Question: Record the transactions below using the balance sheet equation. Be specific about account names. Each account name is labeled as an Asset (A), Liability (L),

Record the transactions below using the balance sheet equation. Be specific about account names. Each account name is labeled as an Asset (A), Liability (L), or Shareholders Equity (SE). Remember that Shareholders Equity (SE) includes income statement items (e.g., revenue and expense accounts).

Lohans Active Pest Deterrents (LAPD) was founded on January 1, 2011. The companys founder, Lindsey, provides two services: Pest Removal and Pest Prevention.

The pest removal service eradicates ants, termites, rats, and other vermin (paparazzi) that might infest your house or business.

Pest prevention service is a service that she provides quarterly to customers, where she treats the house with her patented Pest Prevention Elixirs that discourage ants and termites from entering the customers residence (or business).

During the first fiscal year of operations, Lindsey engaged in the transactions listed as below

On January 1st (2011), LAPD recognized $8,000 of Selling General & Administrative (SG&A) expense, of which $2,500 is paid in cash.

Cash (A) = Accrued Expenses (L) + Retained Earnings (SE)

- 2,500 + 5,500 - 8,000 SG&A expense

Example 2

On January 1st (2011), LAPD used cash to purchase equipment costing $200,000.

Cash (A) Equipment (A)

- 200,000 + 200,000

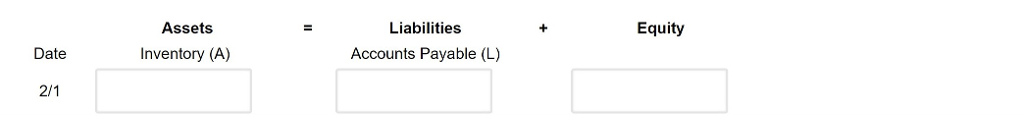

PART A)

On February 1st, the LAPD purchased poison supplies for $20,000 on credit.

Record the transaction below using the balance sheet equation and specifying the account names. The accounts have been filled in for you. If you believe any cell should be empty, insert the number zero, "0". Recall that in accounting negative numbers are represented using parenthesis ( ie. "(1)" instead of "-1" )

PART B)

On April 10, the LAPD performed pest prevention services and received $50,000 payment by cash from DINAs Delightful Deli.

Record the transaction below using the balance sheet equation and specifying the account names. Some of the account names may have been filled in for you. If you believe any cell should be empty, select either N/A in the dropdown or insert the number zero, "0", as a value. Recall that in accounting negative numbers are represented using parenthesis ( ie. "(1)" instead of "-1" )

For the Select Option drop down selection need to select: Cash (A); Account Receivable (A); Inventory (A); PPE (A); Prepaid Insurance (A); Equipment (A); Accounts Payable (L); Accrued Liabilities (L); Wages Payable (L); Note Payable (L); Deferred Taxes (L); Common Stock (E); Contributed Capital (E); Retain Earnings (E); N/A.

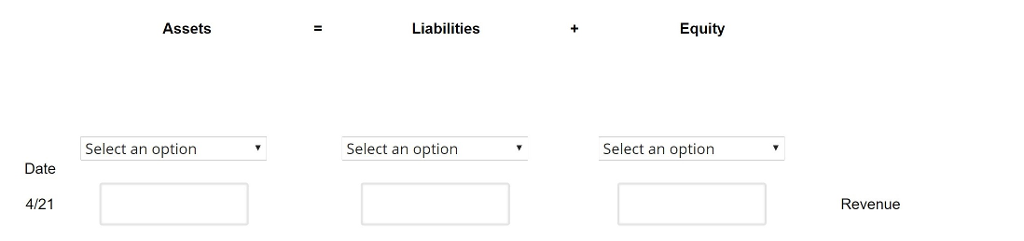

PART C)

On April 21st, the LAPD billed clients for Pest Removal Services performed during the month of April, totaling $75,000.

Record the transaction below using the balance sheet equation and specifying the account names. Some of the account names may have been filled in for you. If you believe any cell should be empty, select either N/A in the dropdown or insert the number zero, "0", as a value. Recall that in accounting negative numbers are represented using parenthesis ( ie. "(1)" instead of "-1" )

For the Select Option drop down selection need to select: Cash (A); Account Receivable (A); Inventory (A); PPE (A); Prepaid Insurance (A); Equipment (A); Accounts Payable (L); Accrued Liabilities (L); Wages Payable (L); Note Payable (L); Deferred Taxes (L); Common Stock (E); Contributed Capital (E); Retain Earnings (E); N/A.

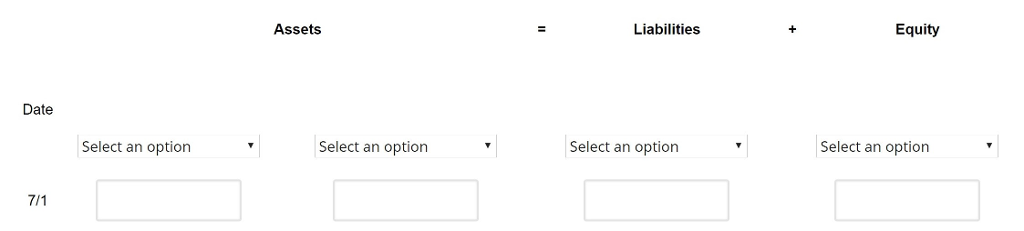

PART D)

On July 1st, the LAPD performed pest prevention services worth of $100,000 and received $50,000 immediately with the remainder on credit.

Record the transaction below using the balance sheet equation and specifying the account names. Some of the account names may have been filled in for you. If you believe any cell should be empty, select either N/A in the dropdown or insert the number zero, "0", as a value. Recall that in accounting negative numbers are represented using parenthesis ( ie. "(1)" instead of "-1" )

For the Select Option drop down selection need to select: Cash (A); Account Receivable (A); Inventory (A); PPE (A); Prepaid Insurance (A); Equipment (A); Accounts Payable (L); Accrued Liabilities (L); Wages Payable (L); Note Payable (L); Deferred Taxes (L); Common Stock (E); Contributed Capital (E); Retain Earnings (E); N/A.

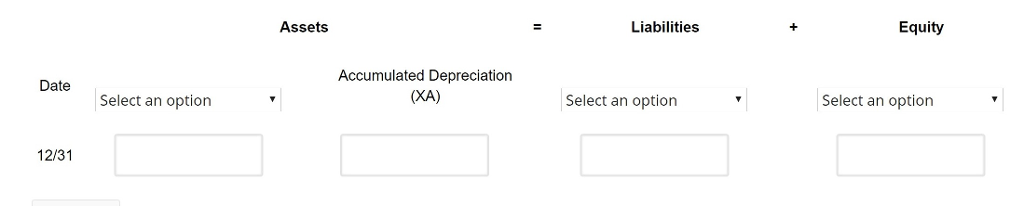

PART E)

On December 31st, the LAPD depreciated the $200,000 of equipment (purchased in Example 2) by $40,000.

(This question has unlimited submissions! Attempt and read the solutions for an explanation.)

Record the transaction below using the balance sheet equation and specifying the account names. Some of the account names may have been filled in for you. If you believe any cell should be empty, select either N/A in the dropdown or insert the number zero, "0", as a value. Recall that in accounting negative numbers are represented using parenthesis ( ie. "(1)" instead of "-1" )

For the Select Option drop down selection need to select: Cash (A); Account Receivable (A); Inventory (A); PPE (A); Prepaid Insurance (A); Equipment (A); Accounts Payable (L); Accrued Liabilities (L); Wages Payable (L); Note Payable (L); Deferred Taxes (L); Common Stock (E); Contributed Capital (E); Retain Earnings (E); N/A.

Assets Liabilities Equity Date Inventory (A) Accounts Payable (L)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts