Question: Reebok Ltd is purchasing a $8.0 million machine, which will cost the firm an additional $44,000 to have the machine transported and installed ready for

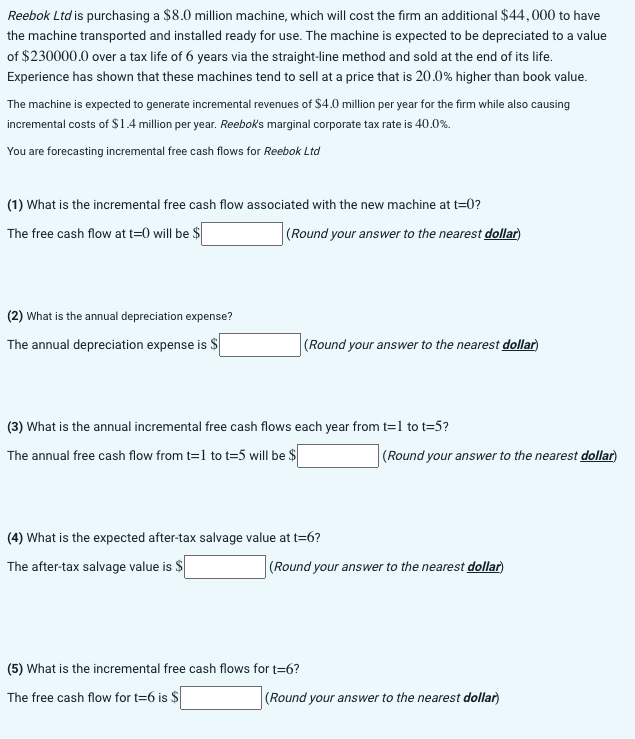

Reebok Ltd is purchasing a $8.0 million machine, which will cost the firm an additional $44,000 to have the machine transported and installed ready for use. The machine is expected to be depreciated to a value of $230000.0 over a tax life of 6 years via the straight-line method and sold at the end of its life. Experience has shown that these machines tend to sell at a price that is 20.0% higher than book value. The machine is expected to generate incremental revenues of $4.0 million per year for the firm while also causing incremental costs of $1.4 million per year. Reeboks marginal corporate tax rate is 40.0%. You are forecasting incremental free cash flows for Reebok Ltd (1) What is the incremental free cash flow associated with the new machine at t=0 ? The free cash flow at t=0 will be $ (Round your answer to the nearest dollar) (2) What is the annual depreciation expense? The annual depreciation expense is $ (Round your answer to the nearest dollar) (3) What is the annual incremental free cash flows each year from t=1 to t=5 ? The annual free cash flow from t=1 to t=5 will be $ (Round your answer to the nearest dollar) (4) What is the expected after-tax salvage value at t=6 ? The after-tax salvage value is $ (Round your answer to the nearest dollar) (5) What is the incremental free cash flows for t=6 ? The free cash flow for t=6 is $ (Round your answer to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts