Question: Recording Asset Exchanges Miley Corp. exchanges old equipment that cost $10.000 (accumulated depreciation of $4,500) for new equipment. The fair value of the new equipment

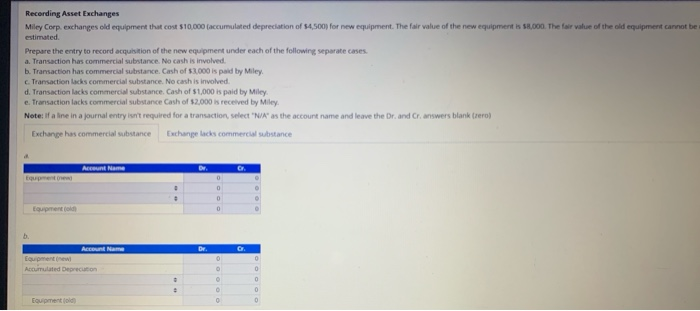

Recording Asset Exchanges Miley Corp. exchanges old equipment that cost $10.000 (accumulated depreciation of $4,500) for new equipment. The fair value of the new equipment is 58,000. The fair value of the old equipment cannot be estimated Prepare the entry to record acquisition of the new equipment under each of ach of the following separate cases. a. Transaction has commercial substance. No cash is involved. b. Transaction has commercial substance. Cash of $3,000 is paid by Miley c. Transaction lacks commercial substance. No cash is involved. d. Transaction lacks commercial substance. Cash of $1,000 is paid by Miley e. Transaction lacks commercial substance Cash of $2,000 is received by Miley. Note: If a line in a journal entry isn't required for a transaction, select "NIA" as the account name and leave the Dr. and Cr answers blank trero) Exchange has commercial substance Exchange lacks commercial substance Account Name Equipment new 0 toperties 0 0 DE ht Equipment Accumulated Deprecation 0 0 3 . 0 Equipment 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts