Question: Refer to #2. Assuming Jumper Inc is using the allowance method. On April 30th, Jumper Inc determined that the Danny Zuko account was uncollectible and

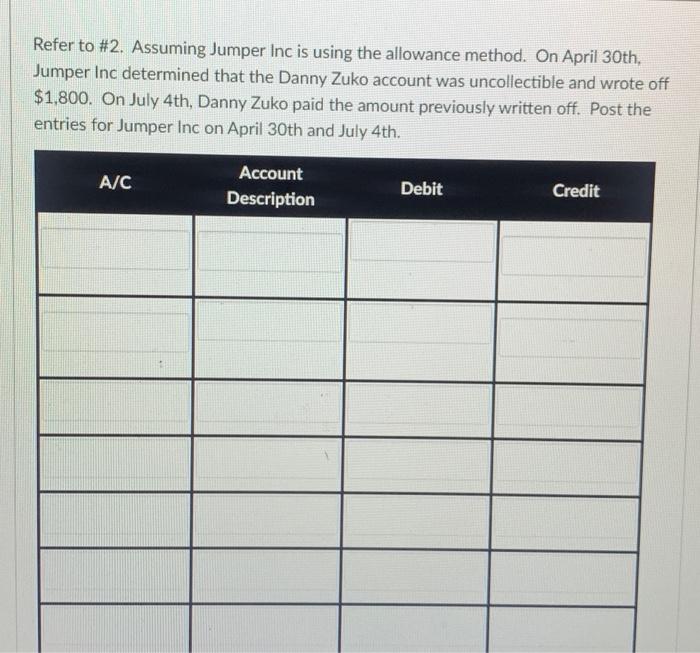

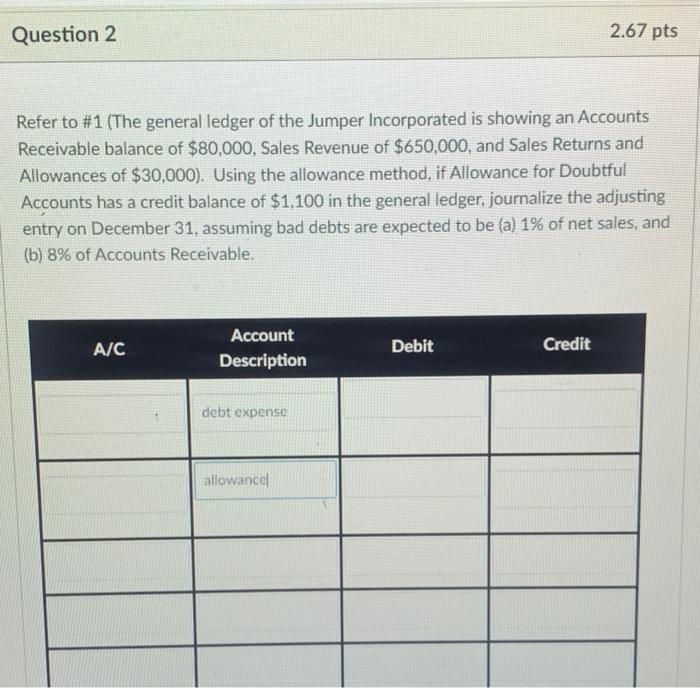

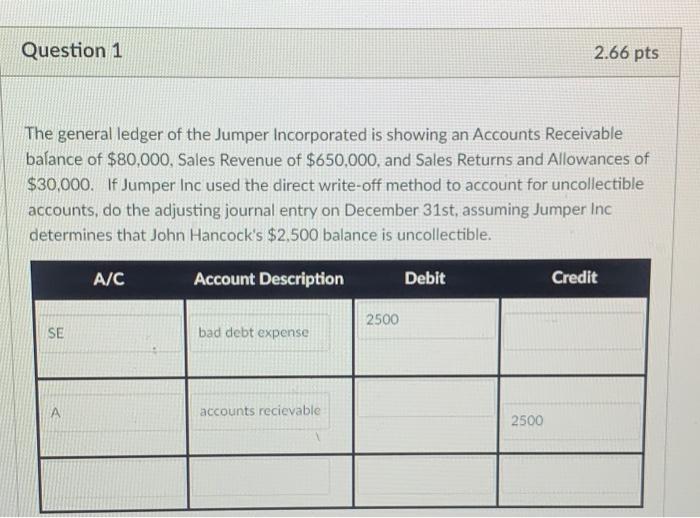

Refer to #2. Assuming Jumper Inc is using the allowance method. On April 30th, Jumper Inc determined that the Danny Zuko account was uncollectible and wrote off $1,800. On July 4th, Danny Zuko paid the amount previously written off. Post the entries for Jumper Inc on April 30th and July 4th. A/C Account Description Debit Credit Question 2 2.67 pts Refer to #1 (The general ledger of the Jumper Incorporated is showing an Accounts Receivable balance of $80,000, Sales Revenue of $650,000, and Sales Returns and Allowances of $30,000). Using the allowance method, if Allowance for Doubtful Accounts has a credit balance of $1,100 in the general ledger, journalize the adjusting entry on December 31, assuming bad debts are expected to be (a) 1% of net sales, and (b) 8% of Accounts Receivable. A/C Account Description Debit Credit debt expense allowance Question 1 2.66 pts The general ledger of the Jumper Incorporated is showing an Accounts Receivable balance of $80,000, Sales Revenue of $650,000, and Sales Returns and Allowances of $30,000. If Jumper Inc used the direct write-off method to account for uncollectible accounts, do the adjusting journal entry on December 31st, assuming Jumper Inc determines that John Hancock's $2,500 balance is uncollectible. A/C Account Description Debit Credit 2500 SE bad debt expense A accounts recievable 2500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts