Question: Record these transactions in the Journal, but do not post to the General Ledger. January 6 Deposit with the state of Pennsylvania the amount of

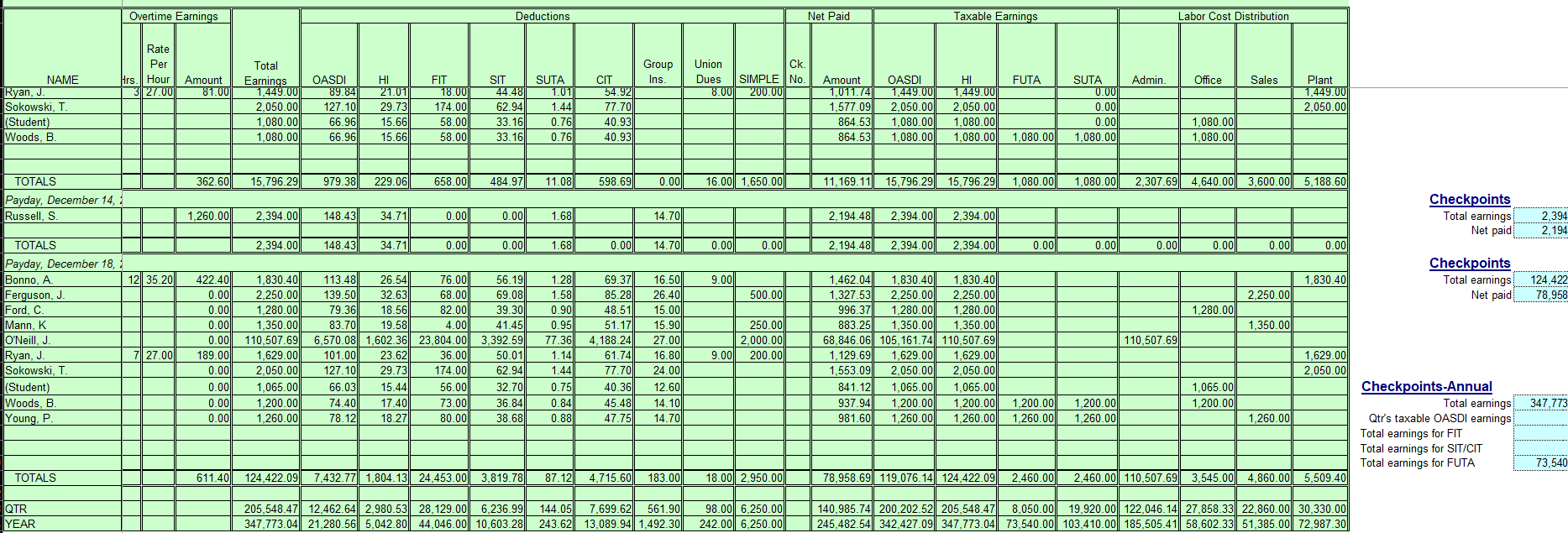

Record these transactions in the Journal, but do not post to the General Ledger. January Deposit with the state of Pennsylvania the amount of state income taxes withheld from the December payroll. Use the current balance of account Employees SIT Payable. Transaction No January Pay the treasurer of the union the amount withheld during the month of December. Use the current balance of account Union Dues Payable. January Electronically deposit the amount of FICA taxes and federal income taxes for the December payrolls. Transaction No Deposit with the city of Philadelphia the amount of city income taxes withheld from the December payrolls. Transaction No February Prepare Form Employers Quarterly Federal Tax Return, for the fourth quarter. The information needed to prepare Form can be obtained from the ledger accounts, payroll registers, employees earnings records, and Federal Deposit forms. The wages paid to Serdar Russell $ and the SIMPLE plan deductions need to be deducted from Line total quarterly wages. Line a wages are total quarterly wages paid less the amount paid to ONeill in excess of the $ cap on Social Security wages, while line c is total quarterly wages. Transaction No Form and all forms that follow are to be signed by the president of the company, Joseph T ONeill Prepare Form Employers Annual Federal Unemployment FUTA Tax Return. Line is the annual gross pay. Line is the total amount of earnings for the year that are subject to FUTA tax. Since the wage base for FUTA is $ you will check the earnings records to see who has earnings in excess of the wage base. Add $ for each employee over the wage base plus the total earnings of any employee earning less than the wage base. Lines and are the difference between these two amounts and represent the earnings in excess of the FUTA wage base of $Remember any amount in excess of $ is not taxed for FUTA. Line total tax paid should equal the February payment. Transaction No Journalize the entry to record the electronic deposit for the FUTA tax liability. Transaction No Prepare Form UC Employers Report for Unemployment CompensationFourth Quarter. In Pennsylvania, a credit week is any calendar week during the quarter in which the employee earned at least $without regard to when paid The maximum number of credit weeks in a quarter is Transaction No Journalize the entry to record the payment of the SUTA taxes employer and employee for the fourth quarter.

Please also assist with finding the error not allowing the check point questions to be correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock