Question: Recording Assignment: Problem Set 8A The Blue Hen Brewery, Inc. is considering an investment of $168,500 to create more brewing capacity to meet the increasing

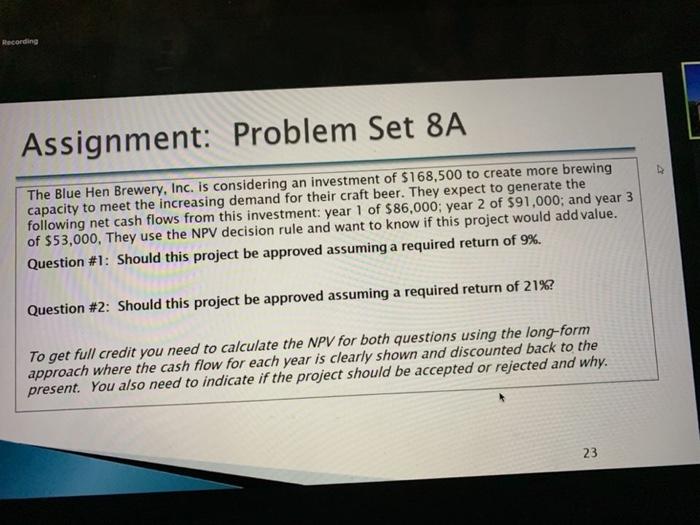

Recording Assignment: Problem Set 8A The Blue Hen Brewery, Inc. is considering an investment of $168,500 to create more brewing capacity to meet the increasing demand for their craft beer. They expect to generate the following net cash flows from this investment: year 1 of $86,000; year 2 of 591,000; and year 3 of $53,000, They use the NPV decision rule and want to know if this project would add value. Question #1: Should this project be approved assuming a required return of 9%. Question #2: Should this project be approved assuming a required return of 21%? To get full credit you need to calculate the NPV for both questions using the long-form approach where the cash flow for each year is clearly shown and discounted back to the present. You also need to indicate if the project should be accepted or rejected and why. 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts