Question: Record the transactions below in the journal; post the entries to the ledgers; find the 12/31/2020 ending balances for each account. 12/1/2020: Davis Design receives

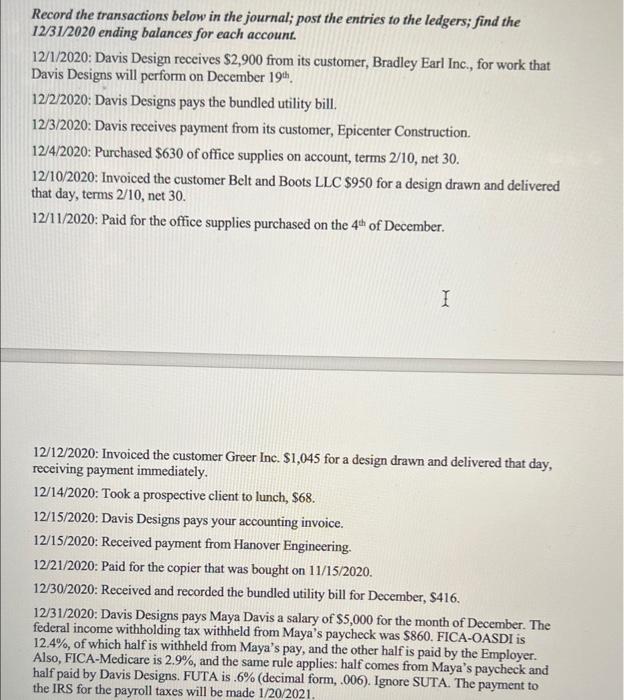

Record the transactions below in the journal; post the entries to the ledgers; find the 12/31/2020 ending balances for each account. 12/1/2020: Davis Design receives $2,900 from its customer, Bradley Earl Inc., for work that Davis Designs will perform on December 194. 12/2/2020: Davis Designs pays the bundled utility bill. 12/3/2020: Davis receives payment from its customer, Epicenter Construction. 12/4/2020: Purchased $630 of office supplies on account, terms 2/10, net 30. 12/10/2020: Invoiced the customer Belt and Boots LLC $950 for a design drawn and delivered that day, terms 2/10, net 30. 12/11/2020: Paid for the office supplies purchased on the 4th of December. I 12/12/2020: Invoiced the customer Greer Inc. $1,045 for a design drawn and delivered that day, receiving payment immediately. 12/14/2020: Took a prospective client to lunch, $68. 12/15/2020: Davis Designs pays your accounting invoice. 12/15/2020: Received payment from Hanover Engineering. 12/21/2020: Paid for the copier that was bought on 11/15/2020. 12/30/2020: Received and recorded the bundled utility bill for December, S416. 12/31/2020: Davis Designs pays Maya Davis a salary of $5,000 for the month of December. The federal income withholding tax withheld from Maya's paycheck was $860. FICA-OASDI is 12.4%, of which half is withheld from Maya's pay, and the other half is paid by the Employer. Also, FICA-Medicare is 2.9%, and the same rule applies: half comes from Maya's paycheck and half paid by Davis Designs. FUTA is .6% (decimal form, .006). Ignore SUTA. The payment to the IRS for the payroll taxes will be made 1/20/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts