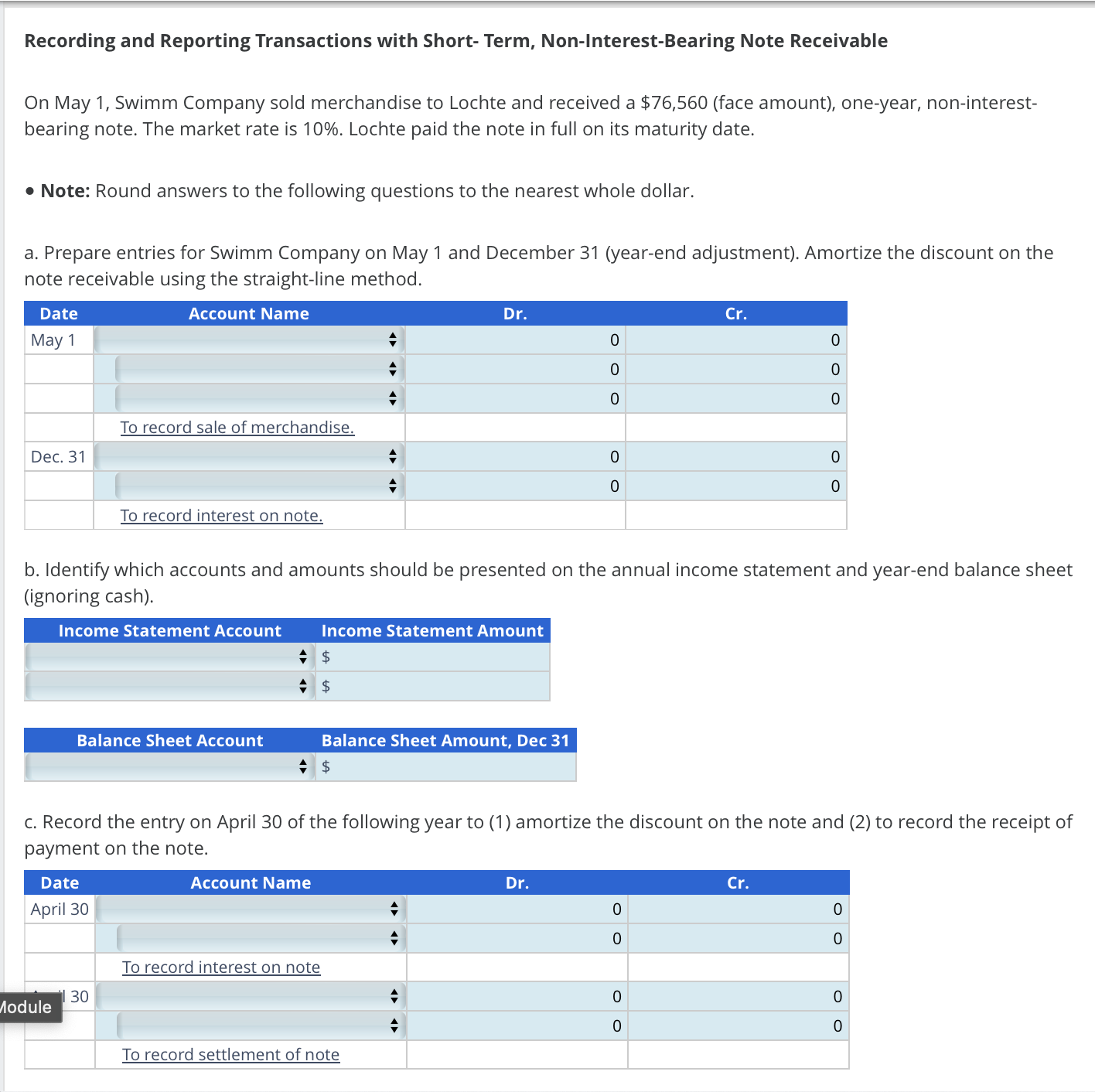

Question: Recording and Reporting Transactions with Short - Term, Non - Interest - Bearing Note Receivable On May 1 , Swimm Company sold merchandise to Lochte

Recording and Reporting Transactions with Short Term, NonInterestBearing Note Receivable

On May Swimm Company sold merchandise to Lochte and received a $face amount oneyear, noninterest

bearing note. The market rate is Lochte paid the note in full on its maturity date.

Note: Round answers to the following questions to the nearest whole dollar.

a Prepare entries for Swimm Company on May and December yearend adjustment Amortize the discount on the

note receivable using the straightline method.

b Identify which accounts and amounts should be presented on the annual income statement and yearend balance sheet

ignoring cash

c Record the entry on April of the following year to amortize the discount on the note and to record the receipt of

payment on the note.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock