Question: Recording Entries for Short - term Notes Payable Masy's Store supported its operations for the year through short - term note financing as follows: May

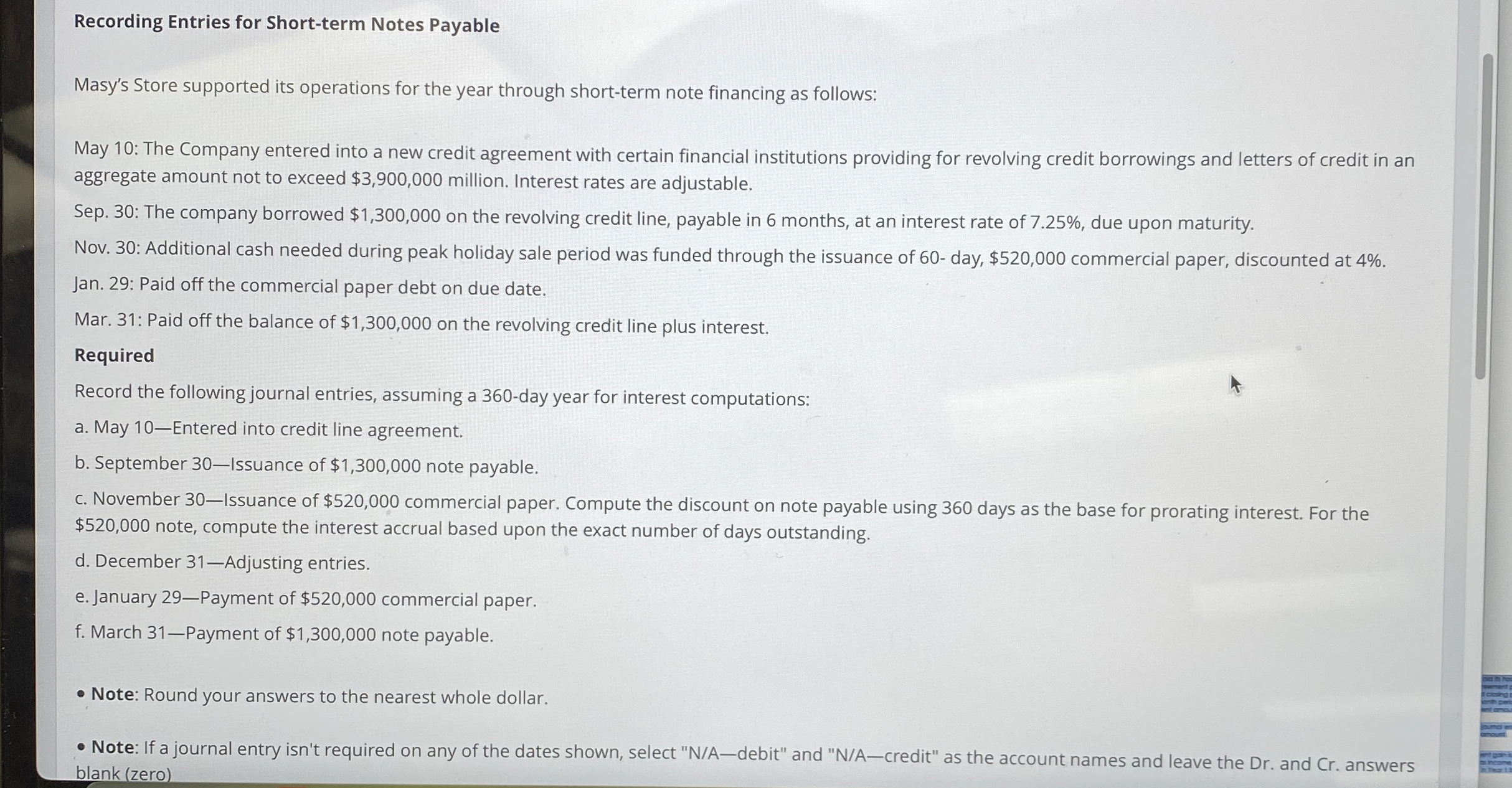

Recording Entries for Shortterm Notes Payable

Masy's Store supported its operations for the year through shortterm note financing as follows:

May : The Company entered into a new credit agreement with certain financial institutions providing for revolving credit borrowings and letters of credit in an aggregate amount not to exceed $ million. Interest rates are adjustable.

Sep. : The company borrowed $ on the revolving credit line, payable in months, at an interest rate of due upon maturity.

Nov. : Additional cash needed during peak holiday sale period was funded through the issuance of day, $ commercial paper, discounted at

Jan. : Paid off the commercial paper debt on due date.

Mar. : Paid off the balance of $ on the revolving credit line plus interest.

Required

Record the following journal entries, assuming a day year for interest computations:

a May Entered into credit line agreement.

b September Issuance of $ note payable.

c November Issuance of $ commercial paper. Compute the discount on note payable using days as the base for prorating interest. For the $ note, compute the interest accrual based upon the exact number of days outstanding.

d December Adjusting entries.

e January Payment of $ commercial paper.

f March Payment of $ note payable.

Note: Round your answers to the nearest whole dollar.

Note: If a journal entry isn't required on any of the dates shown, select NAdebit" and NAcredit" as the account names and leave the Dr and Cr answers blank zero

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock