Question: Redhawk Corp. has two product lines - Punt and Blitz. Financial information is as follows. Punt Blitz Blitz Total Sales volume 400 units 200 units

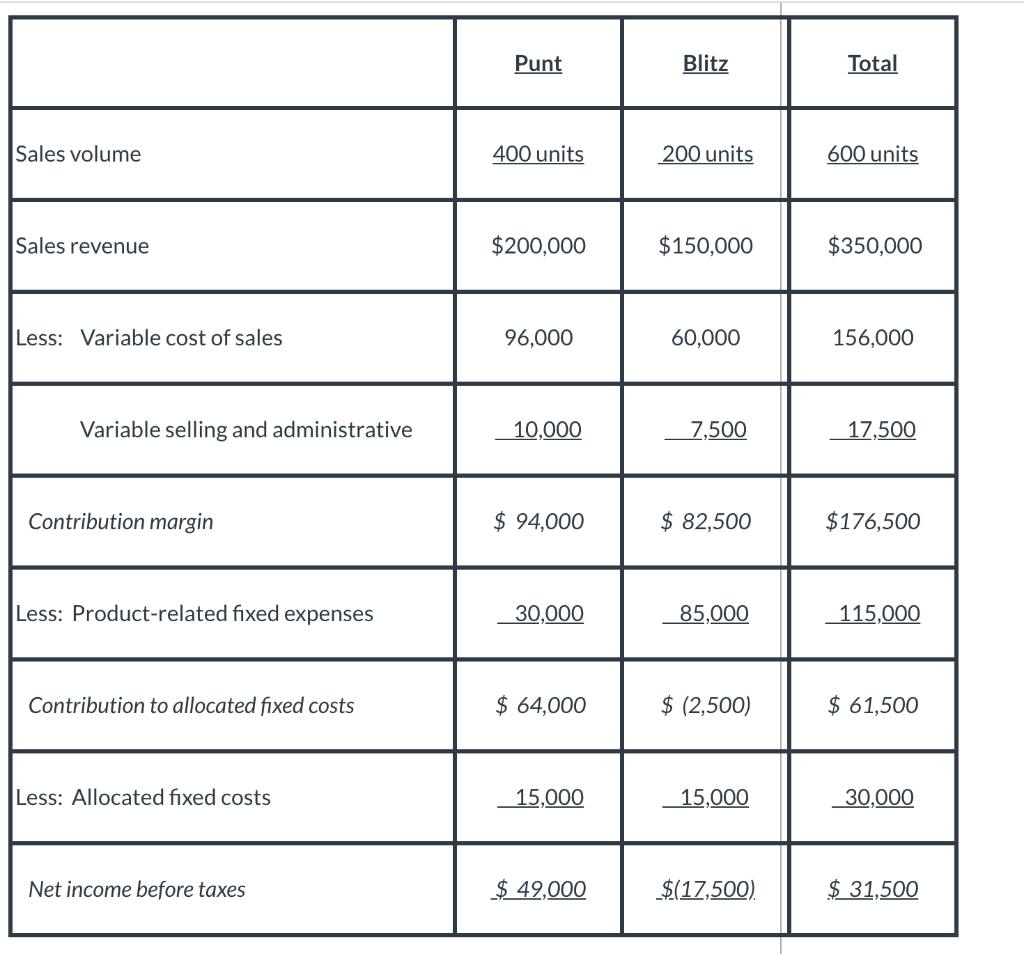

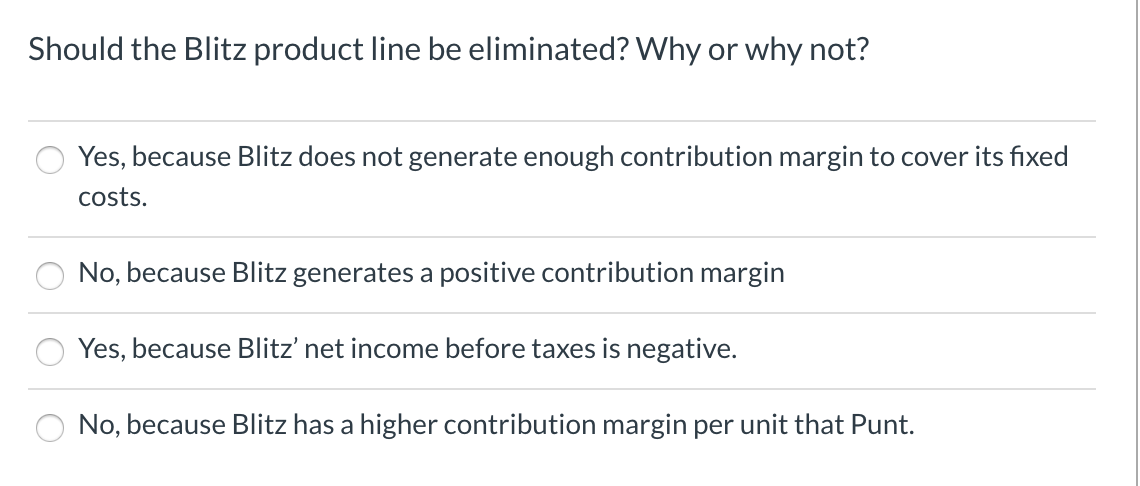

Redhawk Corp. has two product lines - Punt and Blitz. Financial information is as follows. Punt Blitz Blitz Total Sales volume 400 units 200 units 600 units Sales revenue $200,000 $150,000 $350,000 Less: Variable cost of sales 96,000 60,000 156,000 Variable selling and administrative 10,000 _7,500 17,500 Contribution margin $ 94,000 $ 82,500 $176,500 Less: Product-related fixed expenses 30,000 85,000 |115,000 Contribution to allocated fixed costs $ 64,000 $ (2,500) $ 61,500 Less: Allocated fixed costs 15,000 15,000 |_ 30,000 Net income before taxes $ 49,000 $(17,500). $ 31,500 Should the Blitz product line be eliminated? Why or why not? 0 Yes, because Blitz does not generate enough contribution margin to cover its fixed costs. O No, because Blitz generates a positive contribution margin O Yes, because Blitz net income before taxes is negative. O No, because Blitz has a higher contribution margin per unit that Punt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts