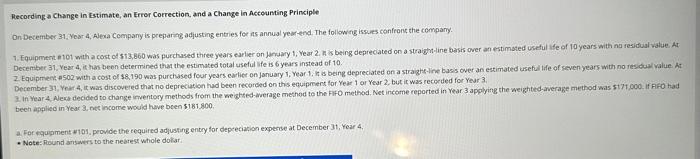

Question: Recording a Change in Estimate, an Errer Correction, and a Change in Accounting Principle December 31. Year 4, it has been determined that the estimated

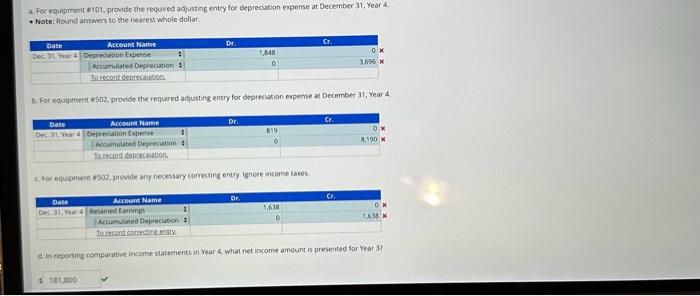

Recording a Change in Estimate, an Errer Correction, and a Change in Accounting Principle December 31. Year 4, it has been determined that the estimated total useful if e is 6 years instead of 10. December 31, Year 4, it was discovered that no depreciasion had been recorded on this equipmens for Year 1 or Year 2 , but ic was recoeded for Yeur 3. bech applied in Year 3 , net incorre would have been $181800. a. For fqupment 4101 , peovide the eequired adjusting entry for depceciavion expense at December 31 , Year 4. - Notez Plound answers to the nebrest whole dolkar. a For equipment =101, provide the requiced adjusting entry for depreciation expense at December 31, Year 4 , - Note: Round answers to the nearest whole dollar. b. For equithinent 1502 , provioe the required adjusting encry for depreciation expetse a: December 31 , Year 4 dis reporting comparative income statements in Year 4 , what net income amoumt is presented far Year 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts