Question: Recording Entries for Long-Term Note Receivable; Effective Interest Method On January 1 of Year 1 , Jacobs Company sells land in return for a $56,000

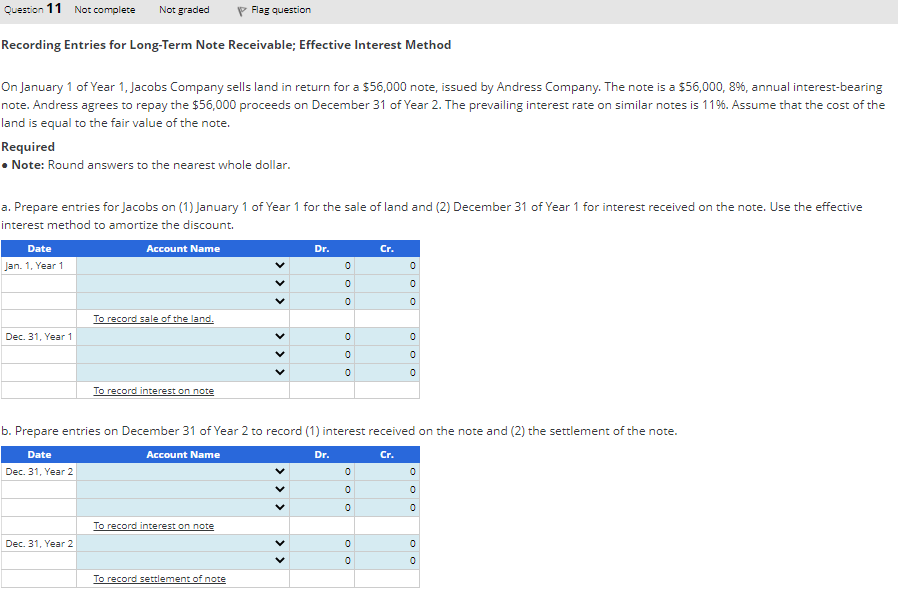

Recording Entries for Long-Term Note Receivable; Effective Interest Method On January 1 of Year 1 , Jacobs Company sells land in return for a $56,000 note, issued by Andress Company. The note is a $56,000,8%, annual interest-bearing note. Andress agrees to repay the $56,000 proceeds on December 31 of Year 2 . The prevailing interest rate on similar notes is 11%. Assume that the cost of the land is equal to the fair value of the note. Required - Note: Round answers to the nearest whole dollar. a. Prepare entries for Jacobs on (1) January 1 of Year 1 for the sale of land and (2) December 31 of Year 1 for interest received on the note. Use the effective interest method to amortize the discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts