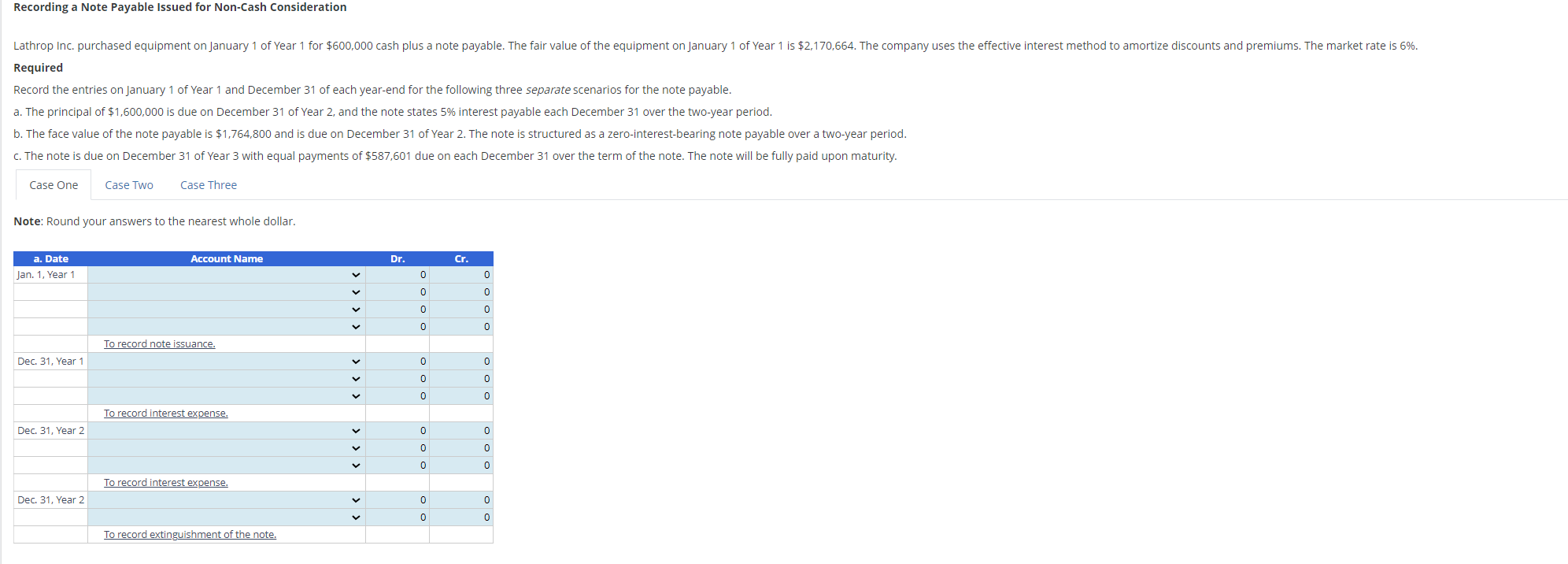

Question: Recording a Note Payable Issued for Non - Cash Consideration Recording a Note Payable Issued for Non - Cash Consideration Required Record the entries on

Recording a Note Payable Issued for NonCash Consideration Recording a Note Payable Issued for NonCash Consideration

Required

Record the entries on January of Year and December of each yearend for the following three separate scenarios for the note payable.

a The principal of $ is due on December of Year and the note states interest payable each December over the twoyear period.

b The face value of the note payable is $ and is due on December of Year The note is structured as a zerointerestbearing note payable over a twoyear period.

c The note is due on December of Year with equal payments of $ due on each December over the term of the note. The note will be fully paid upon maturity.

Case One

Case Three

Note: Round your answers to the nearest whole dollar. Recording a Note Payable Issued for NonCash Consideration

Required

Record the entries on January of Year and December of each yearend for the following three separate scenarios for the note payable.

a The principal of $ is due on December of Year and the note states interest payable each December over the twoyear period.

b The face value of the note payable is $ and is due on December of Year The note is structured as a zerointerestbearing note payable over a twoyear period.

c The note is due on December of Year with equal payments of $ due on each December over the term of the note. The note will be fully paid upon maturity.

Case One Case Two

Note: Round your answers to the nearest whole dollar.

Note: Include any net rounding difference for Note Payable, Net in the interest expense amount for Year

Required

Record the entries on January of Year and December of each yearend for the following three separate scenarios for the note payable.

a The principal of $ is due on December of Year and the note states interest payable each December over the twoyear period.

b The face value of the note payable is $ and is due on December of Year The note is structured as a zerointerestbearing note payable over a twoyear period.

c The note is due on December of Year with equal payments of $ due on each December over the term of the note. The note will be fully paid upon maturity.

Case One

Case Two

Case Three

Note: Round your answers to the nearest whole dollar.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock