Question: Record the LIFO adjustment Required information Problem 6-2A Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (L06-3,

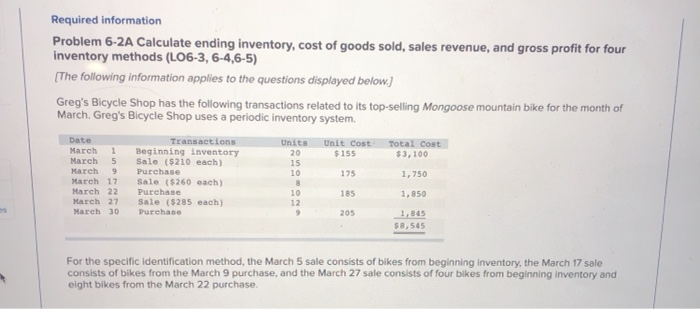

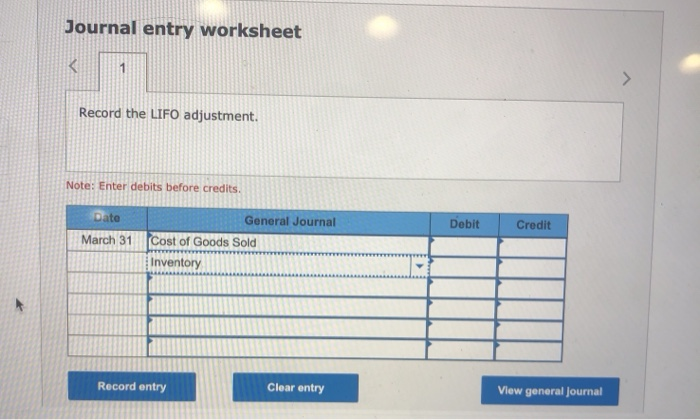

Required information Problem 6-2A Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (L06-3, 6-4,6-5) (The following information applies to the questions displayed below.) Greg's Bicycle Shop has the following transactions related to its top-selling Mongoose mountain bike for the month of March. Greg's Bicycle Shop uses a periodic inventory system. Transactions Unit Cost Total Cost Beginning inventory 20 $155 $3,100 March Purchase Units Sale ($210 each) Date March 1 5 March 9 March 17 March 22 March 27 March 30 175 1,750 Sale (160 each) Purchase Sale ($285 each) Purchase 15 10 8 10 12 9 185 1,850 205 1.865 $8,565 For the specific identification method, the March 5 sale consists of bikes from beginning inventory, the March 17 sale consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes from beginning inventory and eight bikes from the March 22 purchase. Journal entry worksheet 1 Record the LIFO adjustment. Note: Enter debits before credits. Dato General Journal March 31 Cost of Goods Sold Inventory Debit Credit Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts