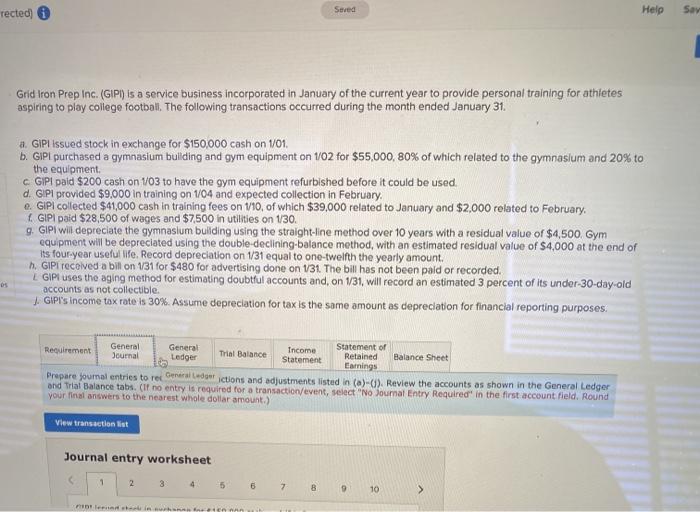

Question: rected) Seved Help Say Grid Iron Prep Inc. (GIP) is a service business incorporated in January of the current year to provide personal training for

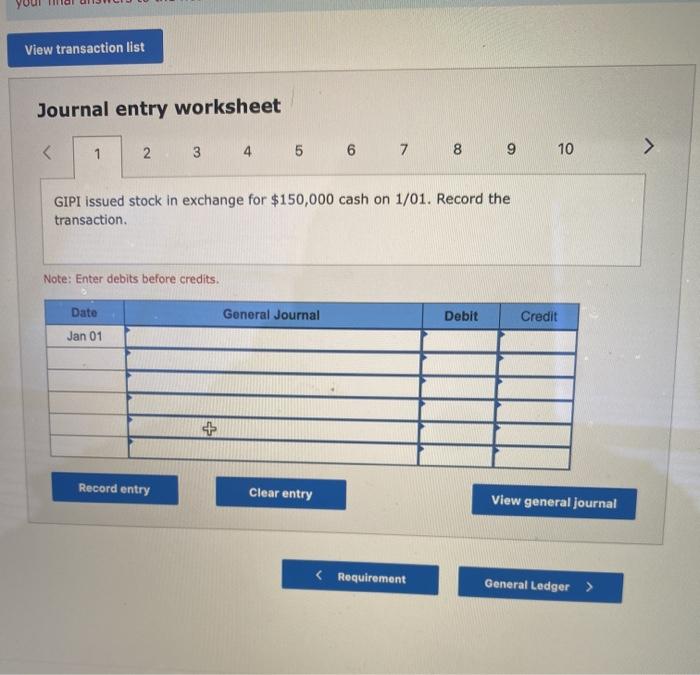

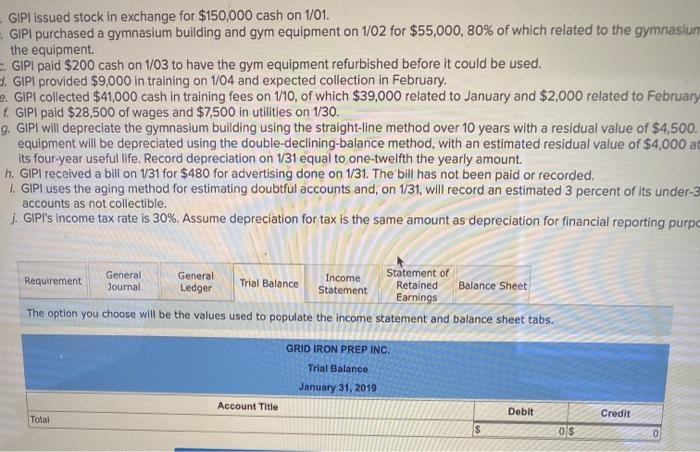

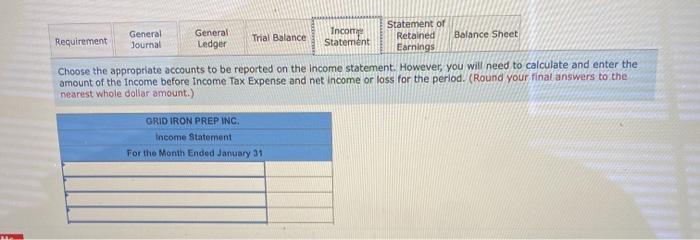

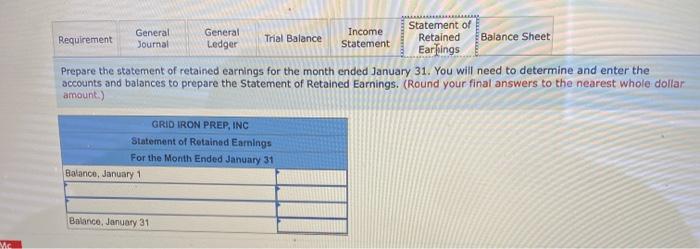

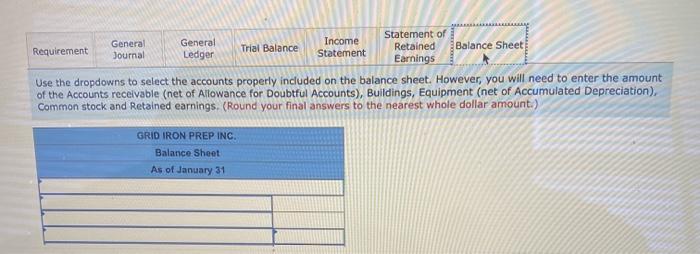

rected) Seved Help Say Grid Iron Prep Inc. (GIP) is a service business incorporated in January of the current year to provide personal training for athletes aspiring to play college football. The following transactions occurred during the month ended January 31. a. GIPI issued stock in exchange for $150,000 cash on 1/01 b. GIPl purchased a gymnasium building and gym equipment on 102 for $55.000, 80% of which related to the gymnasium and 20% to the equipment GIPI paid $200 cash on 103 to have the gym equipment refurbished before it could be used. d. GIPI provided $9,000 in training on 104 and expected collection in February 2. GIPI collected $41,000 cash in training fees on 110, of which $39,000 related to January and $2,000 related to February 1. GIPI paid $28,500 of wages and $7,500 in utilities on 1/30. GIPI will depreciate the gymnasium building using the straight-line method over 10 years with a residual value of $4,500. Gym equipment will be depreciated using the double declining-balance method, with an estimated residual value of $4,000 at the end of its four-year useful life. Record depreciation on 1/31 equal to one-twelfth the yearly amount h. GIP received a bill on 131 for $480 for advertising done on 131. The bill has not been paid or recorded. L GIPI uses the aging method for estimating doubtful accounts and, on 131, will record an estimated 3 percent of its under-30-day-old 1. Gip's income tax rate is 30%. Assume depreciation for tax is the same amount as depreciation for financial reporting purposes. os General General Income Statement of Requirement Journal Trial Balance Statement Retained Ledger Balance Sheet Earnings Prepare journal entries to readon ictions and adjustments listed in (a)-(). Review the accounts as shown in the General Ledger and Trial Balance tabs. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field. Round your final answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 > le 15 View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 > GIPI issued stock in exchange for $150,000 cash on 1/01. Record the transaction Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Record entry Clear entry View general journal GIPI issued stock in exchange for $150,000 cash on 1/01. GIPI purchased a gymnasium building and gym equipment on 1/02 for $55,000, 80% of which related to the gymnasium the equipment GIPI paid $200 cash on 1/03 to have the gym equipment refurbished before it could be used. GIPI provided $9,000 in training on 1/04 and expected collection in February e. GIPI collected $41,000 cash in training fees on 1/10, of which $39,000 related to January and $2,000 related to February f. GIPI paid $28,500 of wages and $7,500 in utilities on 1/30. . GIPI will depreciate the gymnasium building using the straight-line method over 10 years with a residual value of $4,500 equipment will be depreciated using the double-declining-balance method, with an estimated residual value of $4,000 at its four-year useful life. Record depreciation on 131 equal to one-twelfth the yearly amount. h. GIPI received a bill on 131 for $480 for advertising done on 1/31. The bill has not been paid or recorded. 1. GIPI uses the aging method for estimating doubtful accounts and, on 1/31, will record an estimated 3 percent of its under-3 accounts as not collectible. J. GIPI's income tax rate is 30%. Assume depreciation for tax is the same amount as depreciation for financial reporting purpo General General Requirement Statement of Income Journal Trial Balance Ledger Statement Retained Balance Sheet Earnings The option you choose will be the values used to populate the income statement and balance sheet tabs. GRIDIRON PREP INC. Trial Balance January 31, 2019 Account Title Debit Credit Total S as 0 General Statement of General Income Requirement Retained Trial Balance Balance Sheet Journal Ledger Statement Earnings Choose the appropriate accounts to be reported on the income statement. However, you will need to calculate and enter the amount of the income before Income Tax Expense and net income or loss for the period. (Round your final answers to the nearest whole dollar amount.) GRIDIRON PREP INC. Income Statement For the Month Ended January 31 General Statement of General Income Requirement Trial Balance Journal Retained Ledger Statement Balance Sheet Earnings Prepare the statement of retained earnings for the month ended January 31. You will need to determine and enter the accounts and balances to prepare the Statement of Retained Earnings. (Round your final answers to the nearest whole dollar amount.) GRID IRON PREP, INC Statement of Retained Earnings For the Month Ended January 31 Balance, January 1 Balance, January 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts