Question: Refer to Managing Operations to develop a conceptual data model for order processing for the company. thank you when they say conceptual data model they

Refer to "Managing Operations" to develop a conceptual data model for order processing for the company. thank you

when they say conceptual data model they mean E-R diagram. thank you heres the updated information needed.

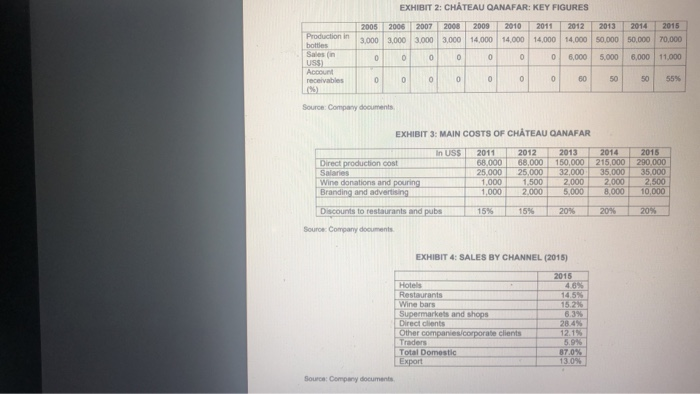

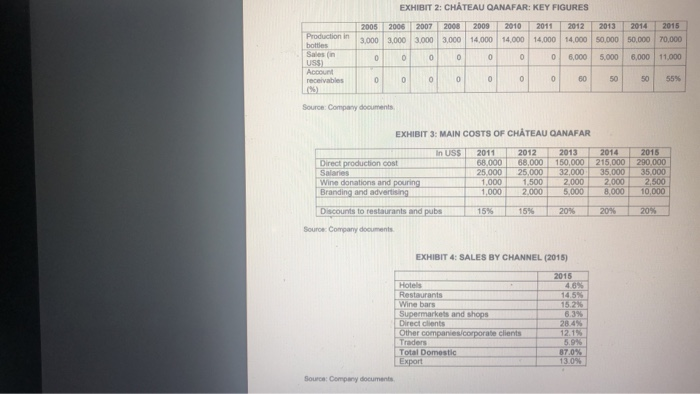

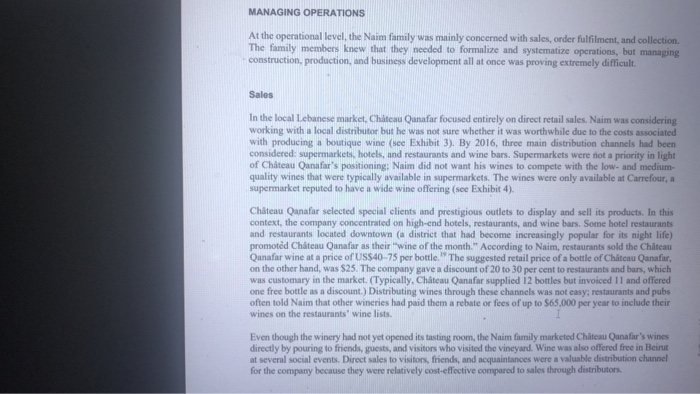

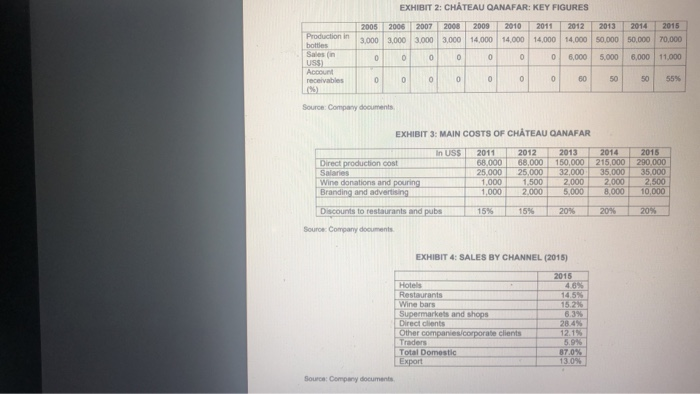

MANAGING OPERATIONS At the operational level, the Naim family was mainly concerned with sales, order fulfilment, and collection. The family members knew that they needed to formalize and systematize operations, but managing construction, production, and business development all at once was proving extremely difficult. Sales In the local Lebanese market, Chateau Qanafar focused entirely on direct retail sales. Naim was considering working with a local distributor but he was not sure whether it was worthwhile due to the costs associated with producing a boutique wine (see Exhibit 3). By 2016, three main distribution channels had been considered: supermarkets, hotels, and restaurants and wine bars. Supermarkets were not a priority in light of Chteau Qanafar's positioning: Naim did not want his wines to compete with the low- and medium- quality wines that were typically available in supermarkets. The wines were only available at Carrefour, a supermarket reputed to have a wide wine offering (see Exhibit 4). Chateau Qanafar selected special clients and prestigious outlets to display and sell its products. In this context, the company concentrated on high-end hotels, restaurants, and wine bars. Some hotel restaurants and restaurants located downtown (a district that had become increasingly popular for its night life) promoted Chteau Qanafar as their wine of the month." According to Naim, restaurants sold the Chteau Qanafar wine at a price of USS40-75 per bottle. The suggested retail price of a bottle of Chteau Qanafar, on the other hand, was $25. The company gave a discount of 20 to 30 per cent to restaurants and bars, which was customary in the market. (Typically, Chteau Qanafar supplied i2 bottles but invoiced 11 and offered one free bottle as a discount.) Distributing wines through these channels was not easy, restaurants and pubs often told Naim that other wineries had paid them a rebate or fees of up to $65,000 per year to include their wines on the restaurants' wine lists. Even though the winery had not yet opened its tasting room, the Naim family marketed Chateau Qanafar's wines directly by pouring to friends, guests, and visitors who visited the vineyard Wine was also offered free in Beirut at several social events Direct sales to visitors, friends, and acquaintances were a valuable distribution channel for the company because they were relatively cost-effective compared to sales through distributors Order-Taking and Fulfilment Process About 30 per cent of Chteau Qanafar's production (21,000 bottles) was sold in the local market. The company had about 50 customers in total, which meant that each customer purchased about 420 bottles per year, on average. The large number of transactions was explained by the fact that some customers ordered weekly, while others ordered biweekly or monthly depending on their storage capacity. Naim explained, "Last week, one of our customers, a restaurant, ordered two bottles! Both Colette and Eddy went to deliver the bottles, but a restaurant of this calibre should at least order one case." To place an order, clients would call one of the Naim family members or send a text message, email requests and orders were rare. The order was immediately confirmed to the client using the same communication medium. The person who received the order sent it to Eddy by email so that he could keep a written record of the order. Once Eddy received the email, he used the accounting system to issue an invoice, then saved the invoice in PDF format and stored it on a shared cloud drive folder. The warehouse manager then printed two copies of the invoice one copy was signed and stamped, and the second copy served as a packing list and delivery note. The warehouse manager prepared the order, attached the two copies of the invoice to the order, and scheduled the delivery. He assigned the delivery to the driver based on the client's preference, and also made sure to give the address and phone number to the delivery driver. The wine was then delivered to the client along with the invoice and delivery note. The client was asked to sign the delivery note, which would be returned to the warehouse manager and filed as a legal proof of delivery. Collection Individual customers usually paid cash, in which case the driver collected the cheque or cash and brought it back to Eddy, who was in charge of invoicing. For business customers, the term of payment was 60 days. Chateau Oanafar sent its clients a statement of account every quarter (or is required) as a polite reminder for payment. At the end of each month, all invoices and receipts were sent by email to the accountant, who worked on a contract basis for the company. The accountant checked the transactions and compared payments with invoices to ensure that all transactions were correct. In the case of inconsistencies, he emailed Eddy, who arranged to check and ratify any inconsistencies The Naim family members described their embarrassment when they gave their customers a tour of the Vineyard and asked them to pay a pending invoice. Naim added that on the other hand, sometimes the cheque was already written and waiting at the customer's to be picked up by Chiltenu Oanafa's driver h d inform Chateau Oanafar that the cheque was ready, and the Naim family To place an order, clients would call one of the Naim family members or send a text message; email requests and orders were rare. The order was immediately confirmed to the client using the same communication medium. The person who received the order sent it to Eddy by email so that he could keep a written record of the order. Once Eddy received the email, he used the accounting system to issue an invoice, then saved the invoice in PDF format and stored it on a shared cloud drive folder. The warehouse manager then printed two copies of the invoice: one copy was signed and stamped, and the second copy served as a packing list and delivery note. The warehouse manager prepared the order, attached the two copies of the invoice to the order, and scheduled the delivery. He assigned the delivery to the driver based on the client's preference, and also made sure to give the address and phone number to the delivery driver. The wine was then delivered to the client along with the invoice and delivery note. The client was asked to sign the delivery note, which would be returned to the warehouse manager and filed as a legal proof of delivery. Collection Individual customers usually paid cash, in which case the driver collected the cheque or cash and brought it back to Eddy, who was in charge of invoicing. For business customers, the term of payment was 60 days Chateau Oanafar sent its clients a statement of account every quarter (or as required) as a polite reminder for payment. At the end of each month, all invoices and receipts were sent by email to the accountant, who worked on a contract basis for the company. The accountant checked the transactions and compared payments with invoices to ensure that all transactions were correct. In the case of inconsistencies, he emailed Eddy, who arranged to check and ratify any inconsistencies The Naim family members described their embarrassment when they gave their customers a tour of the vineyard and asked them to pay a pending invoice. Naim added that, on the other hand, sometimes the cheque was already written and waiting at the customer's to be picked up by Chateau Qanafar's driver." Usually, the customer did not inform Chateau Oanafar that the cheque was ready, and the Naim family members feit uneasy about calling their customers and asking for payments, which they considered rade. Naim recognized that Chateau Qansfer did not control payment terms adequately. He believed the company needed to hire a person responsible for credit and collections, and also needed to set clear policies and procedures for collections and credit control EXHIBIT 2: CHATEAU QANAFAR: KEY FIGURES 2005 3,000 2006 3,000 2007 3,000 2008 3,000 2009 14,000 2010 14.000 2011 14.000 2012 14.000 2013 50.000 2014 50.000 2015 70,000 0 8 .000 5.000 11.000 Source: Company documents EXHIBIT 3: MAIN COSTS OF CHTEAU QANAFAR in USS Direct production cost 2011 68.000 25.000 1.000 1.000 2012 68.000 25.000 1.500 2000 2013 150.000 32.000 2.000 5.000 2014 215,000 35.000 27000 8.000 2015 290,000 35.000 27500 10.000 Wine donations and pouring Branding and advertising 15% 15% 20% 20% 20% Source Company documents EXHIBIT 4: SALES BY CHANNEL (2015) 46% 14.5% 1525 Hotels Restaurants Wine bars Supermarkets and shops Direct clients Other companies corporate clients Traders Total Domestic Export 2874 12.15 5.9% 87.0% 130 Source: Company documents MANAGING OPERATIONS At the operational level, the Naim family was mainly concerned with sales, order fulfilment, and collection. The family members knew that they needed to formalize and systematize operations, but managing construction, production, and business development all at once was proving extremely difficult. Sales In the local Lebanese market, Chateau Qanafar focused entirely on direct retail sales. Naim was considering working with a local distributor but he was not sure whether it was worthwhile due to the costs associated with producing a boutique wine (see Exhibit 3). By 2016, three main distribution channels had been considered: supermarkets, hotels, and restaurants and wine bars. Supermarkets were not a priority in light of Chteau Qanafar's positioning: Naim did not want his wines to compete with the low- and medium- quality wines that were typically available in supermarkets. The wines were only available at Carrefour, a supermarket reputed to have a wide wine offering (see Exhibit 4). Chateau Qanafar selected special clients and prestigious outlets to display and sell its products. In this context, the company concentrated on high-end hotels, restaurants, and wine bars. Some hotel restaurants and restaurants located downtown (a district that had become increasingly popular for its night life) promoted Chteau Qanafar as their wine of the month." According to Naim, restaurants sold the Chteau Qanafar wine at a price of USS40-75 per bottle. The suggested retail price of a bottle of Chteau Qanafar, on the other hand, was $25. The company gave a discount of 20 to 30 per cent to restaurants and bars, which was customary in the market. (Typically, Chteau Qanafar supplied i2 bottles but invoiced 11 and offered one free bottle as a discount.) Distributing wines through these channels was not easy, restaurants and pubs often told Naim that other wineries had paid them a rebate or fees of up to $65,000 per year to include their wines on the restaurants' wine lists. Even though the winery had not yet opened its tasting room, the Naim family marketed Chateau Qanafar's wines directly by pouring to friends, guests, and visitors who visited the vineyard Wine was also offered free in Beirut at several social events Direct sales to visitors, friends, and acquaintances were a valuable distribution channel for the company because they were relatively cost-effective compared to sales through distributors Order-Taking and Fulfilment Process About 30 per cent of Chteau Qanafar's production (21,000 bottles) was sold in the local market. The company had about 50 customers in total, which meant that each customer purchased about 420 bottles per year, on average. The large number of transactions was explained by the fact that some customers ordered weekly, while others ordered biweekly or monthly depending on their storage capacity. Naim explained, "Last week, one of our customers, a restaurant, ordered two bottles! Both Colette and Eddy went to deliver the bottles, but a restaurant of this calibre should at least order one case." To place an order, clients would call one of the Naim family members or send a text message, email requests and orders were rare. The order was immediately confirmed to the client using the same communication medium. The person who received the order sent it to Eddy by email so that he could keep a written record of the order. Once Eddy received the email, he used the accounting system to issue an invoice, then saved the invoice in PDF format and stored it on a shared cloud drive folder. The warehouse manager then printed two copies of the invoice one copy was signed and stamped, and the second copy served as a packing list and delivery note. The warehouse manager prepared the order, attached the two copies of the invoice to the order, and scheduled the delivery. He assigned the delivery to the driver based on the client's preference, and also made sure to give the address and phone number to the delivery driver. The wine was then delivered to the client along with the invoice and delivery note. The client was asked to sign the delivery note, which would be returned to the warehouse manager and filed as a legal proof of delivery. Collection Individual customers usually paid cash, in which case the driver collected the cheque or cash and brought it back to Eddy, who was in charge of invoicing. For business customers, the term of payment was 60 days. Chateau Oanafar sent its clients a statement of account every quarter (or is required) as a polite reminder for payment. At the end of each month, all invoices and receipts were sent by email to the accountant, who worked on a contract basis for the company. The accountant checked the transactions and compared payments with invoices to ensure that all transactions were correct. In the case of inconsistencies, he emailed Eddy, who arranged to check and ratify any inconsistencies The Naim family members described their embarrassment when they gave their customers a tour of the Vineyard and asked them to pay a pending invoice. Naim added that on the other hand, sometimes the cheque was already written and waiting at the customer's to be picked up by Chiltenu Oanafa's driver h d inform Chateau Oanafar that the cheque was ready, and the Naim family To place an order, clients would call one of the Naim family members or send a text message; email requests and orders were rare. The order was immediately confirmed to the client using the same communication medium. The person who received the order sent it to Eddy by email so that he could keep a written record of the order. Once Eddy received the email, he used the accounting system to issue an invoice, then saved the invoice in PDF format and stored it on a shared cloud drive folder. The warehouse manager then printed two copies of the invoice: one copy was signed and stamped, and the second copy served as a packing list and delivery note. The warehouse manager prepared the order, attached the two copies of the invoice to the order, and scheduled the delivery. He assigned the delivery to the driver based on the client's preference, and also made sure to give the address and phone number to the delivery driver. The wine was then delivered to the client along with the invoice and delivery note. The client was asked to sign the delivery note, which would be returned to the warehouse manager and filed as a legal proof of delivery. Collection Individual customers usually paid cash, in which case the driver collected the cheque or cash and brought it back to Eddy, who was in charge of invoicing. For business customers, the term of payment was 60 days Chateau Oanafar sent its clients a statement of account every quarter (or as required) as a polite reminder for payment. At the end of each month, all invoices and receipts were sent by email to the accountant, who worked on a contract basis for the company. The accountant checked the transactions and compared payments with invoices to ensure that all transactions were correct. In the case of inconsistencies, he emailed Eddy, who arranged to check and ratify any inconsistencies The Naim family members described their embarrassment when they gave their customers a tour of the vineyard and asked them to pay a pending invoice. Naim added that, on the other hand, sometimes the cheque was already written and waiting at the customer's to be picked up by Chateau Qanafar's driver." Usually, the customer did not inform Chateau Oanafar that the cheque was ready, and the Naim family members feit uneasy about calling their customers and asking for payments, which they considered rade. Naim recognized that Chateau Qansfer did not control payment terms adequately. He believed the company needed to hire a person responsible for credit and collections, and also needed to set clear policies and procedures for collections and credit control EXHIBIT 2: CHATEAU QANAFAR: KEY FIGURES 2005 3,000 2006 3,000 2007 3,000 2008 3,000 2009 14,000 2010 14.000 2011 14.000 2012 14.000 2013 50.000 2014 50.000 2015 70,000 0 8 .000 5.000 11.000 Source: Company documents EXHIBIT 3: MAIN COSTS OF CHTEAU QANAFAR in USS Direct production cost 2011 68.000 25.000 1.000 1.000 2012 68.000 25.000 1.500 2000 2013 150.000 32.000 2.000 5.000 2014 215,000 35.000 27000 8.000 2015 290,000 35.000 27500 10.000 Wine donations and pouring Branding and advertising 15% 15% 20% 20% 20% Source Company documents EXHIBIT 4: SALES BY CHANNEL (2015) 46% 14.5% 1525 Hotels Restaurants Wine bars Supermarkets and shops Direct clients Other companies corporate clients Traders Total Domestic Export 2874 12.15 5.9% 87.0% 130 Source: Company documents