Question: rect Question 1 0/1 pts Use the following information answer the next (8) questions: Sparky Inc. is trading a machine which has an original cost

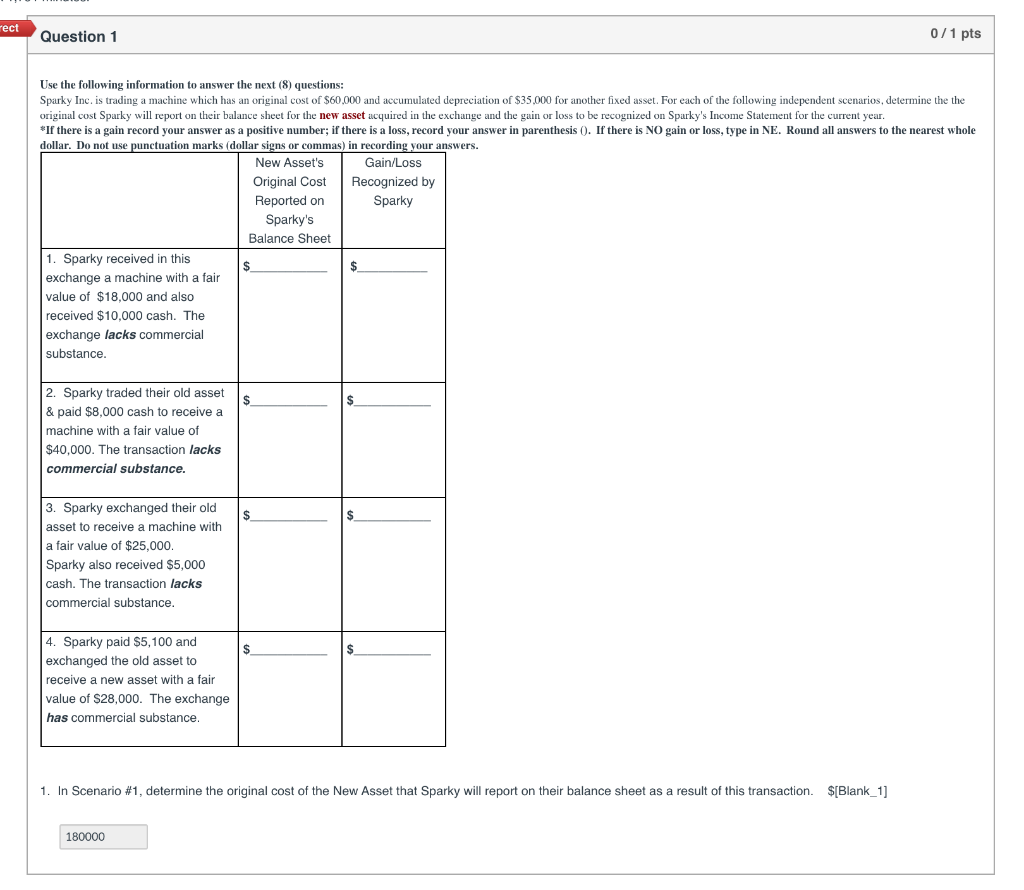

rect Question 1 0/1 pts Use the following information answer the next (8) questions: Sparky Inc. is trading a machine which has an original cost of $60,000 and accumulated depreciation of $35.000 for another fixed asset. For each of the following independent scenarios, determine the the original cost Sparky will report on their balance sheet for the new asset acquired in the exchange and the gain or loss to be recognized on Sparky's Income Statement for the current year. *If there is a gain record your answer as a positive number; if there is a loss, record your answer in parenthesis (). If there is NO gain or loss, type in NE. Round all answers to the nearest whole dollar. Do not use punctuation marks (dollar signs or commas) in recording your answers. New Asset's Gain/Loss Original Cost Recognized by Reported on Sparky Sparky's Balance Sheet 1. Sparky received in this $ exchange a machine with a fair value of $18,000 and also received $10,000 cash. The exchange lacks commercial substance. 2. Sparky traded their old asset & paid $8,000 cash to receive a machine with a fair value of $40,000. The transaction lacks commercial substance. $ 3. Sparky exchanged their old asset to receive a machine with a fair value of $25,000 Sparky also received $5,000 cash. The transaction lacks commercial substance. $ 4. Sparky paid $5,100 and exchanged the old asset to receive a new asset with a fair value of $28,000. The exchange has commercial substance. 1. In Scenario #1, determine the original cost of the New Asset that Sparky will report on their balance sheet as a result of this transaction. $[Blank_1] 180000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts