Question: Red Hill Technologies is considering two potential projects, X and Y In assessing the projects' risks, the company estimated the beta of each project versus

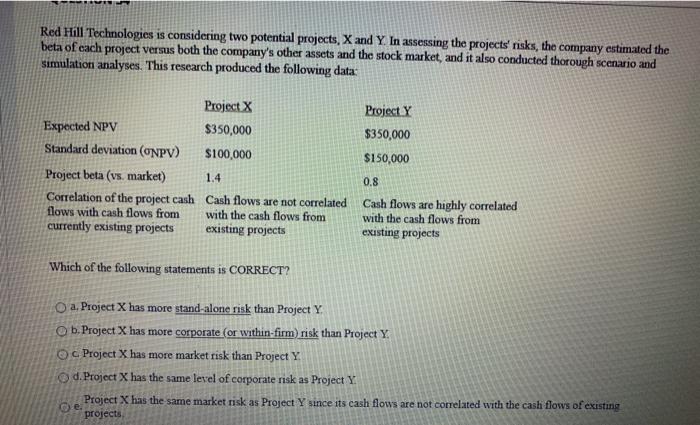

Red Hill Technologies is considering two potential projects, X and Y In assessing the projects' risks, the company estimated the beta of each project versus both the company's other assets and the stock market, and it also conducted thorough scenario and simulation analyses. This research produced the following data: Project $350,000 $150,000 Project X Expected NPV $350,000 Standard deviation (ONPV) $100,000 Project beta (vs. market) 1.4 Correlation of the project cash Cash flows are not correlated flows with cash flows from with the cash flows from currently existing projects existing projects 0,8 Cash flows are highly correlated with the cash flows from existing projects Which of the following statements is CORRECT? O a. Project X has more stand-alone risk than Project Y. b. Project X has more corporate (or within-firm) risk than Project Y. c Project X has more market risk than Project Y d. Project X has the same level of corporate risk as Project Y Project X has the same market risk as Project Y since its cash flows are not correlated with the cash flows of existing projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts