted net assets it had received in prior years.

A. The entity received $1,500 in cash contributions. Of that amount, $1,000 is to be used for medical research. B. The entity received unconditional pledges of $700,000 for its endowment fund. All pledges will be collected next year. c. The entity received donated services of $1,200 from medical researchers who helped with the entity's ongoing drug development research. It also received $300 in donated services from students, who helped clean the research facilities. D Record medical research operating expenses paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts