Question: Recording and Reporting Multiple Temporary Differences Cross Corporation provided the following reconciliation between taxable income and pretax GAAP income. a . Record the income tax

Recording and Reporting Multiple Temporary Differences

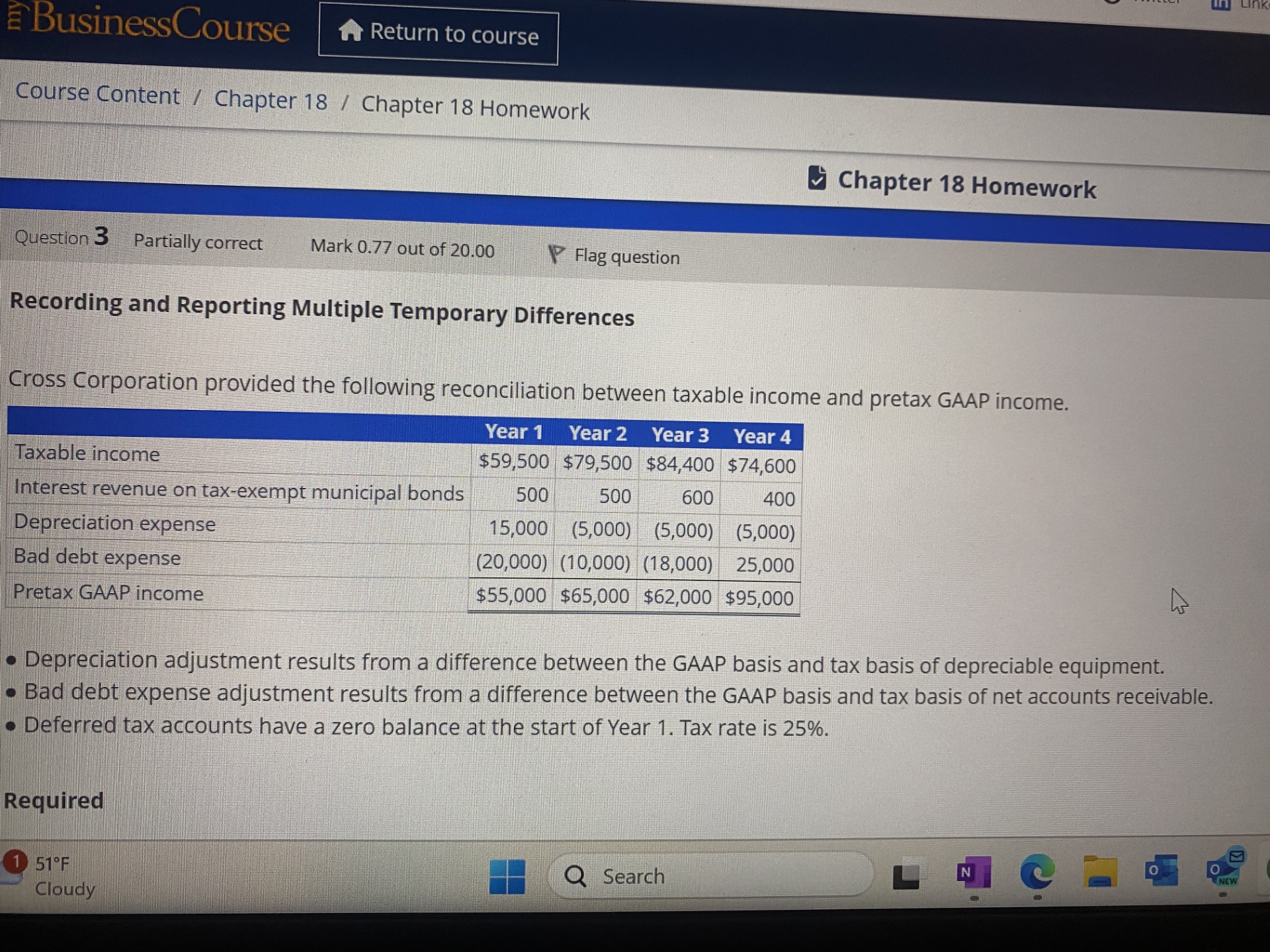

Cross Corporation provided the following reconciliation between taxable income and pretax GAAP income.

a Record the income tax journal entry on December of Year

b Record the income tax journal entry on December of Year

c Record the income tax journal entry on December of Year

d Record the income tax journal entry on December of Year

e Prepare the income tax section of the income statement for Year and provide the disclosure of current and deferred tax expense.

f Indicate the deferred income tax that would be recognized on the balance sheet at December of Year

Journal entriy accounts include income tax expense, income tax payable, deferred tax liability, deferred tax asset

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock