Question: RED = WRONG ( 2 SLOTS) EVERYTHING ELSE IS CORRECT One of the simplest tax avoidance strategies is to contribute to a Roth IRA, although

RED = WRONG ( 2 SLOTS)

RED = WRONG ( 2 SLOTS)

EVERYTHING ELSE IS CORRECT

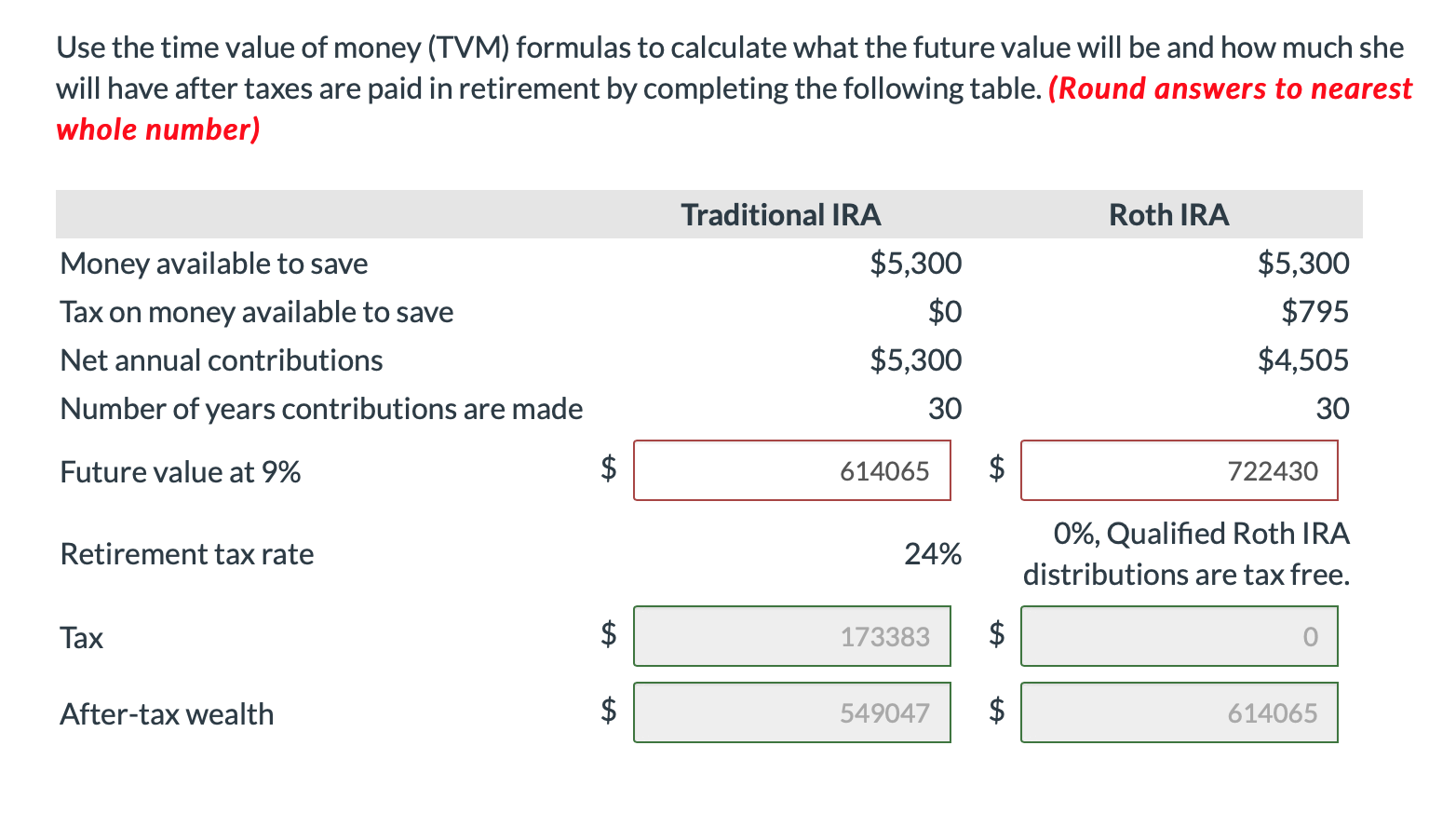

One of the simplest tax avoidance strategies is to contribute to a Roth IRA, although this may not be right for everyone. Some individuals, particularly low-income households that may be eligible for tax credits because of young children in the home, may benefit more from contributions to a traditional IRA. Here, you want to help Jennifer identify the best retirement savings option for her situation. Jennifer is 25, single, and makes $38,000 a year. Jennifer does not have access to an employer-sponsored retirement plan, but she really wants to start saving for retirement. She can contribute $5,300 of pretax money to a traditional IRA, or she can contribute $4,505 of after-tax money to a Roth IRA. The $795 difference represents the tax that Jennifer has to pay. Assume Jennifer continues to make this same annual contribution for 30 years and earns 9% on her investment. Use the time value of money (TVM) formulas to calculate what the future value will be and how much she will have after taxes are paid in retirement by completing the following table. (Round answers to nearest whole number) Roth IRA Traditional IRA $5,300 $0 Money available to save Tax on money available to save Net annual contributions Number of years contributions are made $5,300 $795 $4,505 30 $5,300 30 Future value at 9% 614065 722430 Retirement tax rate 24% 0%, Qualified Roth IRA distributions are tax free. A Tax 173383 After-tax wealth A 549047 614065

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts