Question: Red boxes are incorrect. Please help. Thank you! On December 31, 2024, Kingbird Corporation signed a 5-year, non-cancelable lease for a machine. The terms of

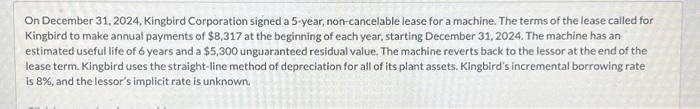

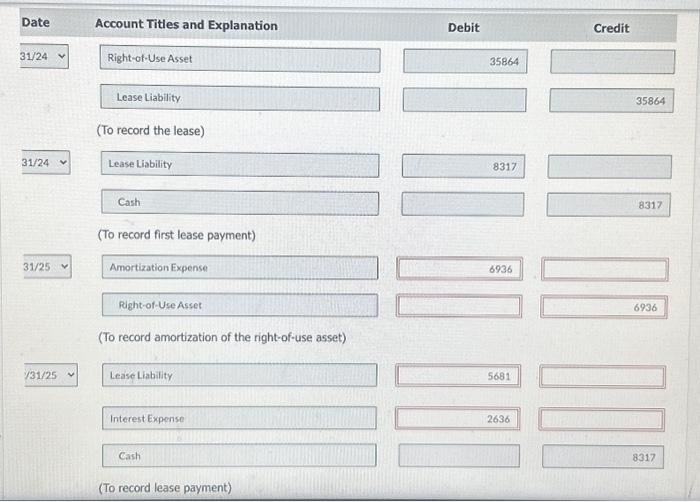

On December 31, 2024, Kingbird Corporation signed a 5-year, non-cancelable lease for a machine. The terms of the lease called for Kingbird to make annual payments of $8,317 at the beginning of each year, starting December 31,2024 . The machine has an estimated useful life of 6 years and a $5,300 unguaranteed residual value. The machine reverts back to the lessor at the end of the lease term. Kingbird uses the straight-line method of depreciation for all of its plant assets. Kingbird's incremental borrowing rate is 8%, and the lessor's implicit rate is unknown. Compute the present value of the lease payments. (For calculation purposes, use 5 decimal places as displayed in the foctor table provided and round final answer to 0 decimal ploces es. 5,275 . Present value of the lease payments \begin{tabular}{|c|c|c|c|} \hline Date & Account Titles and Explanation & Debit & Credit \\ \hline \multirow[t]{3}{*}{31/24} & Right-of-Use Asset & 35864 & \\ \hline & Lease Liability & & 35864 \\ \hline & (To record the lease) & & \\ \hline \multirow[t]{3}{*}{31/24} & Lease Liability & 8317 & \\ \hline & Cash & & 8317 \\ \hline & (To record first lease payment) & & \\ \hline \multirow[t]{3}{*}{31/25} & Amortization Expense & 6936 & \\ \hline & Right-of-Use Asset & & 6936 \\ \hline & (To record amortization of the right-o & & \\ \hline \multirow[t]{5}{*}{1/31/25} & Lease Liability & 5681 & \\ \hline & Interest Expense & 2636 & \\ \hline & & & \\ \hline & Cash & & 8317 \\ \hline & (To record lease payment) & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts