Question: -record year 2 transactions in general journal form and post them to T accounts(begin Year 2 with the ending T account balances from Year 1)

![1) Required information. [The following information applies to the questions displayed below]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6717161e40ba7_2376717161dca311.jpg)

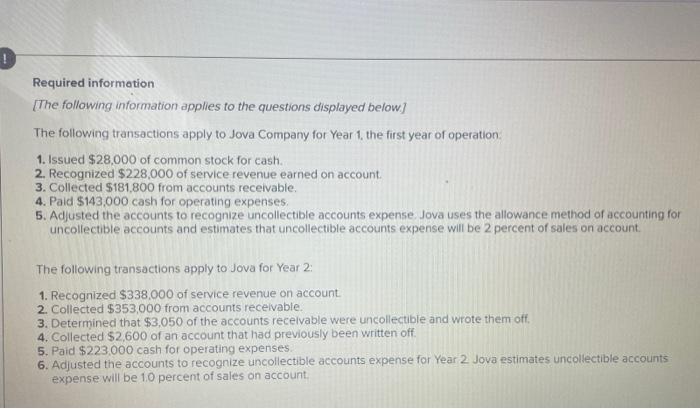

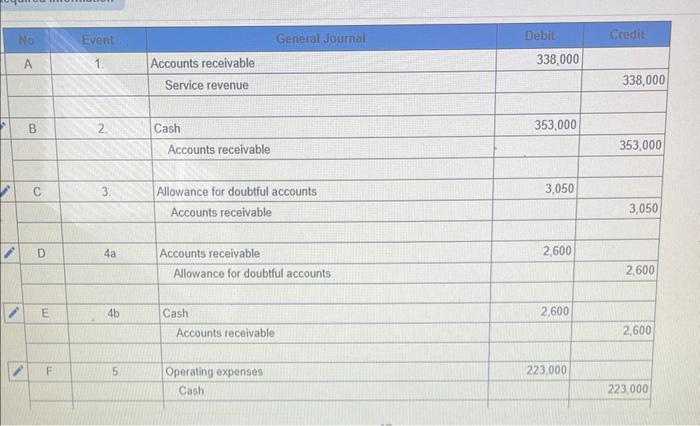

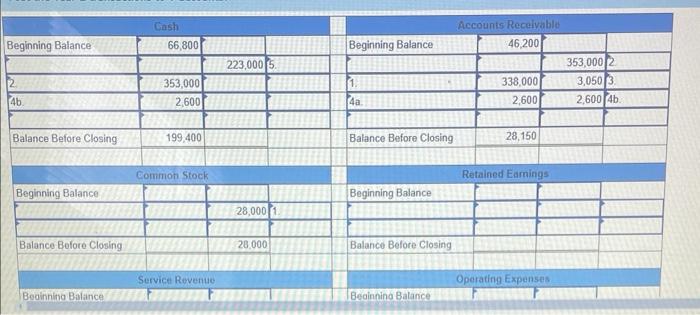

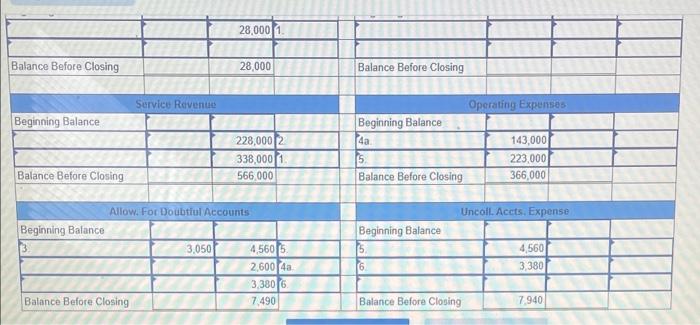

Required information. [The following information applies to the questions displayed below] The following transactions apply to Jova Company for Year 1, the first year of operation. 1. Issued $28,000 of common stock for cash. 2. Recognized $228,000 of service revenue earned on account. 3. Collected $181,800 from accounts receivable. 4. Paid $143,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 2 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $338,000 of service revenue on account. 2. Collected $353,000 from accounts receivable. 3. Determined that $3,050 of the accounts receivable were uncollectible and wrote them off. 4. Collected $2,600 of an account that had previously been written off. 5. Paid $223,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 1.0 percent of sales on account. $ No N B C D E F Event 2. 4a 4b 5. Accounts receivable Service revenue Cash Accounts receivable Allowance for doubtful accounts Accounts receivable Accounts receivable Allowance for doubtful accounts Cash General Journal Accounts receivable Operating expenses Cash Debit 338,000 353,000 3,050 2,600 2,600 223,000 Credit 338,000 353,000 3,050 2,600 2,600 223,000 4a 4b 5. 6. Accounts receivable Accounts receivable Allowance for doubtful accounts Cash Accounts receivable Operating expenses Cash Uncollectible accounts expense Allowance for doubtful accounts 2,600 2,600 223,000 3,380 3,050 2,600 2,600 223,000 3,380 Beginning Balance 4b. Balance Before Closing Beginning Balance. Balance Before Closing Beginning Balance Cash 66,800 353,000 2,600 199,400 Common Stock Service Revenue 223,000 28,000 1 28.000 Beginning Balance 1. 4a. Balance Before Closing Beginning Balance Balance Before Closing Beginning Balance Accounts Receivable 46,200 338,000 2,600 28,150 Retained Earnings Operating Expenses 353,000 2 3,050 3 2,600 4b. Balance Before Closing Beginning Balance Balance Before Closing Beginning Balance 13. Service Revenue Balance Before Closing 28,000 1. 3,050 28,000 Allow. For Doubtful Accounts 228,000 2 338,000 1. 566,000 4,560 5. 2,600 4a 3,380 6 7,490 Balance Before Closing Beginning Balance 4a. 5. Balance Before Closing Beginning Balance 6 Operating Expenses Balance Before Closing 143,000 223,000 366,000 Uncoll. Accts. Expense 4,560 3,380 7,940

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts